November 9, 2024

Competing in Open Banking: Offense, Defense & Intelligence

By Scott McQuilkin, Data and Analytics Transformation Leader

Bankers I speak to regularly tell me how worried they are about the threat posed by Open Banking, which allows third-party providers to safely access banking customer data. They see their customers using Apple Pay to purchase, Venmo to pay their friends, ADP to manage their direct deposit, and their fintech app to manage their overall finances. The bank is losing their customer’s attention and many new fintech apps are also using Open Banking to siphon funds from their customers’ bank accounts.

The time of banks as a walled garden has passed. Now every bank worries their customer base and funds are intensely vulnerable to fintechs offering next generation Open Banking applications.

But those concerns are misplaced. Open Banking is indeed a threat to traditional banks, but it also presents an opportunity. Banks that understand the true nature of the threat can counter it early and gain considerable advantage long-term.

Three threats to traditional banks

First let me illustrate how the Open Banking threat is currently understood, with three use cases.

1. Threat #1: The bank’s connection to its customer has weakened

The Albert app uses Open Banking to link to its customers’ bank accounts and provide personalized insights into their spending habits and financial situation. It can do everything from tracking spending and saving, to alerting customers about overdraft fees and bill hikes, while also cross-selling them new products and services.

While customers still deposit their money with their bank, it has become essentially a utility. Customers’ loyalty, attention, and primary relationship shifts to Albert.

2. Threat #2: Significant ongoing deposit leakage

The Digit app – soon to rebrand as Oportun – is an automated saving program that makes it easy for customers to save and invest by performing these tasks on their behalf.

Digit uses Open Banking to link to customers’ bank accounts and analyzes their cashflow and spending habits, determining how much money users need for upcoming bills. It then pulls over excess money into the Digit App. Digit helps users save for their goals and protects them from overdraft in their checking account.

This leads to ongoing, significant deposit leakage for the bank.

3. Threat #3: Customers prefer personalized point solutions

Tally targets customers with debt problems spread across several high-interest credit cards.

Customers link their cards to the app and, if eligible, Tally will create a payment plan for them, paying off the debt with a custom, low-interest line of credit. Customers pay Tally back in one monthly bill, saving on interest and simplifying their debt management. It’s one of many cases in which a fintech, instead of the bank, uses data, or intelligence, to solve a major financial problem for customers.

The Open Banking battleground

Despite the hype, with a market size of just $16.4 billion in 20211, these fintech Open Banking apps have yet to make a meaningful impact on most banks’ bottom lines. But what about when all banks have that Open Banking technology and the ability to communicate regularly with other banks’ customers?

That time is coming soon. When it does, no customer and no deposit will be safe.

But banks that leverage the full capabilities of Open Banking early will protect themselves from Open Banking apps and also gain a first-mover advantage on other banks.

This is the Open Banking battleground. Let’s look at the tactics you’ll need to survive and thrive.

Your battle tactics: offense, defense, and intelligence

1. Tactic #1: Open Banking Defense – Huntington

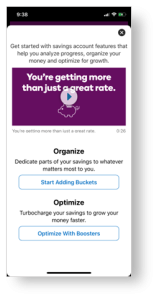

Your best defense is to regularly engage customers with financial data-driven hyper-personalized content, so they log in more frequently to your digital assets and stay longer.

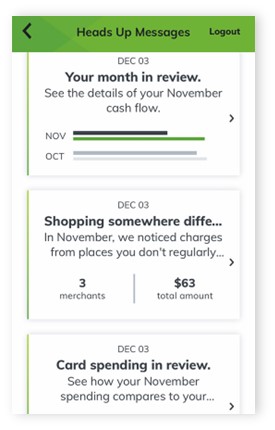

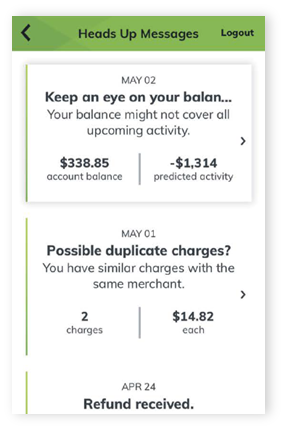

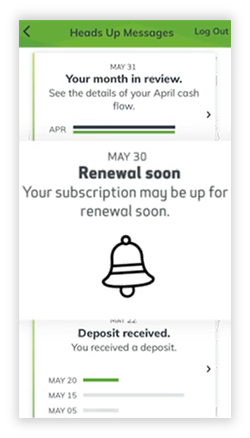

Huntington ranked first among regional banks in the J.D. Power 2022 U.S. Mobile App Satisfaction Study. It has achieved this, in part, by using Personetics’ Engage solution to deliver customers personalized insights and advice on their finances, via push notifications and in-app messages.

These insights might include alerts about duplicate charges or notifications that help customers track their subscription spending. Customers are brought into the application regularly with helpful guidance on their finances, which builds their trust in Huntington.

|

|

|

Personetics has deployed these Open Bank defense capabilities to 130 million customers worldwide, at over 100 banks ranging from Truist to Wells Fargo and the Santander. In every case, the service is tailored to the bank’s specific approach.

The results are profound, including on average 35% digital engagement, 6X conversion rates on product based-advice and a 2.5X lift in customer retention.

2. Tactic #2: Open Banking Offense – Ally Bank

To keep competitors from siphoning money from your customers’ accounts, you must go on the offensive – using the same playbook to divert money from other banks into yours.

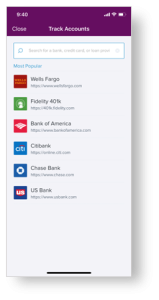

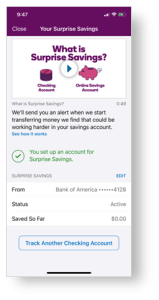

Ally Bank, an American digital-only bank primarily focused on savings, used Personetics’ ACT financial wellness solution to launch “Surprise Savings.” It’s a function that analyzes customers’ spending in their linked account at another bank (through an Open Banking connection) to find free cash not needed in their checking account and then automatically transfers that extra variable amount of money into an Ally savings account.

Customers typically save 10X more than they would otherwise, while Ally grows deposits inside the bank and increases ROI.

|

|

|

To date, Personetics has helped banks transfer $6.5 billion into savings accounts, with more than 30% coming from external institutions. Banks that deploy this Open Banking Offense, see on average 5-10% growth in new accounts and balances.

3. Tactic #3: Open Banking Intelligence – US Bank

The most sophisticated next-gen banks offer customers personalized point solutions to solve their most pressing problems. This strategic use of intelligence underpins any great offense or defensive effort.

US Bank strives to give its customers the best personalized experience, offering more than 2 billion personalized financial insights that proactively help them improve their financial position.

US Bank stands out because it draws on data from a variety of sources – its own customer transactions as well external accounts accessed through Open Banking – to create completely unique propositions for each customer. For example, US Bank might identify a customer with debt who has just been approved for a loan and offer them a way to reduce their high interest debt.

This highly personalized approach delivers impressive conversion rates. Typical click-through rates on generic banner ads are below 1%, but with intelligence-led offers this metric skyrockets to 15-20%. In turn, this drives double-digit growth numbers and, on average, 0.6 more products added per customer.

You’re already competing on this battleground

Some form of Open Banking capability is already table stakes; within a couple of years, the tactics described here will become commonplace.

Your bank is already a competitor on this battleground. Will you implement Open Banking offense, defense, and intelligence capabilities swiftly, to protect your customer base and deposits and build on them? Or a laggard who comes to the game too late and finds their customers’ attention and funds have been drained away? The race is underway. The time to act is now.

To find out more about how Personetics can help your bank implement Open Banking offense, defense, and intelligence capabilities, get in touch with us today.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

The AI Implementation Reality Check

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Scott McQuilkin

Data and Analytics Transformation Leader

Scott has built artificial intelligence products at more than 20 financial institutions over the past 15 years, including 3 of the top 4 U.S. banks. Having managed AI projects with more than 300 stakeholders, Scott has seen first-hand how these undertakings can quickly grow exponentially without a deep understanding of the nuances of AI in the compliance and regulatory environment that banks and credit unions live in. His primary focus is on packaging Personetics products to provide the most value in the least amount of time for our bank partners.