Engage

Un accompagnement personnalisé des clients dans le secteur financier

Engage

Un accompagnement personnalisé des clients dans le secteur financier

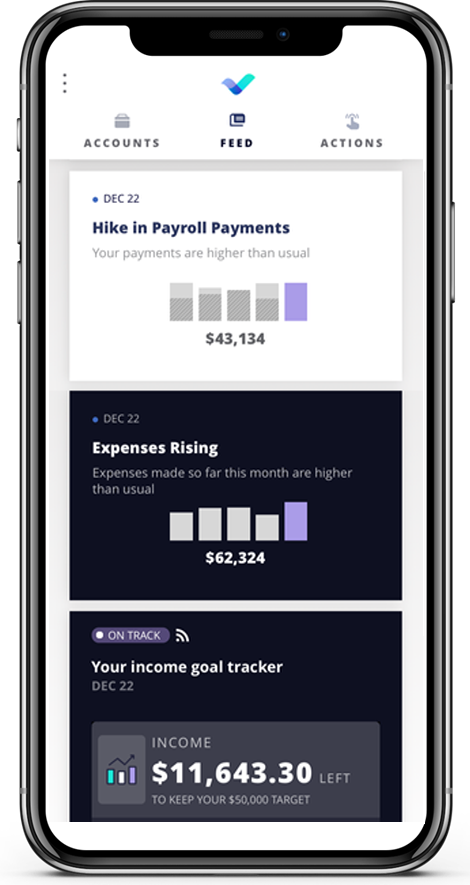

Dans l’ère digitale, les attentes des clients envers leurs fournisseurs de prestations services bancaires vont au-delà de la facilité d’utilisation ou du simple accès aux données. Les clients désirent souhaitent que leur banque leur offre de manière proactive des conseils susceptibles de les aider à atteindre leurs objectifs financiers. Personetics Engage est une solution bancaire innovante, qui priorise véritablement les besoins des clients. Elle offre des aperçus utiles et opportuns qui permettent aux clients de se tenir informés et de maîtriser leurs affaires financières. La relation de confiance entre les banques et les clients connaît un nouvel élan grâce à l’analyse prédictive en temps réel ayant pour but d’autonomiser ces derniers.

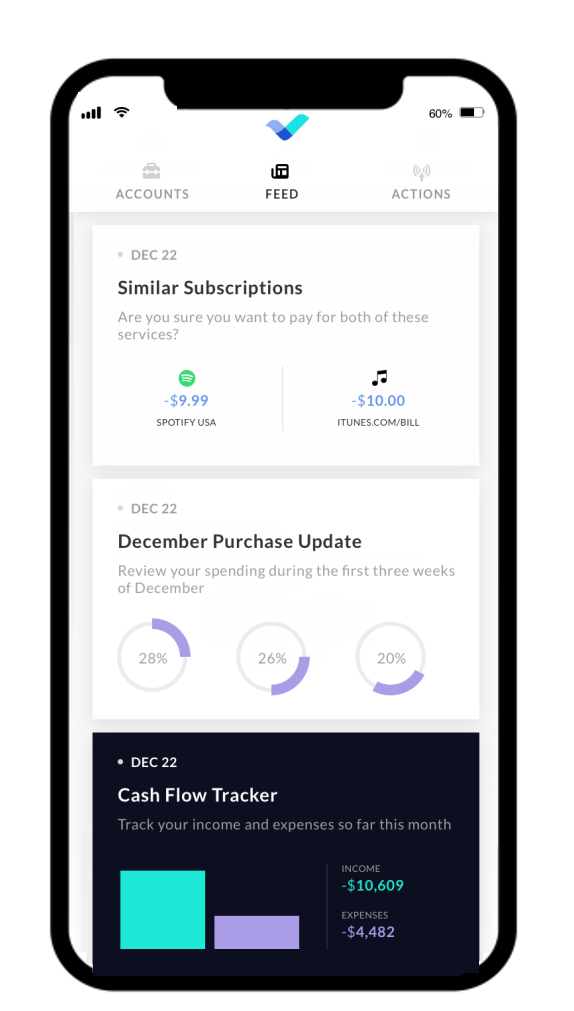

VOICI COMMENT LES BANQUES FONT APPEL À L’ANALYSE PRÉDICTIVE POUR RENDRE LES CLIENTS ENCORE PLUS AUTONOMES

Sensibiliser les clients en matière d’épargne et de bien-être financier à long terme

Proposer des mesures bien déterminées ciblées pour augmenter l’épargne, minimiser les dettes et améliorer les résultats financiers

Lancer des actions automatisées pour aider le client à se conformer au plan et à atteindre ses objectifs financiers

Fournir une rétroaction continue et réaligner les actions sur les objectifs

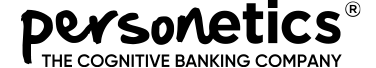

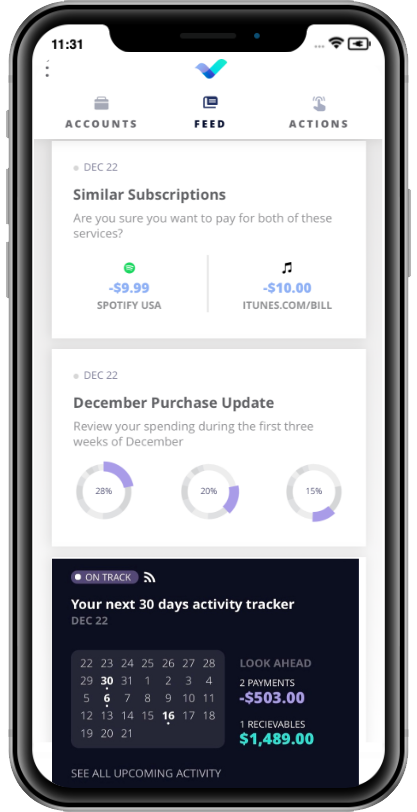

Engage en action

Son fonctionnement

La bonne information au bon moment pour chaque client

Engage analyse les flux de données propres à l’utilisateur dans le but de générer une liste personnalisée de données exploitables. Dans le but de définir l’ordre de priorité et d’affichage optimal pour chacun des utilisateurs, nous utilisons un algorithme d’apprentissage exclusif qui identifie et classe PAR ordonnance les informations les plus pertinentes à tout moment donné.

Informations en temps réel

La production de’Insights renseignements se déclenche lors de l’invocation dans le but de s’assurer qu’ils tiennent compte de l’activité la plus récente du client et de réduire les faux positifs. À titre d’exemple, aviser un client lorsque son solde est bas en s’appuyant sur les opérations de la veille serait inapproprié s’il a reçu un dépôt compensé plus tôt dans la journée.

Des renseignements innovants sur les clients pour les services financiers

Engage dispose d’une bibliothèque très riche en scénarios d’utilisation ET cas d’usages prédéfinis, comprenant des déclencheurs et des flux de travail workflows dédiés au secteur bancaire, validés auprès de clients à travers le monde, avec de nouvelles informations ajoutées de façon continue.

Auto-apprentissage

Au fil du temps, Engage apprend des interactions de clients individuels afin de mieux sélectionner et hiérarchiser les informations pour chacun d’eux. Ceci offre également la possibilité de capturer les commentaires explicites des utilisateurs (notation, likes, etc.) qui sont utilisés dans le cadre de l’algorithme d’apprentissage

Contrôlé par la banque

Engagement Builder offre aux utilisateurs professionnels banques la possibilité de gérer des informations Insights prédéfinies et d’en créer de nouvelles à l’aide du framework Personetics.

Résultats

Améliorer l’engagement, la satisfaction et l’interaction. Grâce à Engage, les banques seront désormais capables de :

Améliorer

l’engagement des clients grâce à des informations Insights et des conseils pertinents adaptés au contexte

Offrir

des produits et services qui tiennent compte des besoins des clients

Accélérer

l’adoption par les clients dès le premier jour - aucune saisie de données ou configuration n’est requise

S’adapter d’une manière transparente

aux préférences de l’utilisateur tout en maintenant un contrôle optimal

Réduire

les délais de commercialisation grâce à des connaissances préétablies en matière de services financiers

90%

Taux de satisfaction moyen par rapport au contenu proposé

15 à 30 %

Taux de réponse à la recommandation par Engage

30 à 40 %

Taux d’engagement moyen des clients

Vous souhaitez savoir comment votre banque peut également exploiter la puissance de l’IA pour engager et servir vos clients ?

Nous collaborons avec des banques de toutes dimensions dans plus de 30 pays et serons ravis de vous assister.

New York

Londres

Tel-Aviv

Singapour