September 17, 2025

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Article By Rotem Kedar, Product Manager, Personetics

Meet Adam. He opens a checking account, completes digital onboarding, and uses your mobile app regularly. Looks like a primary customer—until you learn his everyday card is elsewhere, his savings sit in a high-yield account at another institution, and his investments live with a fintech. You see activity; you don’t see the full relationship.

This isn’t rare. In today’s frictionless market, banking is fragmented, switching is easy and, as recent surveys have shown, loyalty is low.

In fact, according to a 2025 study by Accenture, 73% of customers engage with multiple banks beyond their main bank. It’s hardly surprising then that primacy has become one of the top two innovation priorities for bank execs right now.

But here’s the upside. Banks that do manage to secure primacy see major results, specifically eight times more fee revenue and 10 times more in deposits than secondary accounts, according to Curinos.

Achieving and maintaining primacy, however, can be extremely challenging for financial institutions. Here are some of the key challenges:

Firstly, there is no single definition of primacy. It varies by bank, by customer segment, and by generation. As the younger generations come into the banking space, there is an industry shift from the legacy definition of owning direct deposits towards payments.

Secondly, external activity is usually a blind spot as banks often lack visibility of their customers’ external financial activity without Open Banking.

Thirdly, early churn detection is tough and identifying attrition signals in real-time is still a challenge for banks.

And lastly, there’s a gap between data and action. Banks may have the data, but connecting it to relevant timely offers can be challenging.

The Levers for Primacy

Growing primacy also demands that banks pull three lifecycle levers:

Activation

According to a BCG study, only 30 to 40% of digitally acquired customers actually activate. So, there’s a critical 90-day window in which onboarding should be optimized.

Deepening

For existing customers, it’s a matter of deepening the relationship, leveraging real time transactional data that takes into account both internal and external financial activity signals.

Attrition Prevention

Lastly, being able to detect attrition signals early to increase engagement and prevent churn.

Given the importance of primacy, we at Personetics have launched a new dedicated product module. And we named it…

PrimacyEdge

Representing nothing short of a breakthrough for the banking world, PrimacyEdge is the industry’s first solution dedicated to helping banks grow primacy at scale. Powered by Personetics’ AI-driven Cognitive Banking Platform, it gives financial institutions a programmatic way to identify primacy opportunities and risks — and act on them with real-time, contextual insights.

This is what we call Proactive Primacy.

Why is PrimacyEdge Unique?

PrimacyEdge stands apart by converting financial activity indications, and behavioral patterns into programmatic, contextual actions across the customer lifecycle.

- External Visibility: It leverages Personetics Customer Financial Intelligence to provide you with external activity indicators without relying on open banking data.

- Holistic: It has your bank covered throughout the entire customer lifecycle; from activation through deepening to churn prevention and retention.

- Actionable: PrimacyEdge doesn’t just flag risks or opportunities. It inspires action by targeting real-time contextual offers to the right customer.

- Fully configurable: Since each bank defines primacy in its own way, each institution can fully configure the solution according to its primacy strategy and needs.

How does PrimacyEdge work?

A new module under our Personetics Engage product, PrimacyEdge is built around three pillars to help banks detect and act on primacy risks and opportunities in a programmatic fashion.

It starts with dedicated data Enrichment and Analytical Models designed to help banks detect external financial activity, including risks and opportunities to drive primacy.

Then we move from indications to actions with a dedicated set of pre-built, event-driven primacy insights. Banks can also customize and create their own primacy insights with Personetics Engagement Builder.

But enough about components. How does this translate into the real-life scenarios that bankers see daily?

Remember those primacy levers we discussed earlier? PrimacyEdge addresses each one of them across the entire customer lifecycle so that banks are well placed to drive customer activation, capture external funds and help prevent churn.

Let’s start with New Customer Activation and go back to our friend Adam.

For new customers like him, the first 90 days are critical for building the foundation for long-term loyalty.

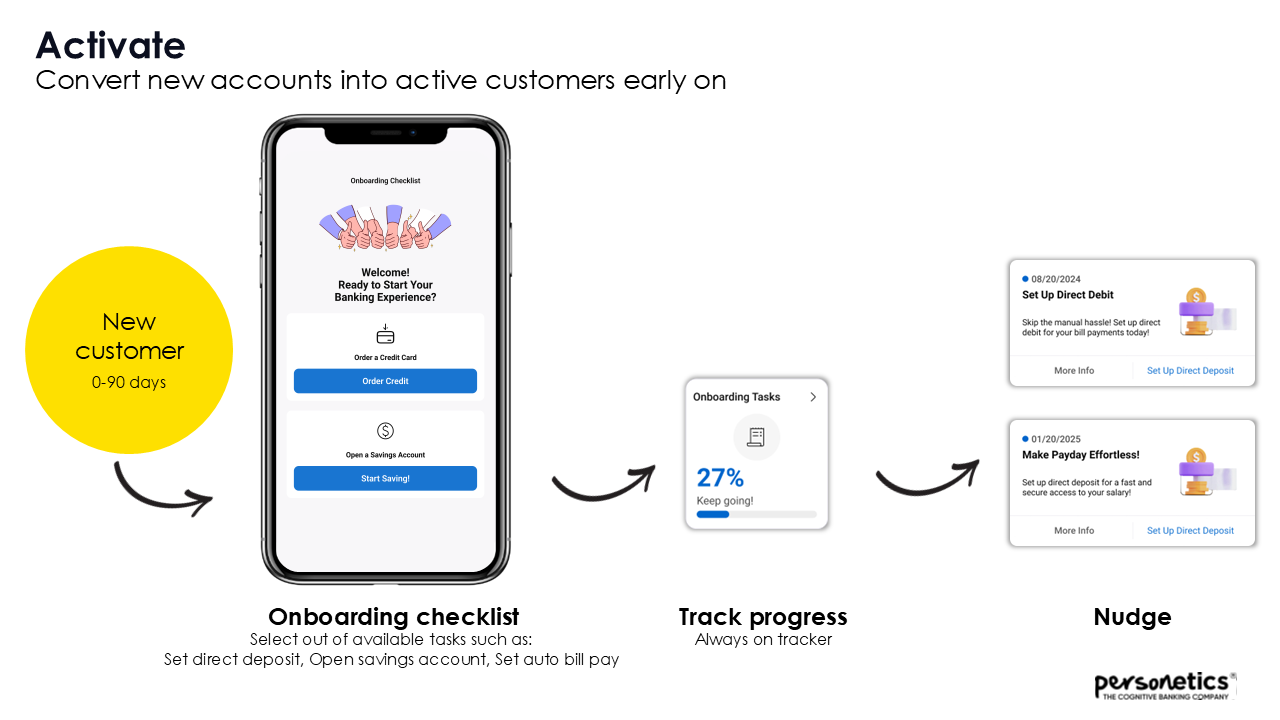

PrimacyEdge creates a flow designed to drive activation early by guiding customers through an onboarding checklist of essential actions. Banks can choose from a selection of onboarding tasks, such as setting up direct deposit, opening a savings account or setting up auto-bill pay.

Through a progress bar, configurable messaging and gamification, Adam can gain a sense of achievement. And if any tasks are left unfinished, PrimacyEdge will prompt Adam with personalized insights and nudges like a reminder to set a direct deposit and help him move forward.

Next is the opportunity to deepen the customer relationship.

