June 18, 2020

Financial Wellness Programs to Build Trust and Resilience

By harnessing AI-based technologies and analyzing financial transactional data, banks can smartly guide customers through their financial journey, addressing current challenges while building up their ability to withstand hardship in the long-term.

Full of uncertainty, the new normal of the post-COVID world has illuminated the need for banks to strengthen customers’ financial resilience, their ability to withstand and recover from temporary financial hardship and disruptions. Resilient customers and their sustainable finance should matter to banks, because they are more prepared for inevitable future downturns, and equipped to better manage their financial situation during turbulent times. The urgency of this moment means, according to Jim Marous of The Financial Brand, that banks need to rethink how they use “data… [and] artificial intelligence (AI)… to impact marketing, innovation, and the digital delivery of products and services”. With AI and data-driven technology, and with personalization, in particular, banks can support customers through a trust-building process that meets them where they are, thereby preparing them to overcome whatever unique hardships they face in their own financial journey. Some banks are already utilizing personalized programs and tools, but there is a significant opportunity for their expansion.

The Need for Personalization

A May 2020 McKinsey report suggests that banks use data “to inform personalized offerings and interactions that take into account each customer’s unique financial situation” in order to not miss “critical nuances.” The ability to not only catch nuances but meet customers where they are and offer them seamless, automated tools that fill their unique needs, are what makes personalization such a critical component of building resilience.

Without personalization, banks miss potential weaknesses or areas that need buffing up. Those weaknesses may be small enough to miss early on but could lead to customer delinquencies and defaults down the line. And they do not appear uniformly across all customers. Banks today are equipped to understand delinquencies and collect debt once a customer is delinquent. They are less prepared to anticipate or predict customers who might go into delinquency and support them to avoid that outcome. The ability to do so strengthens the empathetic message many banks want to send customers right now while also leading to real savings for the bank and its customers.

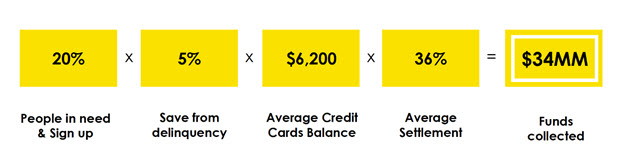

Reference: Based on actual results collected from major banks in the US, UK, and France

According to Personetics’ customer data, if just 20% of customers at a bank that serves 1.5MM customers opt into an automated savings program, and a conservative 5% of those customers avoid delinquency as a result of their participation, the bank can save $34MM (assuming an average credit card balance of $6,200, and that a bank generally recovers 36% of delinquent funds). This demonstrates the significant savings that banks can secure by supporting even just a small fraction of their customers through personalized programs.

By addressing problems while they are small, personalized engagement helps banks build trust and, consequentially, stronger relationships with their customers. Stronger relationships increase customer loyalty and product adoption but also lead to tangible improvements in customers’ financial health, such as wider savings cushion, better spending management, and debt reduction.

Personalization Guides Customers through their Financial Journeys

Traditional engagement tools have shown customers snapshots of a moment in time. But a moment in time can misrepresent – to both customer and bank – customers’ actual financial health at that moment, let alone their long-term resilience. Personalized wellness programs offer the potential to deliver habit-changing value to customers, guiding them through their financial journey and helping to do whatever job is most appropriate for that customer to complete at any point in their lives.

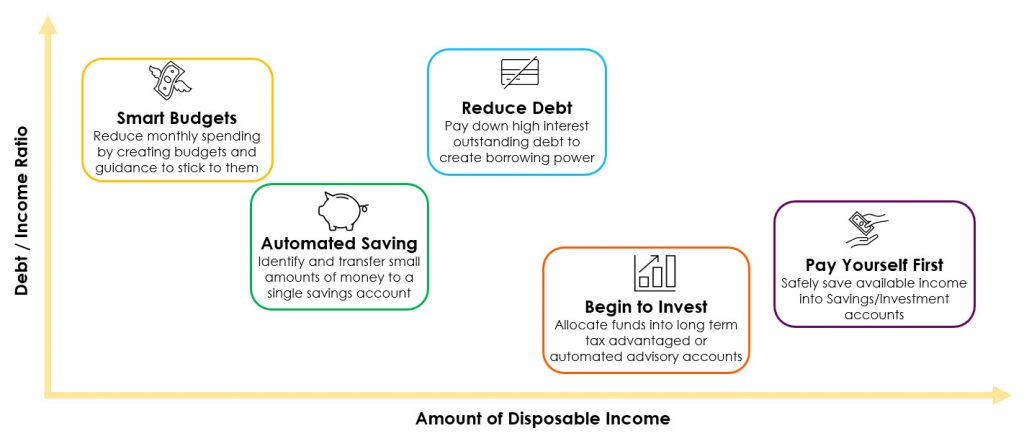

Personalization allows banks to segment their customers into personas and tailor wellness programs as their financial needs evolve throughout their life. Imagine Beth, a recent college graduate who is just starting her career as a nurse. She earns a relatively low salary and has significant student debt to pay off. Beth would benefit from a smart budgeting program, which reduces her monthly spending by suggesting and setting up budgets and guides her behavior to stick to it. After some time, Beth gets married with two incomes now supporting her household and gives birth to a baby. At that point, the bank may offer Beth’s family an automated savings program, which identifies and transfers small amounts of money to a single liquid savings account, perhaps toward college tuition or a bigger home.

As Beth and her partner move forward in their careers and gain more disposable income, they can start to make serious headway on their college debt and mortgage. Debt reduction programs can help them pay down outstanding debt to create borrowing power. Around the same time, Beth and her family can opt into a “Pay Yourself First” program, which safely saves part of their income into a savings account. And as they build wealth, they may also choose to increase their investments. Personalized programs can set aside money for the long term into tax-advantaged savings accounts or automated advisory accounts.

The bank has met Beth where she is and helped her to do whatever financial job was needed at that point in her life. Throughout this time, the bank has retained Beth as a customer with increasing product adoption and share of wallet. Beth has received a valuable, holistic lifetime service that has helped her develop healthy habits and nurtured her financial resilience. She has built trust in the bank’s genuine interest in her long-time financial health.

Personalization Builds Trust

Engagement initiatives need a personalization evolution, and there is much-untapped potential in this market. According to Accenture, most offerings today still focus more on traditional customer engagement rather than on building trust and concretely impacting financial health. Meanwhile, 47% of customers agree it is critical or very important for banks to treat them as human, not just as a customer.

Banks have a significant opportunity to leverage data for personalized programs that create true value, especially when coupled with the elevated need to build resilience in the COVID-19 world. According to McKinsey, banks can consider a broader role of economic and social stewardship on behalf of their customers, including remaining thoughtful about collections and rethinking credit strategies to ensure appropriate lending. All these in an effort to build more resilient customers. Personalization is a critical tool for building financial resilience, which builds trust, driving a new paradigm of mutual advocacy and long-term stability for customers.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook