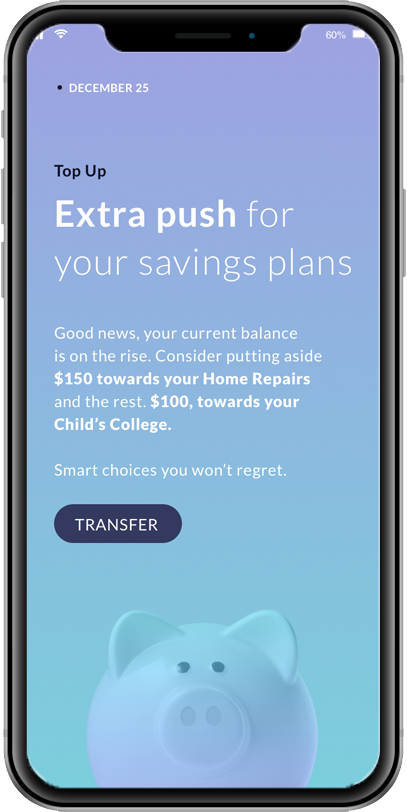

Open banking regulation gives customers the opportunity to centralize their banking activity and seamlessly move funds from one bank to another. By offering Financial Wellness Programs that allow customers to transfer funds between banks, customers ensure their funds are working for them while the bank increases its share of wallet.

Personetics Act

Self-Adjusting, Automated, Financial Wellness Programs

Personetics Act

Self-Adjusting, Automated, Financial Wellness Programs

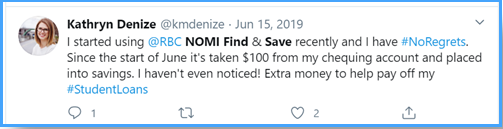

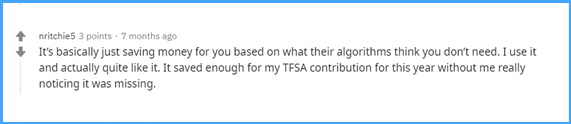

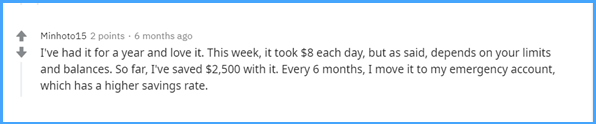

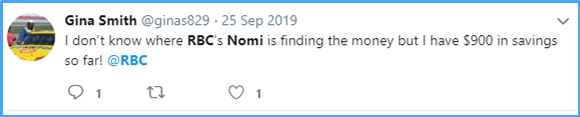

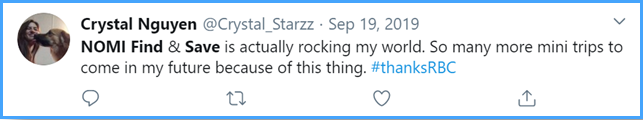

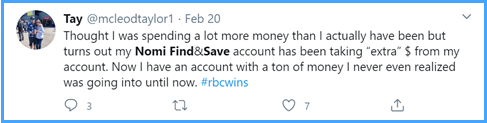

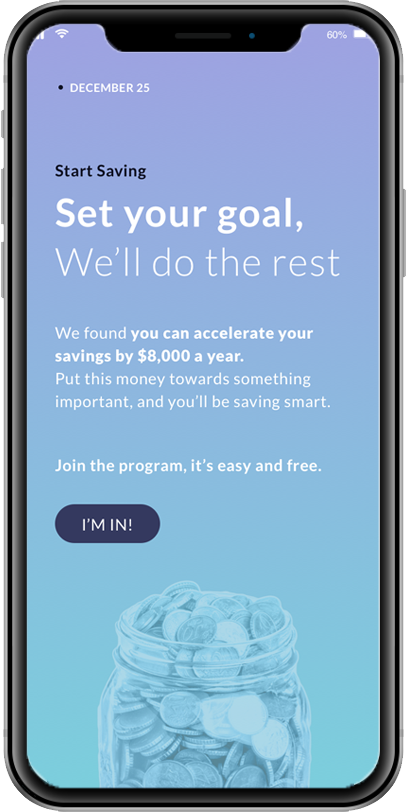

Personetics Self-Adjusting, Automated, Financial Wellness Programs help customers reach long-term financial goals and achieve financial resilience by engaging customers in habit-forming financial wellness behavior over an extended time frame.

PERSONETICS' SELF-ADJUSTING, AUTOMATED, FINANCIAL WELLNESS PROGRAMS

HAVE HELPED PEOPLE SAVE

$

US Dollars Since Launch

Covering a Wide Range of Financial Programs

Automated Savings

- Strengthen customer’s financial security by automatically identifying pockets of available funds and transferring them to an appropriate savings account.

Pay Yourself First

- Help customers safely save part of their income. The program identifies recurring income and transfers a safe portion of it according to an AI based risk strategy.

Smart Budgets

- Helps target customers reduce monthly spending in specific categories by recommending smart targets and help to stay on track.

Begin To Invest

- Help customers put aside money into tax advantaged savings accounts and automated advisory accounts. The program combines of smart recurring transfers and impulse savings recommendations.

Reduce Debt

- Help customers pay-off high interest debt (e.g., credit card). The program provides automated transfers and impulse recommendations to prioritized credit account.

The Benefits of a Resilient Customer on the Bank

A Resilient Customer Has

The Benefits of a Resilient Customer on the Bank

- Higher Life Time Value

- Greater Loyalty

- Increased Product Adoption

- Reduced Delinquency and Defaults

A Resilient Customer Has

- 3-6 month Emergency Cushion

- Impactful Spending Management

- Ability to Borrow

- High Savings/Income Ratio

- Higher Life Time Value

- Greater Loyalty

- Increased Product Adoption

- Reduced Delinquency and Defaults

- 3-6 month Emergency Cushion

- Impactful Spending Management

- Ability to Borrow

- High Savings/Income Ratio

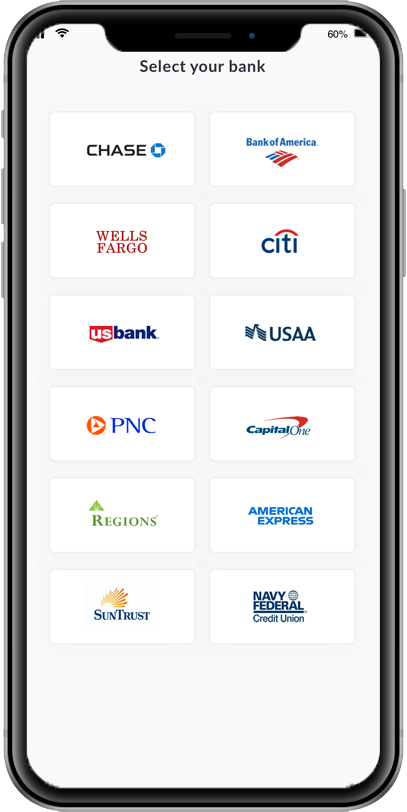

Optional Aggregation Links External Accounts For More Visibility

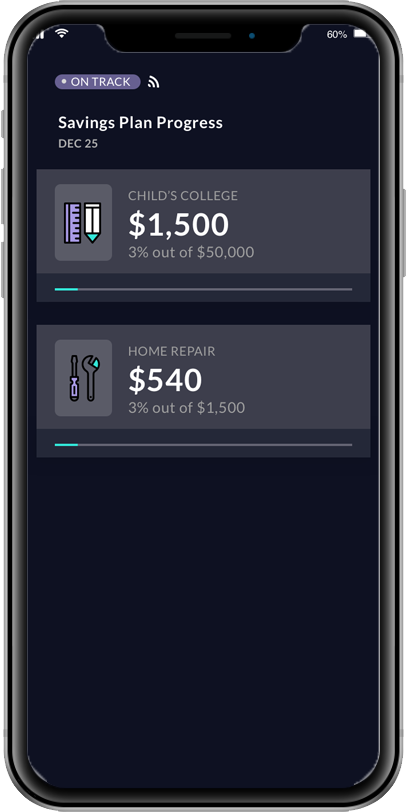

Segment, Map, Invite Customer

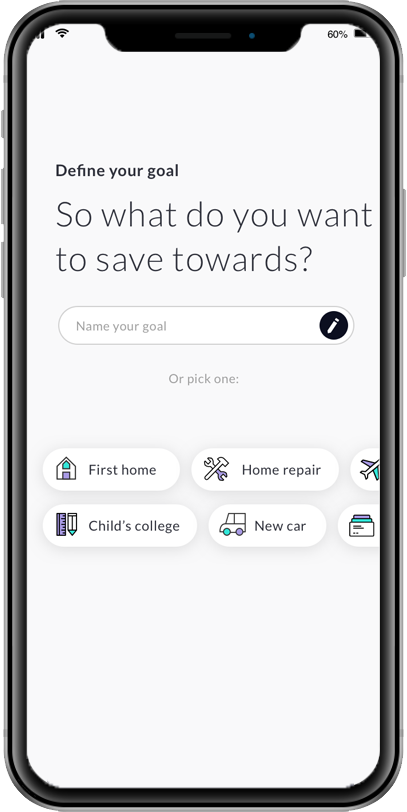

Define Goals

Aggregate

Auto Transfer & Tracking

Nudge and Adjust

Want to explore how your bank can harness the power of AI to engage and serve customers?

We work with banks of all sizes across all geographies and will be happy to see how we can help.

New York

London

Tel Aviv

Singapore

Tokyo

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.