Webinars

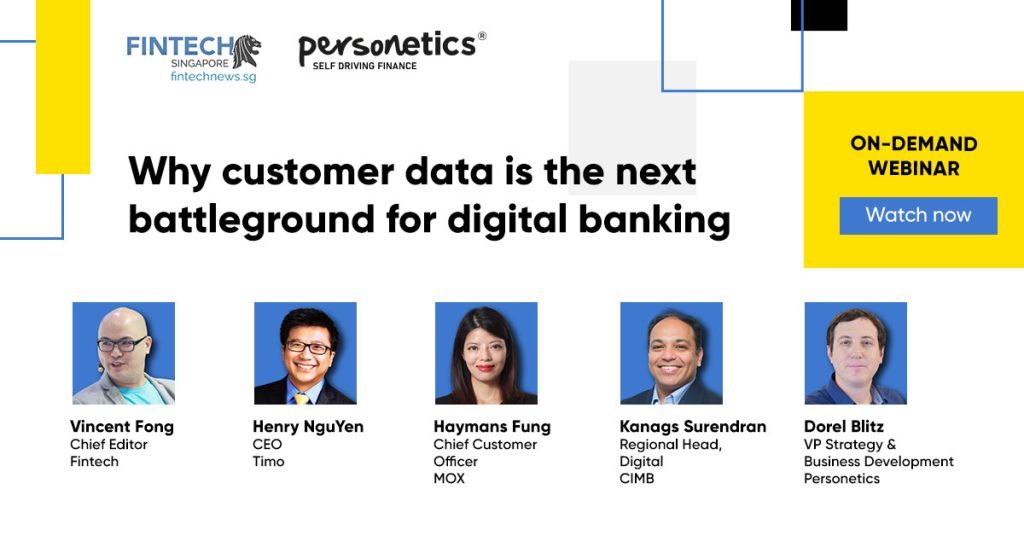

[Webinar Replay] Why Customer Data is the Next Battleground for Digital Banking

Banks in Asia are leading the way to the future of digital banking. The Asian banking market is one of the most dynamic and digitized and Asian banks have developed various new approaches to becoming more customer-centric and data-driven. At a moment when many banks around the world are struggling to realize the full potential of their customer data, and trying to find the right solutions to offer a more personalized banking experience, Asia’s digital banks can offer significant lessons.

Personetics recently participated in a panel discussion hosted by:

Vincent Fong from Fintech News Singapore

Including leaders from some of Asia’s top digital banks:

- Henry Nguyen, CEO of Timo Digital Bank in Vietnam

- Haymans Fung, Chief Customer Officer, Mox Bank in Hong Kong

- Kanags Surendran, Regional Head, Digital, CIMB, Malaysia

Let’s take a closer look at what Asia’s digital banking leaders have to say about the future of banking – and how your institution can stay ahead of these trends.

- Customer Data is Essential for Every Digital Bank

- Understanding Customer Data Helps Banks Deliver Faster, More Relevant Service

- Understanding the “Art” of Customer Engagement