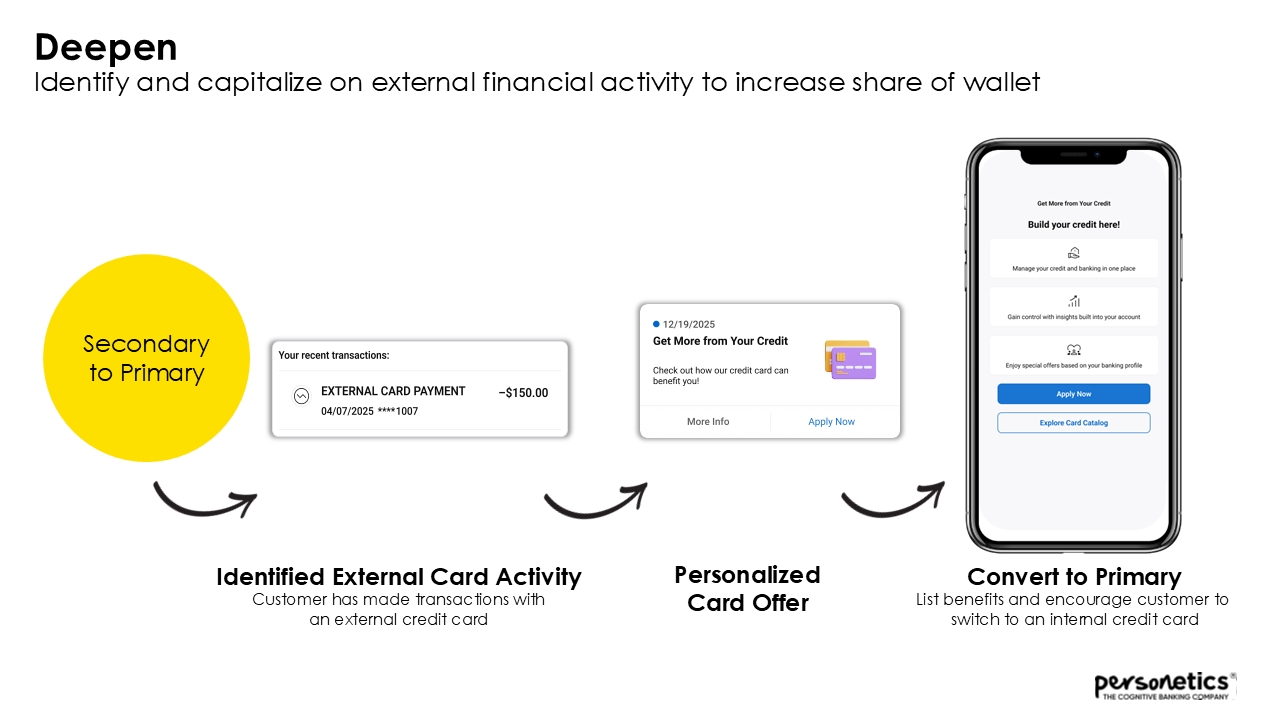

Let’s meet Paula. PrimacyEdge has detected that she is transferring funds to an external credit card. It will then deliver a timely and personalized credit card offer that highlights the value and benefit for Paula and encourages her to open a credit card account within the bank to drive product adoption and increase share of wallet. And thanks to the Engagement Builder that underlies PrimacyEdge, the bank can further customize the offer by defining a credit threshold tailor-made for Paula. It can also offer her any other products aligned to her financial status and the bank’s business needs.

