April 10, 2025

What is Cognitive Banking?

By Udi Ziv, CEO of Personetics

Here’s a wake-up call: JD Power reported that over the six years between 2018-2024, there was a 60% increase in account switching.

It’s no coincidence that digital banking has become ubiquitous over this same period. But while it has been a cost saver for banks and a time saver for customers, the digital banking experience has become increasingly impersonal.

And yet, as I wrote in my previous blog, one truth has become clear: consumers across all ages and geographies still want to feel cared for; even when their user experience has become primarily digital. They don’t want to ask for help, they want their bank to anticipate what they need, when they need it.

That’s where Cognitive Banking comes in. It’s about taking the kind of highly curated financial guidance that was once available only to the wealthy and making it accessible to everyone, everywhere, at any time.

Download our report: The Cognitive Banking Advantage: How an AI-Powered Customer Experience Drives Results.

It represents a shift from product-centric campaigns to intelligent engagement—powered by AI, real-time data, and behavioral insight. As Jim Marous (Top 5 Retail Banking Influencer, Global Speaker, Podcast Host and Co-Publisher The Financial Brand) puts it so eloquently: “Cognitive Banking is like going back to the future. We’re essentially rebuilding what made community banking great; a financial institution that deeply understands each customer’s needs and context—but doing it at massive scale through AI and digital banking.”

What Does Cognitive Banking Do?

Let’s be clear: Cognitive Banking is not about making a few personalization enhancements. It’s about completely redefining the way banks engage with their customers. At its core, it delivers intelligence that’s actionable, contextual, and genuinely helpful.

But what does that actually involve?

Here are the six essential capabilities that define Cognitive Banking:

- Analyze all the transactions of each customer

This begins with continuous, behind-the-scenes processing of a customer’s full financial activity. It’s not just about categorizing transactions—it’s about leveraging AI to interpret all of the customer’s financial data so that your bank can understand their financial behavior, detect changes, and uncover patterns that static data simply can’t reveal. From bill payments to lifestyle shifts, every action adds to a richer, more dynamic customer profile.

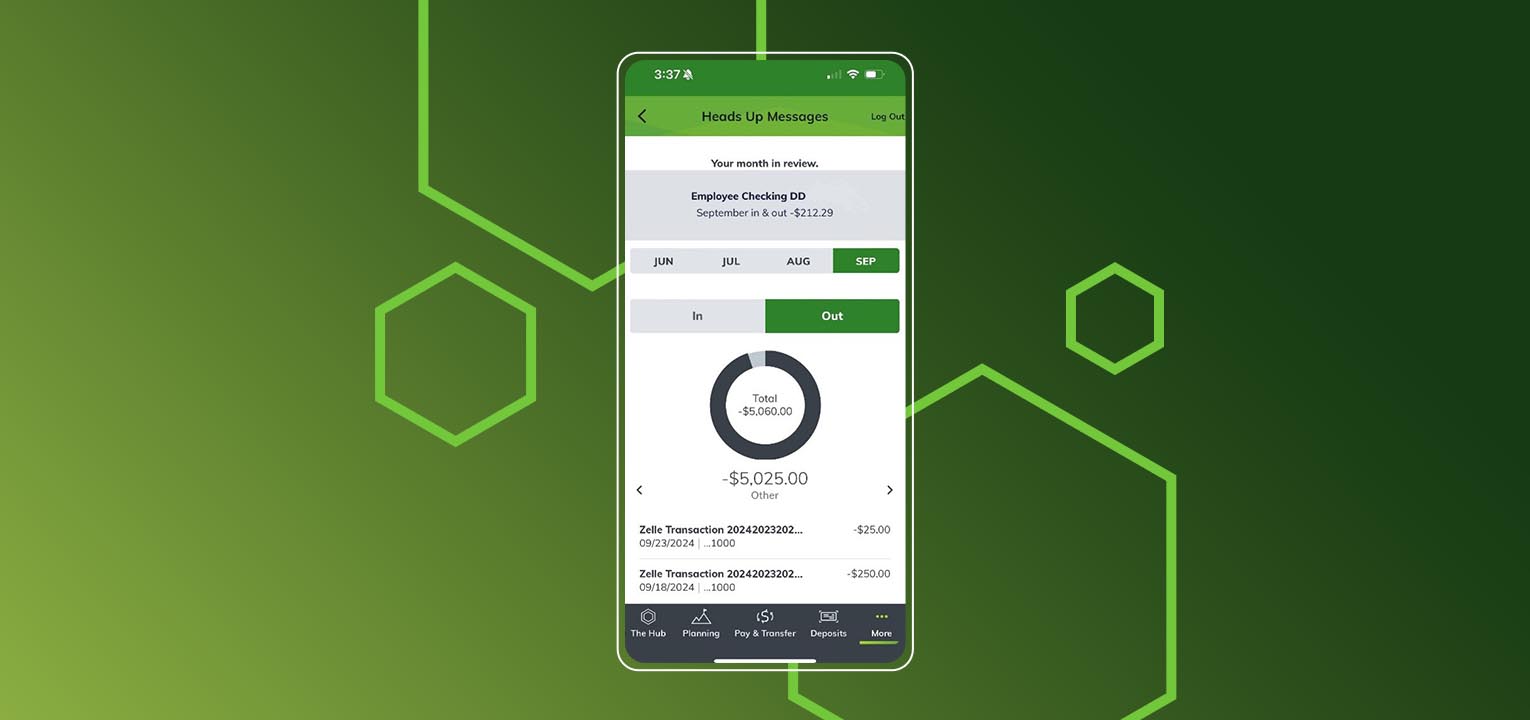

- Present the financial situation in a useful, readable way

Cognitive Banking takes the complexity out of finance. It translates raw data into clear, intuitive messages that help customers immediately understand where they stand. Instead of charts and balance tables, they receive actionable insights like:

“You’ve spent 30% more on groceries this month—would you like help setting a new budget?”

Or instead of sending customers a list of their credit card transactions in some unidentifiable code, they can see logos of the stores to easily identify where they made their purchase.

This kind of clarity fosters day-to-day confidence and long-term trust.

- Identify the customer’s current needs

By analyzing behavior in real time, Cognitive Banking spots what the customer needs right now. That might be identifying duplicate subscriptions and allowing the user to initiate cancelling one of them with the click of a button. Or suggesting a way to avoid late fees. These are not sales moments; they’re service moments that build meaningful engagement.

4. Anticipate or predict future needs

A Cognitive Banking platform also looks ahead. By forecasting potential challenges—like flagging a risk of overdraft before payday—or spotting long-term opportunities—like an increasing savings habit that could support specific financial goals—Cognitive Banking helps customers plan, prepare, and feel in control.

- Offer the exact product that addresses the need

This is where needs-based selling comes in. Instead of pushing blanket promotions, Cognitive Banking delivers product offers that are timely, relevant, and connected to the customer’s real financial situation. If a customer is likely to carry a negative balance next week, the platform might suggest a short-term credit solution tailored to their behavior—not their demographic.

- Learn from the customer’s reaction to improve next time

Every insight or offer generates feedback—explicitly or implicitly. Did the customer engage? Did they ignore it? Did they take action? Cognitive Banking platforms capture and learn from this behavior to fine-tune future interactions. Over time, the system becomes more attuned to the customer, delivering smarter, more relevant support.

A Win-Win for Banks and Their Customers

The value of Cognitive Banking goes beyond any single transaction or feature—it transforms the very nature of the bank-customer relationship. By shifting from reactive service to proactive partnership, banks can create a financial experience that is not only more useful, but also more human.

This reimagined model delivers measurable gains on both sides: empowering customers to make smarter decisions, and enabling banks to drive stronger engagement, loyalty, and long-term value.

The Win For Customers

Customers gain tools that simplify decision-making and reduce financial stress. Instead of reacting to problems, they’re equipped to avoid them altogether.

When a bank uses AI to help a customer avoid overdraft fees, save more effectively, or prepare for upcoming expenses, it builds the kind of trust that used to come from knowing your local banker personally.

The Win For Banks

The result is measurable: increased customer satisfaction, stronger retention, and up to 10x higher engagement rates compared to traditional banner campaigns.

David M. Brear (Chief Executive Officer, 11:FS) frames the stakes clearly:

“The future is no longer about 10x lower cost. It’s about 10x lower cost, but 10x better service as well. We now have all the capabilities and technology. We just need to build the case for serving customers in a better way.”

It’s Time to Get Thinking

Cognitive Banking is more than an innovation, it’s a shift in mindset. It moves banks from product-pushing to trusted partnership, using AI to drive smarter engagement and stronger relationships.

We’re just scratching the surface of what’s possible. The future of banking will be proactive, predictive, and optimized for each customer’s individual needs.

Let’s build that future… together.

Want to Learn More?

If you’re ready to take a deeper dive into how Cognitive Banking works and why it matters, I invite you to download our report: The Cognitive Banking Advantage: How an AI-Powered Customer Experience Drives Results.

Want to explore how your bank can harness the power of Cognitive Banking to engage and serve customers? Request a demo now

Related Posts

Beyond Digital: Jim Marous on Why Banking Must Become Cognitive

Huntington Bank: A Masterclass in Data Enrichment and Customer Engagement

Leading with Excellence: Personetics Honors Women in Leadership this International Women's Day

What Your Customers Really Want in the AI-Banking Era

3 Banks' Secrets to Deeper Customer Relationships: Data-driven Personalization

Leading Through Disruption: Insights from the FT Global Banking Summit

Udi Ziv

Chief Executive Officer

Udi Ziv is a seasoned CEO with a proven track record of leading companies to scale. His 30 years of leadership span both entrepreneurial ventures and overseeing large-scale operations as a senior executive at some of the largest global enterprise software companies. Before joining Personetics, Ziv served as CEO of Earnix, guiding the company through a landmark period of expansion. Prior to Earnix, he led Pontis to a successful acquisition by Amdocs, was President at NICE Systems, Managing Director at SAP, and the co-founder of TopTier which was later acquired by SAP.