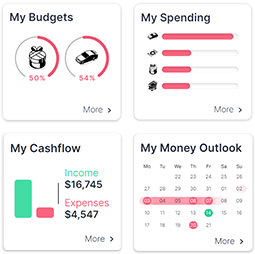

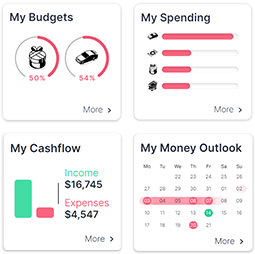

Personetics Express

An enterprise-level customer engagement platform, delivered at mass-market speed.

Personetics Express: Tailored to the Need of Midsize Banks

Achieve business impact fast

With a cost-effective investment that suits midsize banks' timeframes and budgets