March 30, 2023

How European Banks Can Grow and Retain Deposits

Since the fall, European banks have been struggling with deposit outflows – €214bn from eurozone banks, according to European Central Bank data.

As consumer confidence wavers and interest rates rise, banks’ efforts to retain deposits have intensified. Every day it seems, there are a host of financial stories with the word “deposits” in the headline.

There are multiple reasons for why we’ve reached this point, but instead of focusing on that, let’s turn to what banks should do to both retain savings and attract deposits in this hyper-competitive environment.

Drop the Traditional Tactics: Level Up Your Deposit Strategy

Battling for deposits isn’t a new thing for the banking industry, but the current situation requires a different approach to be successful. Traditional tactics like promotional rates and sign-up bonuses, don’t deliver sustainable gains. And they often don’t make much of impression on customers, either. Recent research by the UK-based Building Societies Association (BSA), “found that almost a quarter (23%) of savers don’t check the interest rate before opening an account, with a third (33%) failing to compare interest rates between other accounts.”

Traditional ways can sometimes deliver a bump in new customer acquisition, but they don’t attract the kinds of relationships that banks really want. Also, customers expect more from their financial institution than simply incentives to open new accounts.

These tactics are not going to strengthen customer loyalty and are not going to look very innovative when compared to some of the aggressive tactics used by fintechs.

4 Steps for a Differentiated Approach to Deposit Gathering

Instead, you should complement your bank’s incentive programs with a comprehensive program that will help you stand out from the competition to retain and grow your current deposits, as well as attract new funds.

1. Use Your Customers’ Financial Data to Identify Deposit Vulnerabilities and Opportunities

Instead of implementing a one-size-fits-all strategy across customers, consider a more tailored approach based on customer needs and behaviors. This starts with an understanding of the customers’ financial situation, depth of relationship, and how dynamic (or static) their funds are.

This can be done by leveraging advanced data and analytics capabilities and creating a “customer money map.” The customer money map is derived primarily from the transaction account and shows what moneys are being retained or leaving the institution and the capacity the customer has to save. The customer money map can also incorporate open banking data to offer a more holistic view of the customer.

2. Use Customer Financial Data to Foster Engagement and Build Loyalty

Most customers don’t just shop rates. They want to put money with institutions they feel are “looking out for them” and will help improve their financial well-being.

To move this from slogans to actions, European banks need to leverage customers’ financial data to deliver timely, contextual and hyper-personalized insights and advice via the digital channels (and subsequently through their bankers). Customers seek out these personal, forward-looking interactions, like when a bank alerts them when they’re likely to have an overdraft issue or when they have a subscription service that’s about to renewed at a fee.

The insights should also inform customers when they have excess cash they can move into the bank’s savings account, capturing funds before they are likely to leave the institution, as identified in the Customer Money Map.

These are the interactions that build customer engagement, which then quickly builds loyalty and customer satisfaction. And a loyal customer is far more likely to keep their savings with your bank.

3. Use Customer Financial Data to Better Segment and Tailor Marketing Campaigns

Hyper-personalization takes this approach a step further by leveraging customer financial data and behavior to provide timely personalized recommendations, offers, and messages about saving in marketing campaigns. Banks can determine exactly which customers should receive those messages about saving, and then tailor them accordingly to increase the likelihood of conversion.

4. Do the Hard Savings Work for Your Customers

Many customers want to increase their savings. They just don’t want to figure out all the details. They have lives to lead, kids to raise, businesses to run. Managing their money and figuring out how much to set aside every month is stressful and burdensome. Often, as our recent e-book detailed, customers suffer from cognitive biases and self-defeating behaviors that prevent them from making savings decisions that are in their best long-term interest.

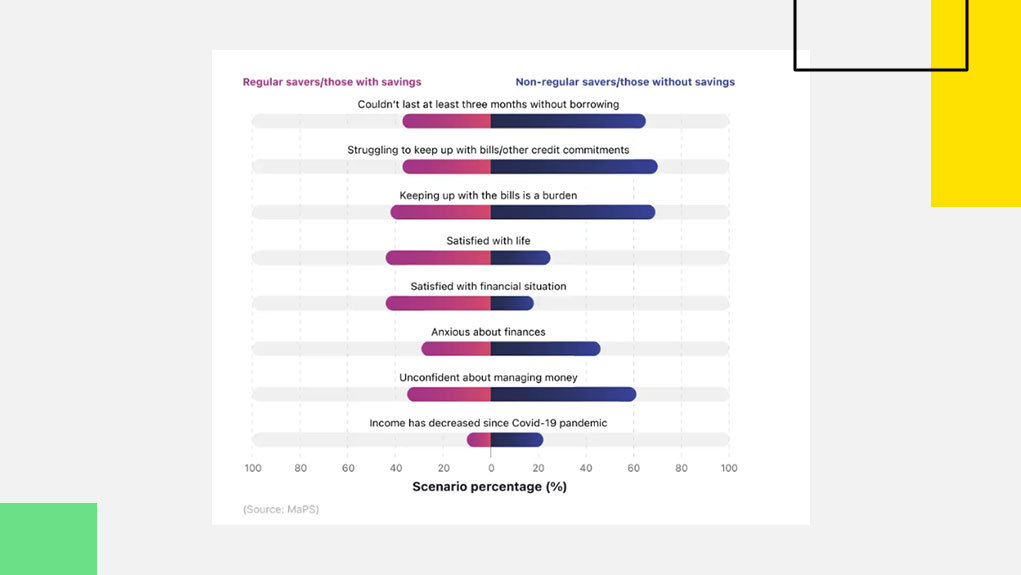

It’s little wonder then, that we see these sorts of charts detailing how little many customers have set aside and how much this worries them.

Again, it’s not enough to show customers a chart of their previous income and expenses. Banks need tools to analyze each customer’s cash flows and then let them know when it’s safe to set aside money into savings, how much they can safely move out of checking and into savings, and even – if the customer feels comfortable – automatically move the money into a deposit account for them. Deliver a practical savings journey that helps customers set up saving goals – a new home, a vacation, a child’s education, etc. – and helps them track their progress toward them.

When an EMEA regional bank recently adopted these tactics without any paid campaigns, they saw immediate results. Within 10 months, the number of customers enrolled in their savings programs increased almost 30%, while the total amount transferred into savings rose by 100%.

Here’s a similar story I shared when I spoke recently at MoneyLive 2023. Ally is an American bank, but their approach – particularly how well they make use of open banking to bring in deposits – is very relevant to the European market.

To put it succinctly, giving your customers a helping hand in the savings journey is more valuable to most customers than the extra quarter point the bank down the street is offering on their deposits account.

You Can’t Afford to Ignore the Competition for Deposits

Identifying the right situations to grow and retain deposits, fostering engagement to build loyalty and trust, and delivering savings journeys should be part of your bank’s comprehensive, differentiated deposit strategy.

It’s more challenging than simply raising rates or offering incentives but it will deliver rewards, in the form of a strong customer deposit franchise. And if you don’t do anything to protect your customers’ deposits and to attract new funding, rest assured, your competitors most certainly will.

To learn about how Personetics can give your institution the tools to grow and retain deposits, click here to book a demo.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.