April 21, 2020

Leveraging Personetics Insights to Improve Financial Recovery

Personetics CEO, David Sosna, recently presented a webinar that highlighted some practical examples that our banking customers’ have released using Personetics’ Financial-Data-Driven Personalized Insights to support retail and small business customers through this Covid-19 crisis.

[Webinar Replay] Leveraging Personetics’ Insights to Help Customers Through COVID-19 Financial Recovery

With very few options and nowhere to turn, consumers are naturally turning to their banks for clarity and support. Banks have always held a central role in consumers’ daily lives and now, when financial anxiety is high, banks have been stepping up as quickly as possible with different levels of support including better access to liquidity, informing them about government benefits, relief, and deferments.

To stay relevant and solvent, banks will need to avoid overdrafts at all costs:

- With social distancing requirements, banks have been working hard to give their customers access to a wider range of digital services.

- As the increase in call volume puts additional pressure on Bank call centers, Banks have been scrambling to fully staff and educate their overwhelmed agents.

- Banks are trying to communicate all the offerings and options to their customers.

But, in an attempt to move quickly, most banks are missing the point that personalized communications will reduce anxiety and instead are using a one-size-fits-all approach leaving customers extremely confused. Leading banks are creating microsites that outline everything the bank can offer leaving the onus on the customer to sift through all the information and determine what is relevant to them. This is not the proactive, smart, relevant and personalized approach customers’ are expecting from their banks.

And possibly more disturbing, once things do settle back down, we expect many customers will be exposed to deepening financial unrest, unable to make their payments and being exposed to collections, default and even bankruptcy.

Data-Driven Personalization as a Mitigator

We’ve seen many of our global banking customers taking action and using the Personetics toolset to make their response to the Covid-19 pandemic more personalized, smart, financial-data driven and targeted with communications, solutions and advice specifically targeted for each customer. Although we believe this approach is a best practice in normal times, it is even more critical during times of crisis as customers sink deeper into financial distress and are desperate for compassion and support.

Personetics bases its insights on the customer’s full, real-time analysis of financial behavior, and by using AI and ML models, Personetics can immediately recognize and understand small and immediate changes in customer patterns such as deposit delays or balance issues.

In addition to hundreds of out-of-the-box and validated insights based on traditional banking activities, Personetics Engagement Builder tool allows banks to both customize existing insights and advice to more effectively respond to new circumstances but also allows customers to create simple or complex logic on their own insights from scratch, as we are seeing many of our more visionary customers do.

By using the same core logic used to identify criteria for presenting an insight, banks are identifying opportunities to use the same logic to offer more sympathetic and relevant offers to customers to help them stay financially healthy during this time.

The Personalized Way

When looking at insights, we’ve grouped them into 3 categories.

- My situation – Presents the current situation to consumers and how the bank can best help

- My options – Suggests specific advice and actions for customers to overcome the current situation

- My path forward – Recommends financial-wellness programs and tools to help customers succeed and avoid collections

Now let’s take a deeper look at some ways our customers have been utilizing Personetics and the Engagement Builder tool to specifically address the needs of customers around the Covid-19 financial crisis.

My Situation

The first goal banks should be considering is reducing consumer stress by delivering a clear picture of their financial situation using visual tools and personalized insights that demonstrate an intimate understanding of the consumer’s financial complexities.

- Amending Existing Insights – Ensure that the content is relevant and make logical links between issues and solutions. Offer relevant links to a microsite, support line or relevant content, connecting the consumer with the information relevant to their financial position.

- Fee Reversed – By using the same logic to identify where a customer may have encountered an overdraft fee, banks are taking the same opportunity to remove anxiety by alerting the customer that their overdraft fees have been waved. Furthermore, to reduce a call to a call agent, these insights also include terms of the wavers and any other relevant communication.

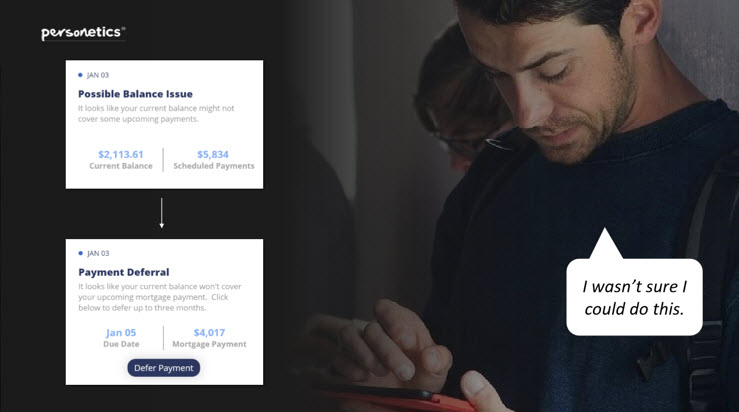

- Payment Deferrals – Personetics monitors buying and payment patterns which can now be utilized to recommend payment schedules or payment deferments to be immediately executed, reducing consumer stress and allowing customers to handle their payments independently.

- Fee Reversed – By using the same logic to identify where a customer may have encountered an overdraft fee, banks are taking the same opportunity to remove anxiety by alerting the customer that their overdraft fees have been waved. Furthermore, to reduce a call to a call agent, these insights also include terms of the wavers and any other relevant communication.

My Options

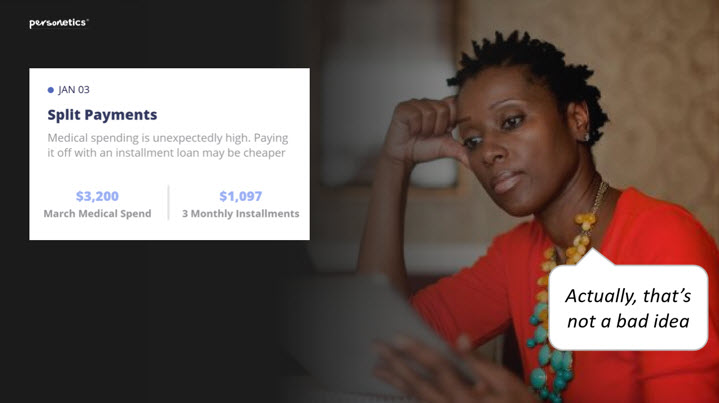

- Split Payments – Banks have been able to identify significant purchases or categories of purchases. They can now utilize the same insights to offer consumers an unsecured loan, split payments or revolving credit including the terms and a call to action to take advantage of the offer. If the bank can predict that a customer is unlikely to be able to pay their credit card balance, the bank’s ability to offer that customer a loan increases the likelihood that they will be able to collect in the future.

- Navigating Government Assistance – Many local, state or federal governments are offering relief programs but the complexity behind each program including eligibility, preconditions and qualifications can be almost impossible to navigate. Banks are being used as the go-to place to navigate these complexities.

- VAT Deferment – Personetics tracks and recognizes VAT payments. We’ve seen Banks alter these insights to give eligible customers the relevant VAT deferment information including an option to be redirected directly to the site to take advantage of it.

- Conversational Insights – By using Personetics conversation insights that ask customers a series of eligibility questions via a quiz mechanism, banks are able to recommend benefits that are appropriate for the customer’s specific sector.

- VAT Deferment – Personetics tracks and recognizes VAT payments. We’ve seen Banks alter these insights to give eligible customers the relevant VAT deferment information including an option to be redirected directly to the site to take advantage of it.

My Path Forward

While macro-level financial recovery is still uncertain, banks can proactively target customers with income disruptions and help them adjust their spending behavior to rebuild their finances before they would otherwise reach collections.

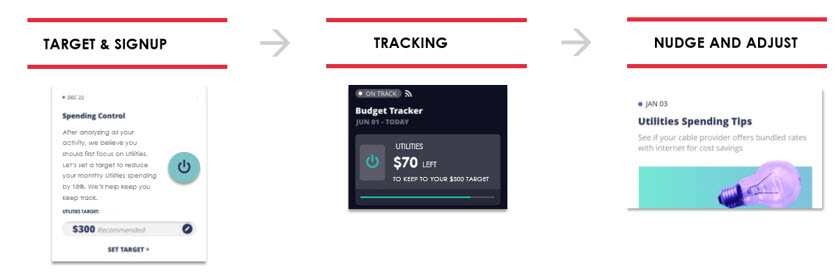

- Smart Budget Programs – Personetics standard Smart Budget Program tracks non-essential spending and makes recommendations to keep people on cashflow targets. When customers are looking to build recovery budgets, essential and non-essential purchases would be analyzed and targets set within the new levels of income.

- Debt Reduction Programs –Personetics can recognize customers that are likely to reach collections but who may have payment alternatives, invite them to join a program to cut their debt and recover borrowed funds before reaching collections.

Unfortunately, most banks are distracted by the immediate pressures of an insecure financial crisis and aren’t looking for ways to mitigate a worst-case scenario in the future. The more we can prepare for this now, the more money a bank will save, the less we will need to depend on governments to step in and the more likely more customers will be able to recover financially.

Data-Driven Personalization will reduce customers’ financial stress by giving them the relevant information they need to make educated decisions about financial wellbeing. This benefit is not only for the immediate but also for the longer term, when banks’ customers will return to work and will be taking their first steps towards recovery and will remember that their bank was there for them during their darkest times. If we can help even a fraction of consumers face a better future, these investments will have been worth their weight in gold.

Check out these additional resources

- [Webinar Replay] Leveraging Personetics Insights to Help Reduce Customer Anxiety and Secure a Better Financial Recovery

- [Report] Wellness Recommendations for Retail Bank Customers

- [Report] Wellness Recommendations for Small Business Bank Customers

- [Blog] Compassionate Banking For Customer Resiliency

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue