Huntington Launches Money Scout – Automated Savings Tools To Boost Customer Financial Resilience

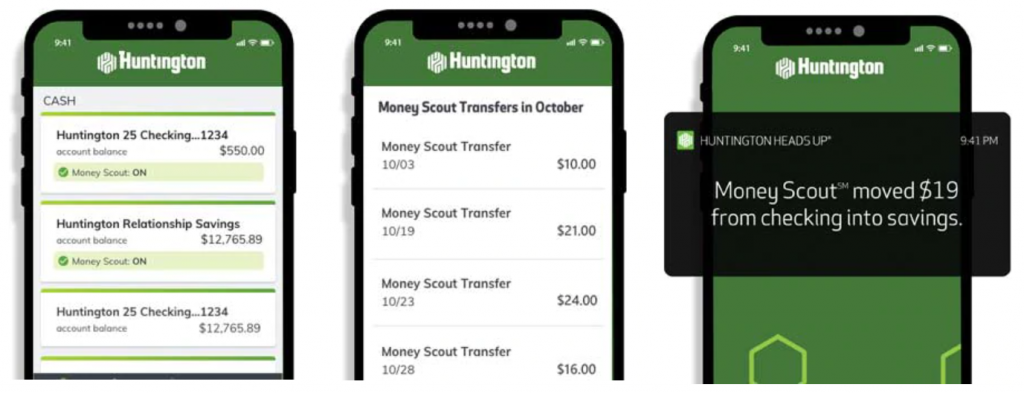

Huntington Bank launched “Money Scout” Automated Savings Tool, powered by Personetics Act, that analyzes customer spending habits, income, and upcoming expenses, finds pockets of available funds and then automatically moves those funds to savings. Huntington began the project early this year but fast-tracked it when the pandemic hit and customers suddenly needed more help.

We actually had this in pilot and I chose to accelerate it because I thought there was a need,” said Andy Harmening, the $118 billion-asset company’s director of consumer and business banking. The dollars really add up, and it shows you what’s possible.”

Huntington conducted a four-month pilot with a few thousand” people and has helped those customers save $1.7 million, or an average of $115 a month.

It helps people get started and maybe see an opportunity where they didn’t. It gives them a cushion where they need it most.”

This release follows the previous successful launch of Heads Up” based on the Personetics Engage Solution, and uses AI models to find money that is not being used in day to day expenses. Money Scout” self-adjusts to determine the optimal amount to transfer and ensures the account has sufficient funds to cover all transactions, all friction-free and seamless to the customer.

Money Scout” continuously monitors the progress of the savings and sends push notifications to update customer progress, alerts that promote the amount of funds already saved and supportive nudges to keep people on track.