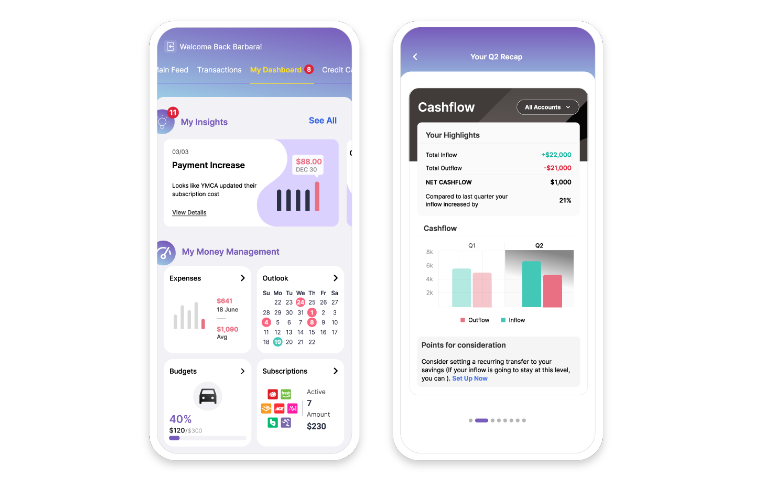

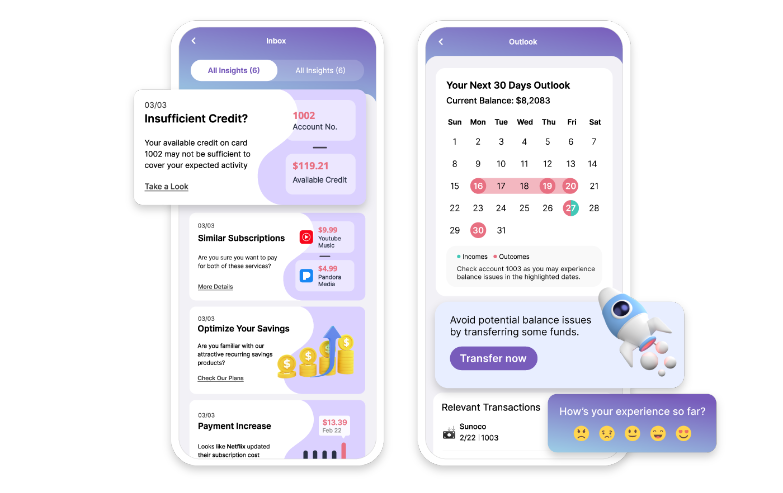

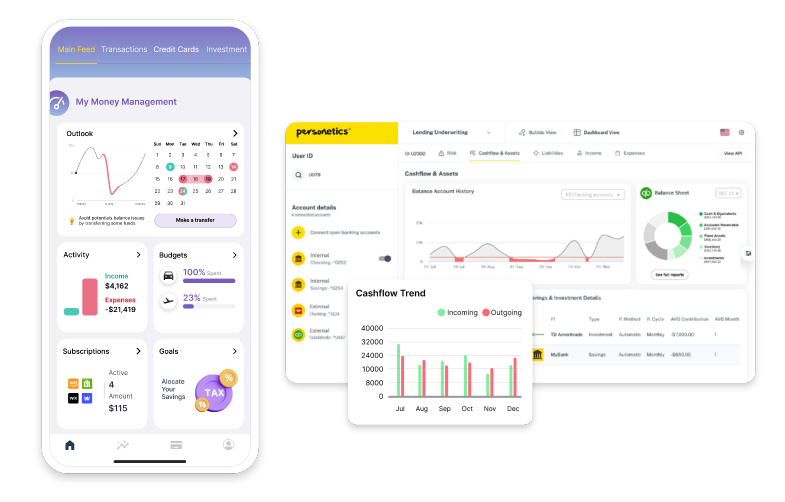

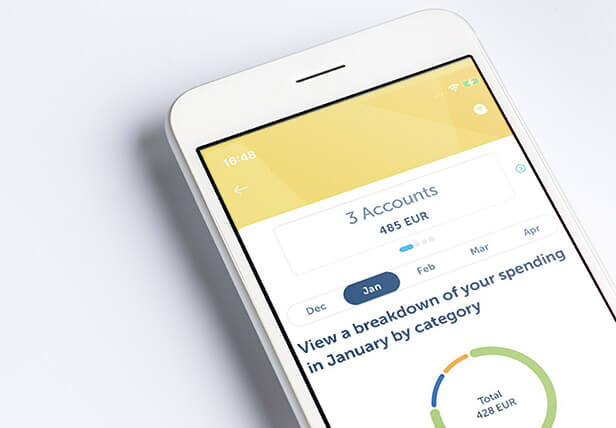

Advanced PFM and money management solutions

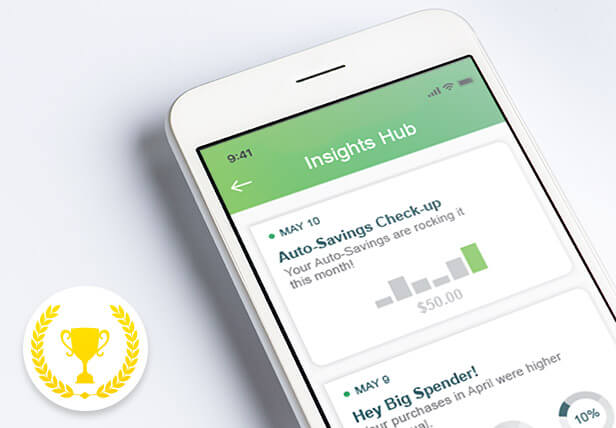

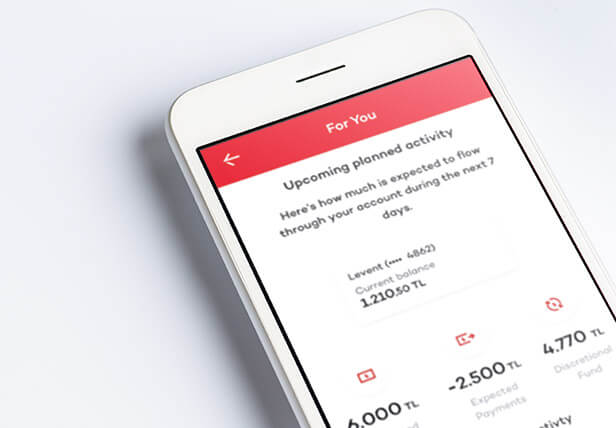

Hyper-personalized, actionable insights and advice

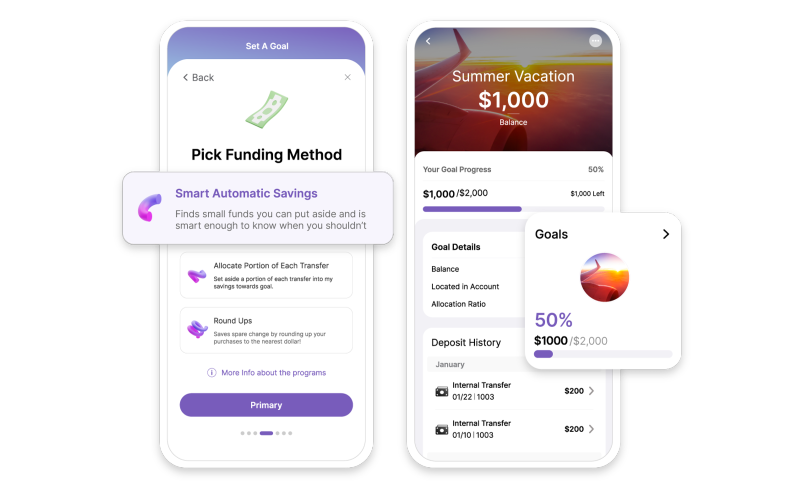

Goal-based savings and automated journeys

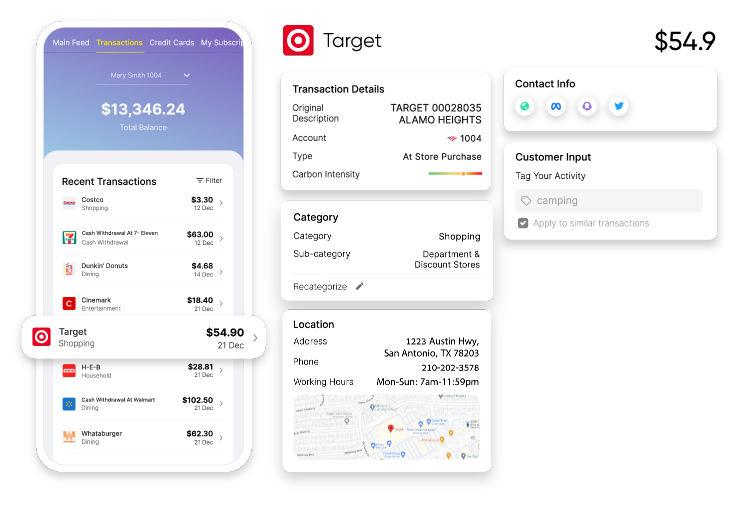

Data cleansing, enrichment, and categorization

Comprehensive suite for small businesses & bankers

