AI Powered and Data Driven Small Business Banking

Insights and Guidance for Day-to-Day Money Management & Cashflow Optimization

AI Powered and Data Driven Small Business Banking

Insights and Guidance for Day-to-Day Money Management & Cashflow Optimization

Small business owners and managers have high expectations from financial services providers in the digital age. With cashflow critical to their survival, an aggregated real-time view of their finances anytime anywhere is a key requirement. Beyond survival, they need forward-looking insight and advice to ensure adequate liquidity and be well-positioned for growth.

Using the power of AI in Banking and predictive analytics to help businesses control their finances and simplify money management, banks can establish themselves as a trusted partner and build deeper relationships with their small business customers.

90%

Of SMBs owners would like to conduct basic banking activities digitally

41%

Do it today

Scan payment and expenses activity to flag exceptions

Suggest corrective actions to avoid cash shortages and other business disruptions

Increase business agility by identifying and responding to liquidity and growth needs

Educate the business about relevant bank products & services that can simplify and improve financial control

EMPOWERING SMALL BUSINESS FINANCIAL MANAGEMENT WITH ACTIONABLE INSIGHTS AND CASHFLOW PREDICTIONS

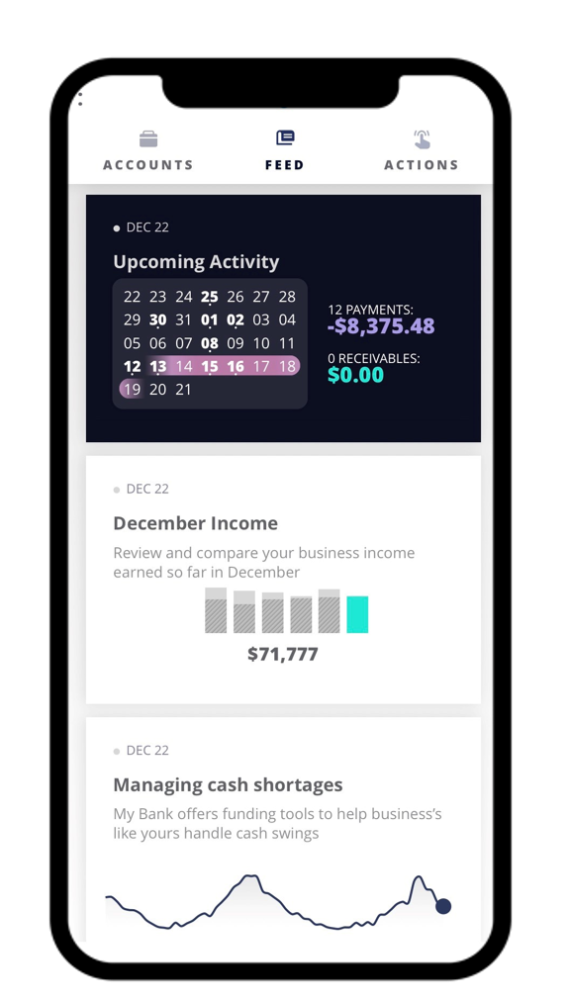

Day-to-day Banking Insights

Simplify everyday financial management by proactively highlighting important issues and suggesting corrective actions.

Cashflow Predictions

Enable the business to preempt expected balance shortfalls by predicting future cashflows.

Mobile-enabled Money Management

Integrate the experience into the bank's mobile app, allowing business owners and employees to stay on top of their financials anytime anywhere.

Out-of-the-Box Business Insights

Shorten time-to-market with a rich library of prebuilt insights tailored to business user' needs.

Customized and Controlled by the Bank

The Personetics Engagement Builder allows your bank to modify pre-built insights, add your own custom insights, and control the user experience.

67%

of small businesses want their bank provide online cashflow management, forecasting and budgeting tools.

A new way to serve and engage business customers

Personetics Self-Driving Finance™ delivers a new level of engagement and insight, transforming your bank into the financial partner of choice for your business customers.

Increase

business customer engagement with contextually-relevant insights

Offer

products and services that anticipate and meet the needs of each business such as real-time line of credit or loan

Jumpstart

customer adoption from day one – no data entry or setup needed

Seamlessly

adapt to user preferences while retaining the ultimate control

Accelerate

time-to-market with pre-packaged financial services knowledge

AWARDS

Want to explore how your bank can harness the power of AI to engage and serve customers?

We work with banks of all sizes across all geographies and will be happy to see how we can help.

New York

London

Tel Aviv

Singapore

Tokyo