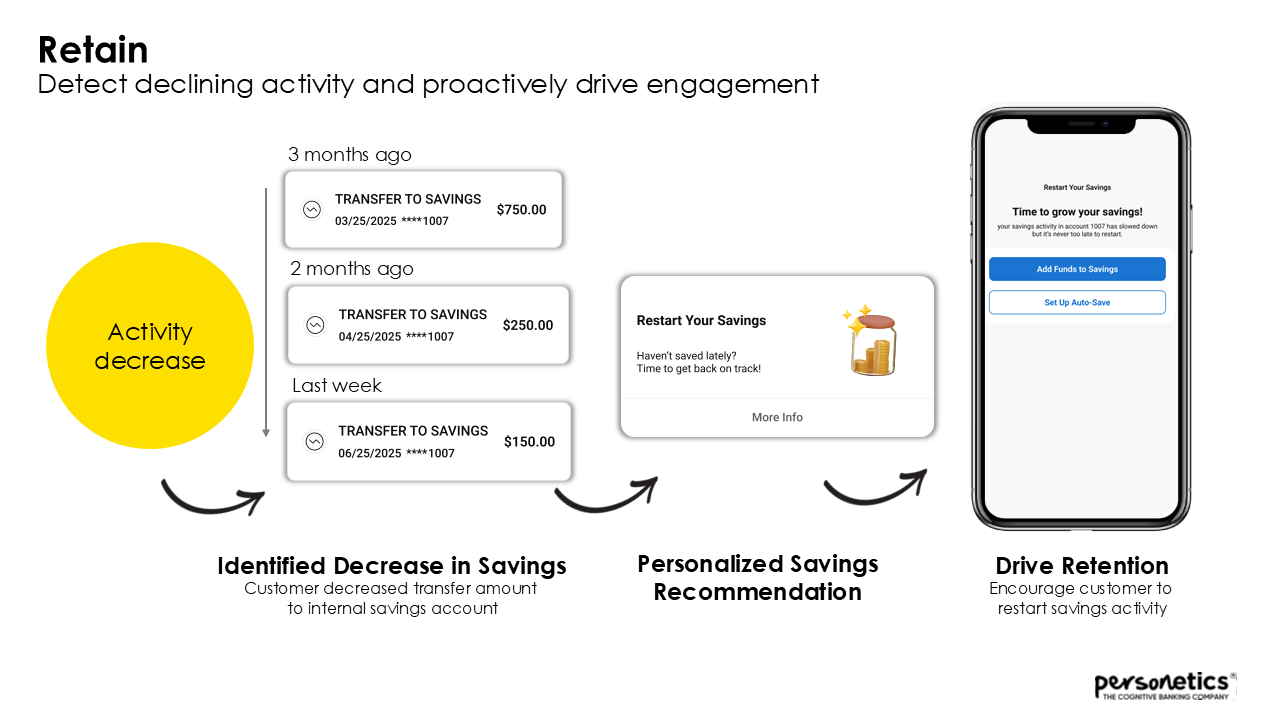

Lastly, PrimacyEdge helps retain customers that are showing a decrease in activity or risk of churn.

Meet Robbie. The bank has detected that his savings activity over the last two months has decreased. PrimacyEdge will take the opportunity to encourage Robbie to kickstart his savings again by either setting up an autosave program or simply transferring funds.

Human + Automated: Better Together

Cognitive Banking has been about bringing the human touch back into the digital banking experience so that customers feel they have a true advocate for their financial wellbeing.

Eventually PrimacyEdge will take this a step further by blending customer actionable insights with banker intelligence.

This hybrid approach—human plus automated—is far more effective than either channel on its own. Call centers understand the customer, responding to real-time insights, upselling more effectively, and making every touchpoint more efficient.

By blending automated personalized insights with human relationship building PrimacyEdge helps banks maintain the personal touch that grows share-of-wallet and deepens relationships. And it all happens seamlessly, without adding to banker workload.

Make Primacy Your Edge

Primacy is now a clear industry imperative. Personetics is meeting that mandate with PrimacyEdge—a solution that inspires action to drive primacy and grow share of wallet across the customer lifecycle. It doesn’t just tick the boxes; it extends them, giving your teams the clarity and control to win more of the relationship.

Make it your Proactive Primacy playbook.

Book a PrimacyEdge demo today by filling out the form on this page.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Maximize SaaS Value and Future-Proof Your Platform

Truist's Performance Marketing Journey: From Merger Challenges to Million-Dollar Results

How Asia Pacific Banks Are Redefining AI-Driven Engagement

How iBank and Personetics are Transforming Personal Finance in Japan

Rotem Kedar

Product Manager

Rotem, a product manager at Personetics, is passionate about turning strategy into impactful products that make a difference in the market. With a background that bridges product management, strategy consulting, and customer experience optimization, Rotem has led products from concept to launch and driven measurable growth across industries.

Bringing together creativity and analytical depth, Rotem thrives on building customer-first, data-driven products that deliver real value.