September 27, 2018

Personetics Reveals Self-Driving Finance™ Platform

Increasing levels of personalized guidance from insights and advice to automated money management provide financial institutions a roadmap to Self-Driving Finance

Bank AI 2018 (Austin, TX), September 27, 2018 –

Personetics, the leading provider of customer-facing AI solution for financial services, is revealing the industry’s first Self-Driving Finance™ platform.

Self-Driving Finance offers a novel way to simplify financial decision-making – using AI to safely and effortlessly guide consumers and businesses towards their financial goals.

Using Self-Driving Finance capabilities, banks are able to provide retail, small business and wealth management customers with varying degrees of guidance in managing their finances, ranging from real-time insights to personalized recommendations and automated money management.

Self-Driving Finance™: A Game-Changer for Financial Services

A recent report published by the World Economic Forum (WEF) points to the major impact Self-Driving Finance will have on the way financial services connect with customers and compete for their loyalty. As past methods of differentiation erode, AI presents an opportunity for institutions to escape a race to the bottom in price competition by introducing new ways to distinguish themselves to customers. Future customer experiences will be centered on AI, which will automate much of customers’ financial lives and improve their financial outcome. Self-driving finance, the report predicts, will upend existing competitive dynamics, pushing returns to the customer experience owner while commoditizing all other providers.

The Need for Self-Driving Finance

Self-Driving Finance is aiming to fill a gaping hole in customers’ financial lives. As many as 57% of Americans struggle financially, according to research by the Center for Financial Services Innovation (CFSI). They expect more help from their financial services providers – three in five consumers say banks are failing to keep up with their need. This expectations gap is a threat to customer loyalty: according to an EY survey, only 27% of customers view their bank as the first place they would turn to for anything to do with their finances.

Yet banks are ill-equipped to meet these customer needs today. As the WEF report states, current online and offline channels have limited ability to provide insights to customers on their financial habits and the impact of those habits on their future financial wellbeing, leading customers to make suboptimal decisions that are detrimental to financial health.

Modes of Self-Driving Finance

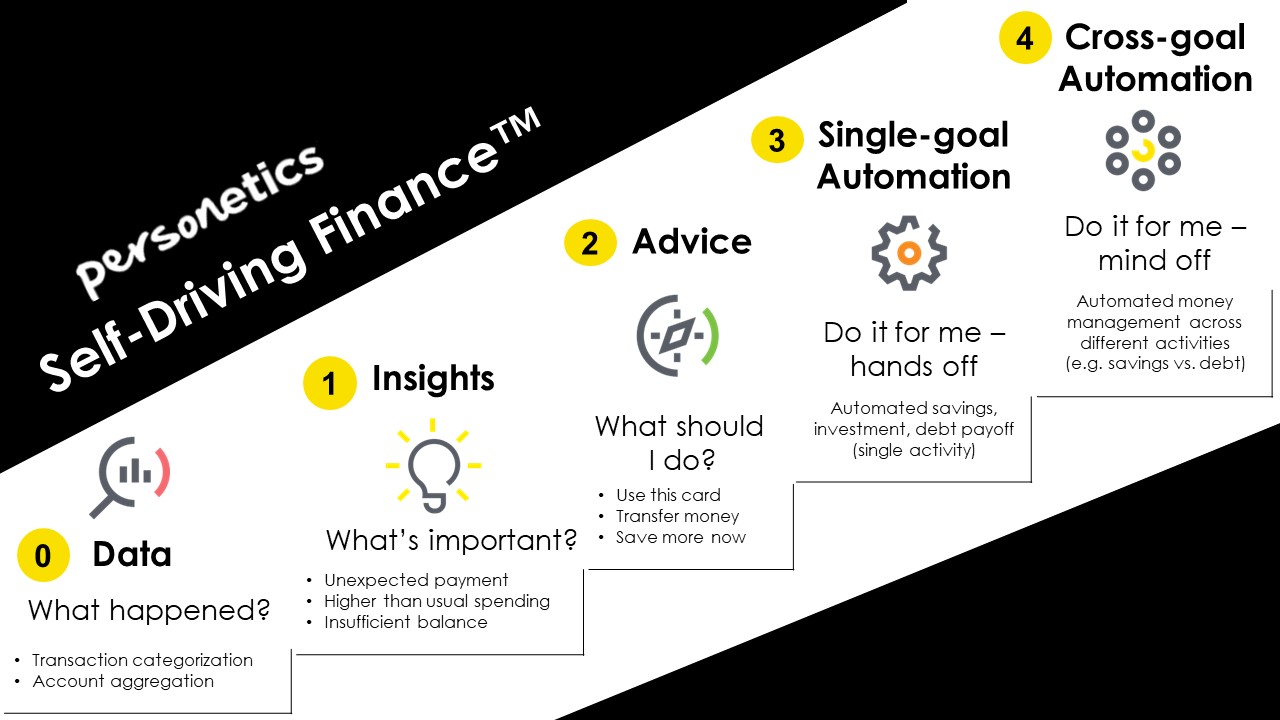

Like self-driving cars, Self-Driving Finance is not an all or nothing proposition but rather a multi-level framework with increasing degrees of autonomous capabilities. Each level provides a foundation for more advanced capabilities that can be added to the bank’s offering.

- Data (Level 0): transaction categorization and account aggregation provide an integrated view of the customer’s financial history.

- Insights (Level 1): adding a layer of analytics to highlight exceptions and important events.

- Advice (Level 2): moving from descriptive to prescriptive analytics, just-in-time advice is offered to help customers manage their day-to-day finances.

- Single-goal Automation (Level 3): focused on a specific goal, automated money management makes it easier for customers to save more, increase their investment funds, or pay off their debt.

- Cross-goal Automation (Level 4): the ultimate level of Self-Driving Finance automates decisions that involve multiple options for improving the customer’s financial wellbeing, including cashflow management and allocation of funds towards various financial goals.

“By empowering customers to improve their financial lives, Self-Driving Finance can be a catalyst to establishing the bank as the go-to financial partner for the customer,” said David Sosna, Personetics Co-founder and CEO. “Working with the world’s leading banks, we are witnessing firsthand how these solutions are lifting engagement levels, increasing share of wallet, and allowing banks to offer new products and services that cater to a new generation of digital-native customers.”

About Personetics

Personetics is the leading provider of customer-facing AI solution for financial services and the company behind the industry’s first Self-Driving Finance™ platform.

Harnessing the power of AI, Personetics’ Self-Driving Finance™ solutions are used by the world’s largest financial institutions to transform digital banking into the center of the customer’s financial life – providing real-time personalized insight and advice, automating financial decisions, and simplifying day-to-day money management.

Serving over 50 million bank customers worldwide, Personetics has the largest direct customer impact of any AI solution provider in banking today. Personetics now counts among its customers 4 of the top 5 US banks and 6 of the top 12 banks in North America and Europe, as well as other leading banks throughout the world.

Led by a team of seasoned FinTech entrepreneurs with a proven track record, Personetics is a rapidly growing company with offices in New York, London, Singapore and Tel Aviv. The company has been named a Gartner Cool Vendor, a Top Ten FinTech Company by KPMG, and a Top Ten Company to Watch by American Banker.

For more information, visit https://personetics.com.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook