February 22, 2023

European Banks Need Solid Money Management Capabilities That Nurture Customers’ Financial Well-Being

This year will likely be remembered as one with the sharpest drop in household income on record. In these difficult times, banks must lead with purpose, doing everything they can to help customers navigate the crisis and improve their financial well-being.

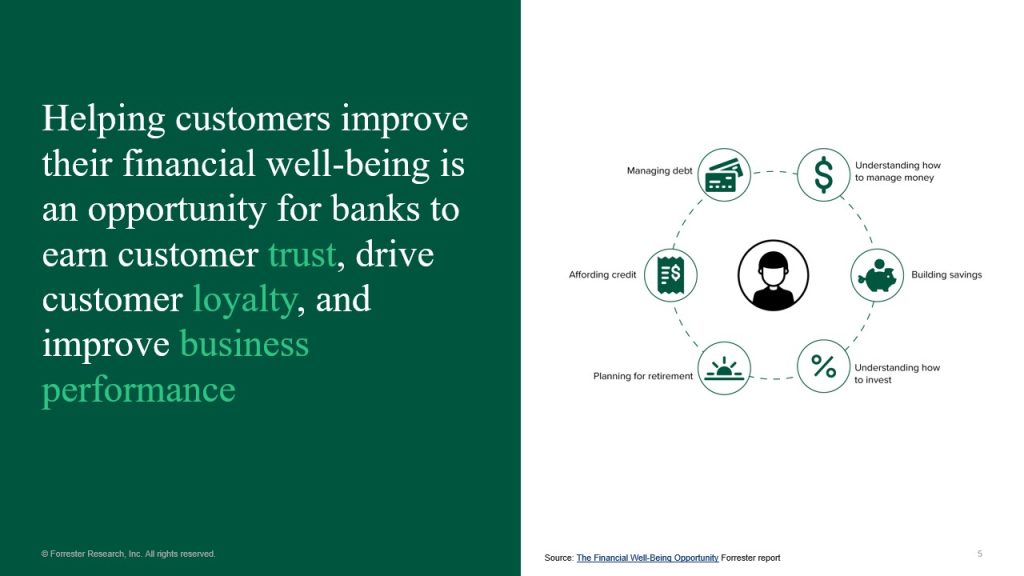

Financial well-being is a condition in which a person can fully meet current and ongoing financial obligations, feel secure in the financial future, and make choices that allow them to enjoy life – and it’s a huge opportunity for banks to earn customers’ trust, drive loyalty, and improve business performance.

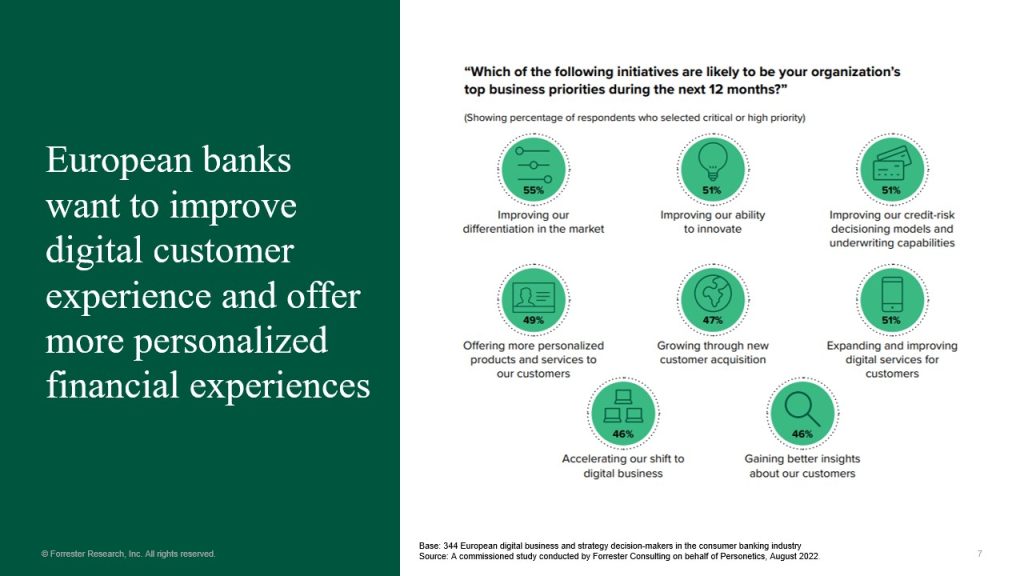

A joint study by Forrester and Personetics of 344 directors and decision-makers in banks across Europe showed that 73% of European banks already offer some sort of digital money management tools to help customers manage their finances, which they see as an opportunity to increase customer engagement, retention, and revenue by improving feelings of financial well-being.