"At U.S. Bank, we are committed to providing our customers with tools and solutions that help them better manage their complex financial lives…‘Pay Yourself First’… helps customers build their savings by giving them intuitive insights about how best to do that, in a way that is personalized..."

"The first step to achieving one’s financial goals always starts with savings. We are delighted to partner with Personetics to introduce the new Auto-Save feature on our TMRW mobile banking app to provide our customers with a simple, smart, and automated way to save more for their future."

"My Money Manager is the result of a new partnership between Santander and Personetics, generating new use cases and co-creating off-the-shelf solutions. Building long-lasting and meaningful relationships with our strategic partners is key to accelerating Santander’s digital transformation."

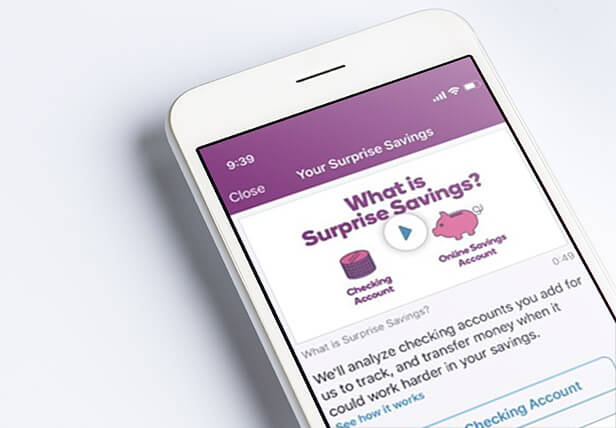

“We were able to bring the ‘Surprise Savings’ to market very quickly because we already had a successful implementation with our partners at Personetics. It took some of the burden off of the heavy lifting that we had to develop on our end.”

