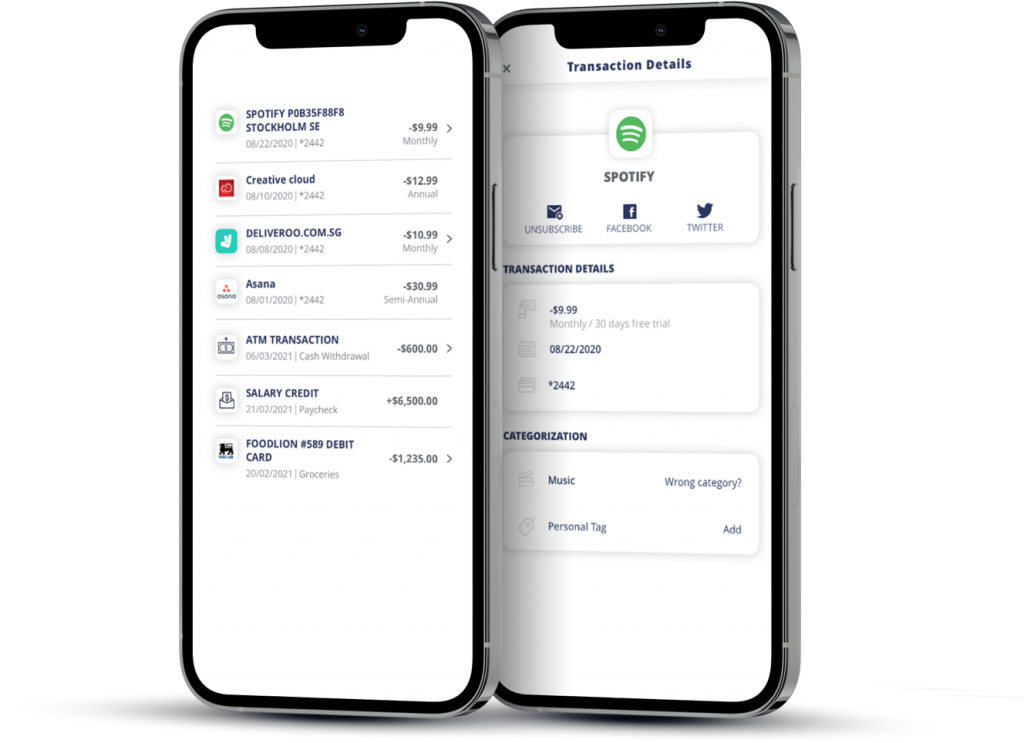

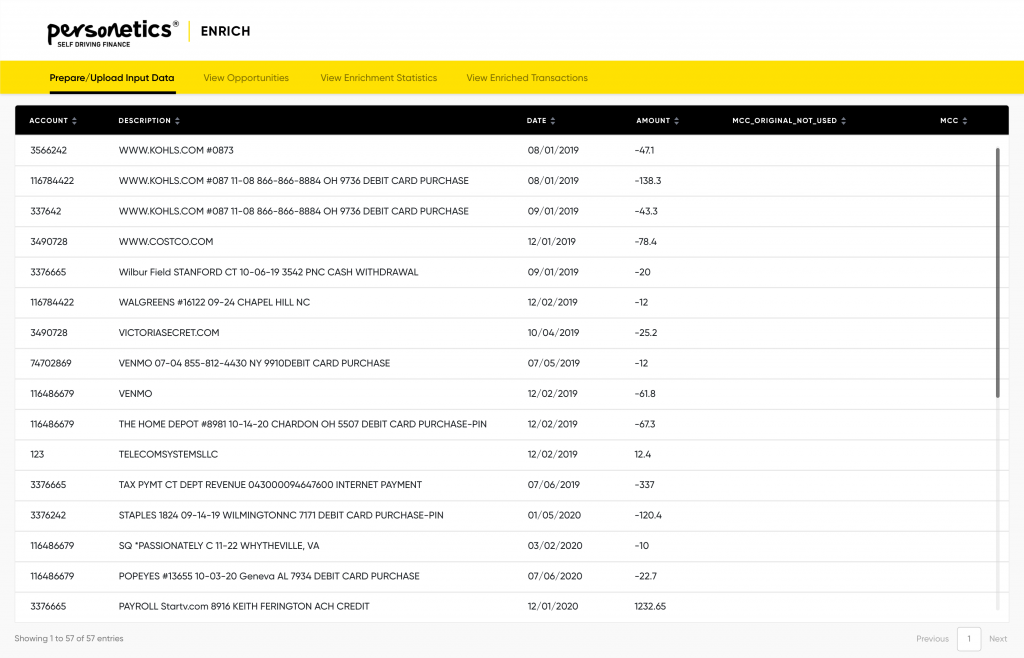

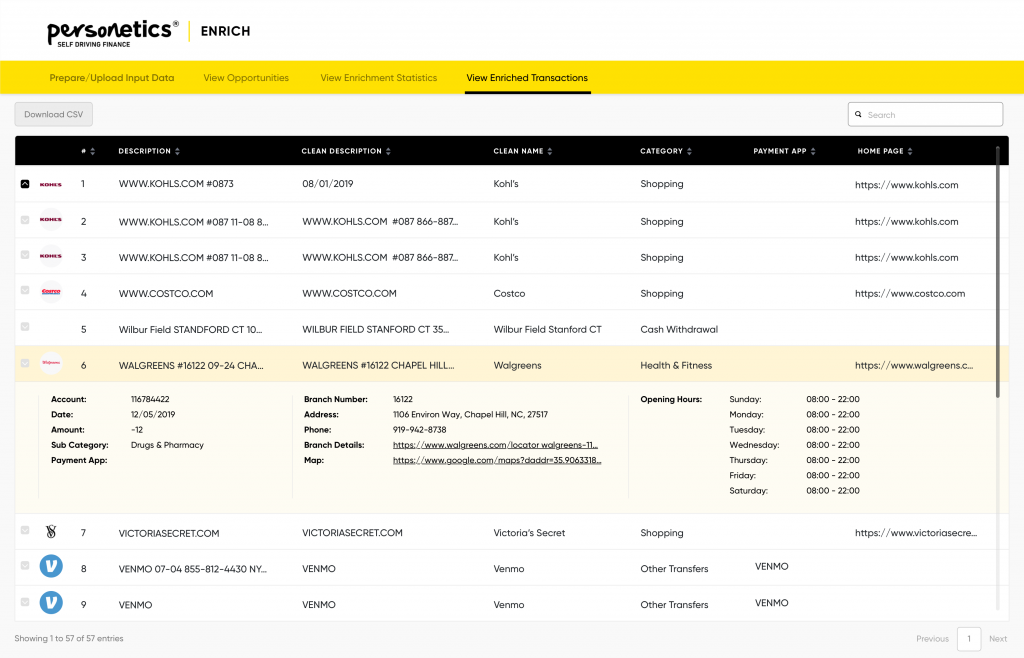

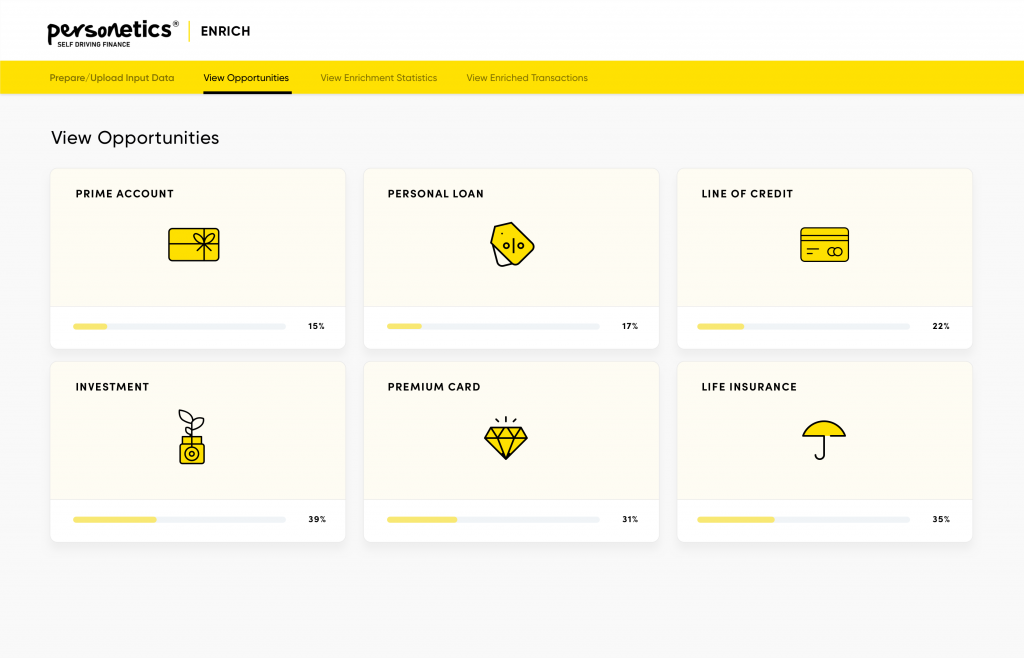

Personetics offers an AI-based solution to clean, categorize, and enrich transaction data.

Designed for financial institutions and Fintechs to fuel innovation while reducing operational costs.

Fully customizable delivery

On-premise and SaaS installation based on Financial Institution / Fintech’s infrastructure and security preferences

APIs and widgets with a real-time invocation. Customizable widgets provide a turnkey experience

Leading banks already use Personetics end-2-end platform to engage 135 million worldwide customers

Want to explore how your bank can harness the power of AI to engage and serve customers?

We work with banks of all sizes across all geographies and will be happy to see how we can help.

New York

London

Tel Aviv

Singapore

Tokyo

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.