But the reality is that for 77% of respondents, only half of their customers actively use these solutions.

So what can banks do to bridge this gap and overcome the challenges they face in the usage and business case of money management tools for financial well-being? I discussed the answer to this in a webinar with Aurelie L’Hostis, Principal Analyst at Forrester.

How Banks can deliver better customer and business outcomes using advanced money management capabilities

As Aurelie explains, banks face several challenges in implementing their financial well-being strategies. These include executive support, organizational alignment, access to quality data and insights, and a clearly defined technology investment strategy. Aurelie suggests three keys to overcoming these challenges and delivering improved outcomes for the customer and the business alike.

1. Establish an enterprise-wide strategic vision

Begin by securing organizational buy-in and aligning across the organization to successfully design and execute your strategy. Collaborate cross-functionally to coordinate enterprise-wide investment in technology, always keeping customer needs in mind to drive the alignment of personalization investments.

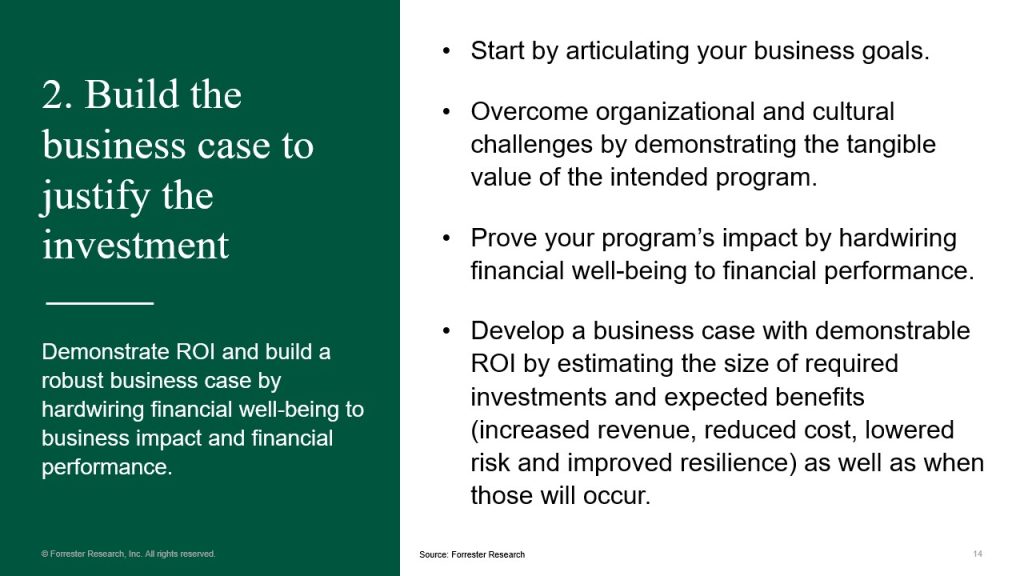

2. Build the business case to justify the investment

Next, aim to demonstrate ROI and build a robust business case by hardwiring financial well-being to business impact and financial performance. From articulating your business goals, you can move on to demonstrating the tangible value of your intended program. You’ll be able to demonstrate ROI by estimating the size of required investments and expected benefits (increased revenue, reduced cost, lowered risk, and improved resilience), along with a timeline for when to expect these results.

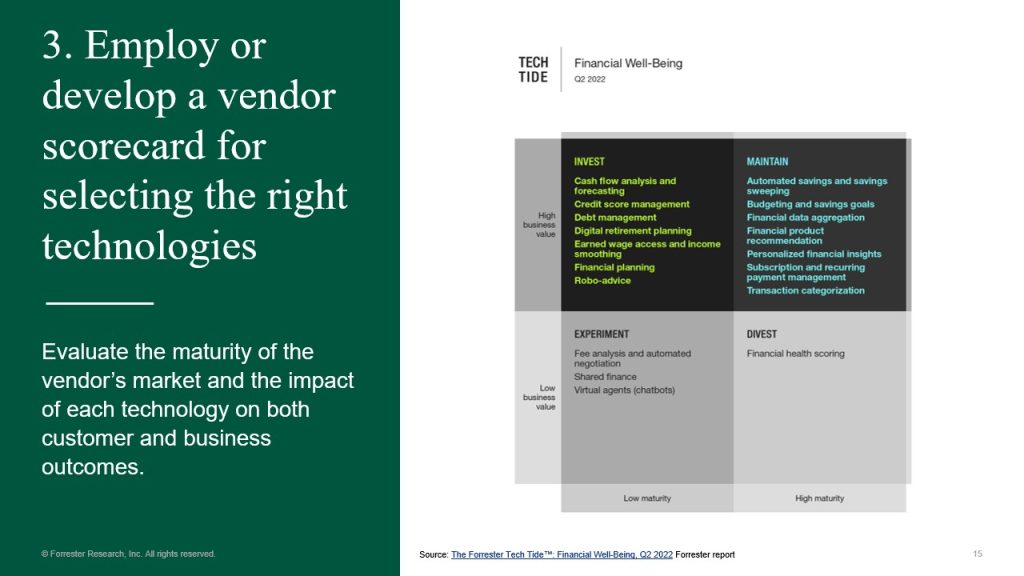

3. Use a vendor scorecard for selecting the right technologies

When choosing vendors, there are two factors to look at that will help you select the right technologies for your business.

- Business value – What impact does the technology have on customer and business outcomes? Do they have a demonstrated track record? Can they offer case studies to prove the quantitative value they have been able to bring their clients? What kind of ROI would this technology offer your bank?

- Maturity of the technology – How long has the vendor been on the market? What is their penetration? What is their growth potential?

How Personetics’ advanced money management capabilities deliver financial wellness that drives actual business impact for the world’s leading banks

Personetics offers a unified money management platform that helps concurrently with customer intelligence, customer engagement, and digital sales, driving impact on key business outcomes including account and balance growth and customer experience rating, among many more. Let’s take a look at how certain banks have utilized the Personetics platform to achieve some amazing results.

Santander UK increases NPS by helping customers with the cost-of-living crisis

We worked with Santander UK, one of the largest banks in the United Kingdom, to develop My Money Manager, a personalized insights and advice platform. To help address the cost of living crisis, the platform offers a tool that assists customers in unsubscribing from duplicate subscriptions. Among many other offerings, it provides sustainability insights in the form of a carbon footprint score, including the ability to provide product-need-based advice to customers.

The result? Santander increased their NPS score by 23% in just months and reached over 2 million users and over 40 million insights.

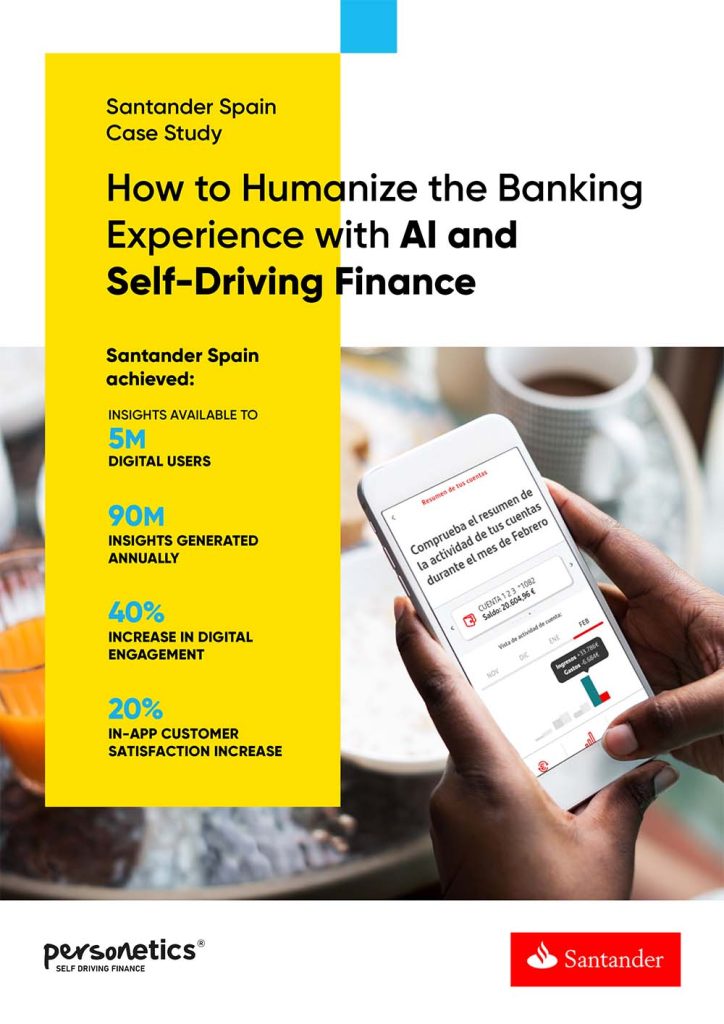

Santander Spain focus on financial wellness increases satisfaction by 20%

Santander Spain, the largest Spanish bank, partnered with Personetics to create an AI-based personalized insights solution within their mobile app. This tool allows customers to anticipate financial events and solve issues before they even happen. Using previous transaction data and predictive analytics, the Self-Driving solution is able to offer a suite of capabilities to support customers’ financial wellness.

The results of the roll-out were exceptional: 5 million digital users, a 40% increase in digital engagement, and a 20% increase in in-app customer satisfaction.

“Our goal at Santander is to help people and businesses prosper, and with our self-driven finance tools, we think we are helping customers to make better decisions and contribute to that goal.”

Manuel Cantalpadiedra

Chief Innovation Officer, Santander Spain

Read the full case study of how Santander Spain elevates their banking with self-driving finance

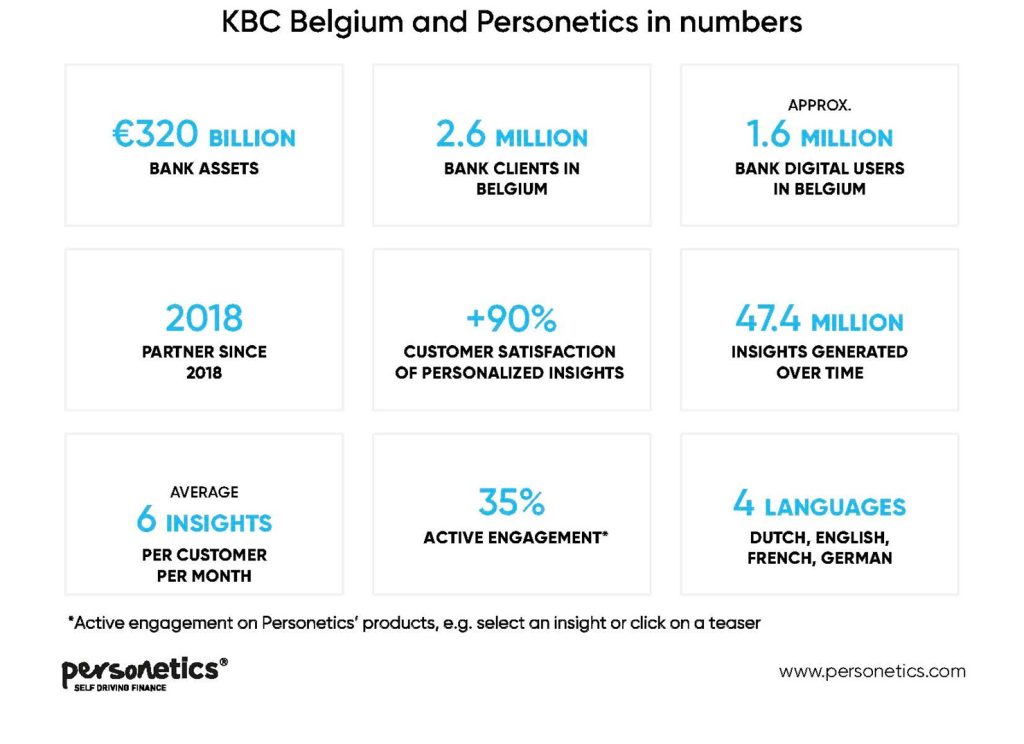

KBC offers spending reduction ideas, receives 90% positive ratings

The largest bank in Belgium, KBC, used Personetics to create a smart budgets and goals platform that allows customers to track budgets while receiving spending reduction ideas and product-based advice. For example, the platform might notify a customer that their loan repayment will be increasing due to rising interest rates, as well as recommend what they can do about it.

KBC’s results demonstrated just how hungry customers are for this type of relevant, succinct information about their finances. Customer usage is growing 20% month to month and receiving over 90% positive customer ratings.

“Exceeding customer expectations of KBC Mobile is what excites our team. One way of achieving this is through saving time & money. For example: getting a quick heads-up to check if a double payment was intended. Or a notification when you received a payment, in the likes of a tax return.

Each time we are able to provide such relevant information, it may give a small, but tangible benefit to the customers’ life and add to his or her personal financial insight. Personetics is helping us achieve that type of relevance.”

Karin Van Hoecke

General Manager (Digital) Transformation and Data at KBC

Read a case study about how KBC enables their clients’ dreams

Ultimately, Personetics is a strategic partner and enabler, helping build the business case and drive business impact. Because customer data is the most valuable asset for banks, however converting it into actionable advice is what creates an advantage. This is where Personetics can help.

Request a demo today to discover how Personetics can help your bank harness the power of AI to support your customers’ financial well-being.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

How AI is Elevating Customer Engagement at Central Bank

Elevating Finance: OpenAI's Role in Revolutionizing Banking

Humanizing the Banking Experience: Interview with “George” Banking Platform Creator Maurizio Poletto

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.