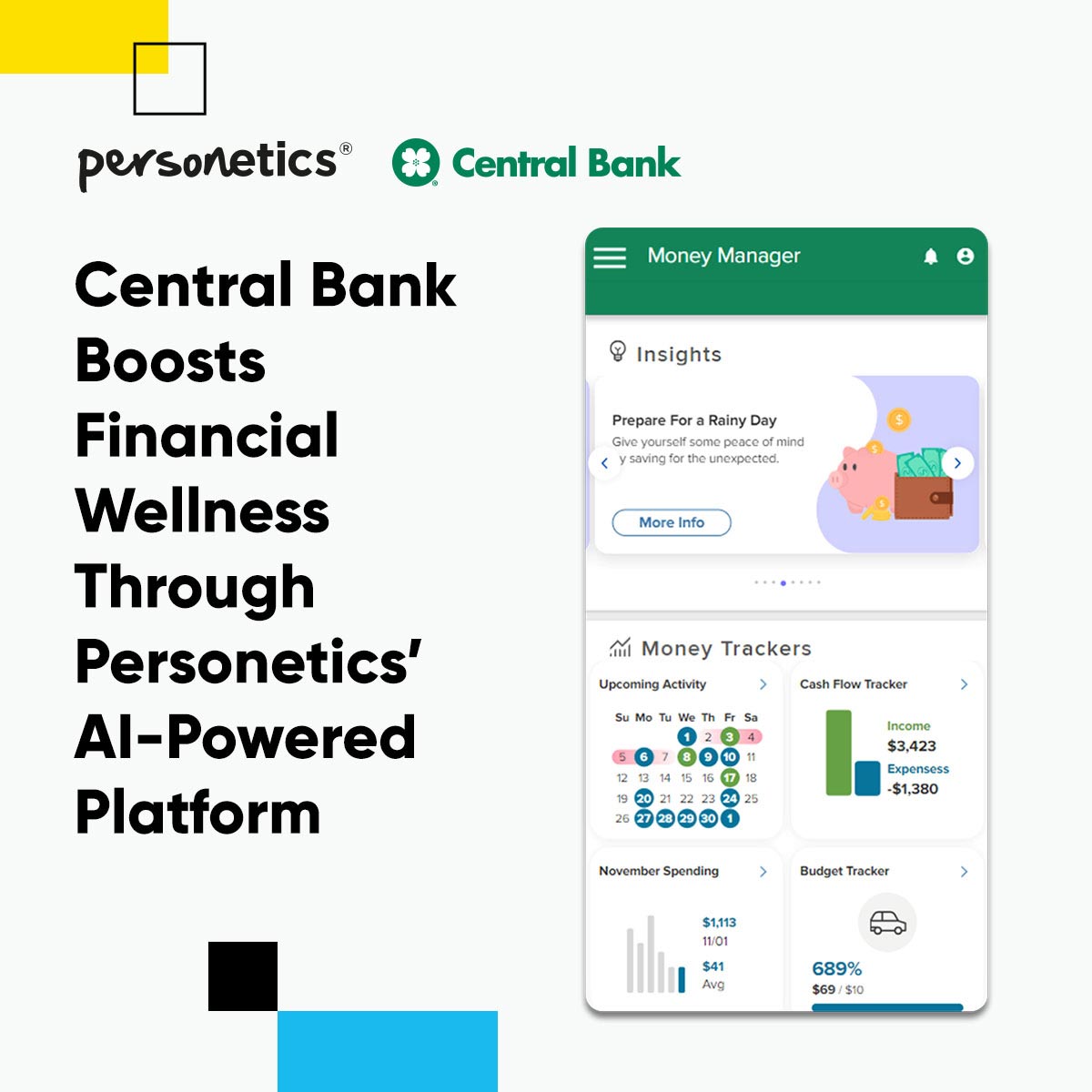

“We believe that data-led insights and personalized financial solutions are the key to unlocking true financial wellness. Our partnership with Personetics marks a significant milestone in our long-term vision of enhancing our customers’ lives by making banking hyper-personal to each and every customer.”

"Exceeding customer expectations of KBC Mobile is what excites our team...Each time we are able to provide such relevant information, it may give a small, but tangible benefit to the customers' life and add to his or her personal financial insight. Personetics is helping us achieve that type of relevance."

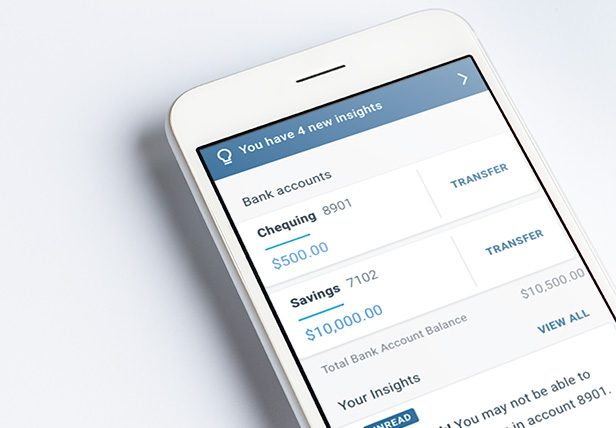

"Huntington Bank is proactively increasing customers’ Financial Wellness by leveraging Personetics' Self-Driving Finance solutions for Heads-Up and Money-Scout digital tools. As a result, Huntington National Bank saw mobile use more than double from 2019 to 2020, along with an overall increase in mobile users."

"Personetics helped MyState Bank transform the way we drive value from our data assets... In the past year we have helped our customers save almost AU$1.4M collectively, with a typical Auto-Savings transfer amount of $24.69."

"Customers demand financial guidance, especially now, with the cost of living rising, and Ma French Bank is ideally positioned to help customers navigate challenging times with communications that create “stickiness” in mobile apps and digital channels."

"In the first quarter of launch, over 20 thousand new deposit accounts were opened, and 30 thousand customers have set up savings goals…This is a fantastic outcome we’ve seen for a new product and experience".

“Thanks to Personetics, we have been able to expand our services to include 42 hyper-personalized, AI-based insights that cover expenses, budget management, and cash flow. Ultimately, we are generating 450 million insights annually with an impressive approval rating of 86%.”

“Personalizing financial management remains a priority for process simplification, becoming a differentiator for financial organizations,” Greg said. “Effective use of analytics is the biggest gap that financial institutions need to bridge.”

"UOB’s TMRW Quadrupled Its Customer Engagement Rate in One Year: "Our focus at UOB TMRW is to always create a delightful banking experience for each individual…We wanted to sharpen the information that we provide our diverse customer base so that it is always relevant and personalized.."

“It’s exciting to show people how these data-driven insights can make a real difference in their financial wellness, helping them see their own spending more clearly, set smart budgets, and identify opportunities to save.”

"Providing real-time, personalized insights within our online and mobile banking platforms will allow us to help our customers work toward their goals more confidently, one financial decision at a time."

"Working with Personetics allows us to shorten time-to-market with pre-built content and knowledge that can be readily applied across our retail and small business segments."

“Our ongoing partnership with Personetics has been extremely positive and continues with deepening innovation towards our customer-centric goals. Together, we have laid the groundwork for continued digital innovation at Discount Bank to better serve our customers in a very dynamic banking market."

"Personetics is an ideal partner in providing our customers with the tools and direction they need to become more involved and active in shaping their own financial future"

“I see it as a dance, a beautiful dance of that choreography between the digital and the human coming together. Right now, I think most banks - and we’re one of them - are in the elementary class of that. But I see the future where that comes together really beautifully.”

“We have been live for over 7 months, and we are getting very good response, people are rating the tips very well, they find them helpful, they find them useful. Its a feature that really speaks to a lot of people and that’s a great result that we are vey happy with.”

“Personetics accelerated our product development immensely, enabling us to bring Pulsoo to market in only 6 months. In addition, our lively exchanges of ideas with the Personetics team, based on their extensive experience with creating hyper-personalized insights and presenting them in real time, helped make Pulsoo even better.”

“Mobile banking is becoming our branch of the future. We have to move past that teller line experience and recreate that high-touch, consultative experience digitally. By partnering with Personetics, we can dip our toe in the artificial intelligence waters to meet customer expectations set by industry leaders.”

Digital engagement

Advice & product

recommendations

Avg. deposit balances

(engaged vs. unengaged)

Avg. number of accounts

(engaged vs. unengaged)

Avg. monthly income

(engaged vs. unengaged)

Avg. annual savings

(registered users)

Improved CX

Explore how Personetics can help you leverage financial-data intelligence to optimize

customer experiences and deliver business impact.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |