July 21, 2022

Mobile Banking: Untapped Potential for Differentiation

There is a fascinating “race” underway in the banking industry: mobile technology advancements versus rising customer expectations of their app experience. Despite significant advancements in banks’ mobile experience in recent years, customers’ expectations of banks’ mobile apps appear to be climbing more rapidly as mobile banking becomes more central to their lives. Forrester research shows that 54% of banking customers agree with the statement, “I should be able to accomplish any financial task through a mobile device.”

Although banks have embraced the centrality of bank mobile apps, most struggle with how to differentiate through their mobile experience. Forrester found that 54% of banking customers believe that their bank’s mobile app is “about the same” as most other mobile banking apps. Bank executives must feel like they are in a technology arms race to even stay at parity with industry leaders.

Financial institutions have an opportunity to evolve their banking relationship models to keep up with these changes in customer attitudes and behavior. It requires a rethink of how they serve customers’ needs across digital and banker channels, with mobile banking apps at the center of this discussion.

A few key questions are driving this shift in the mobile banking relationship model:

How can financial institutions differentiate themselves in a competitive market?

Which mobile banking capabilities will be must-haves for banks to compete?

How can banking executives prioritize the right strategic framework for mobile banking, without getting caught up in a digital features arms race?

Peter Wannemacher, Principal Analyst at Forrester, shared insights from his team’s latest mobile banking research when he was a special guest on our recent webinar, “Mobile Banking: What Role Should a Bank Play in a Customer’s Life.”

Mobile Banking: Untapped Opportunity for Differentiation

While basic mobile app functionality is table stakes, knowing how to differentiate through mobile is more obscure. By taking a thoughtful, strategic approach, banks can better harness the potential of their mobile banking app to provide a compelling, memorable customer experience that helps them stand out from competitors.

“Banks remain largely undifferentiated from each other, even as banking becomes more digital,” said Peter Wannemacher, Principal Analyst at Forrester. “This combination will severely inhibit a bank’s growth if it doesn’t act.”

Peter described how banks tend to differentiate themselves not by being “unique” in the mobile banking features or experiences that they offer, but by being “better” in certain features. Even if your institution could implement every possible mobile feature, this all-encompassing approach will not lead to sustained profitable growth.

Instead, Peter recommends that banking leaders take a careful, strategic approach to deciding which mobile features to invest in.

How Mobile Banking Will Change: Which Mobile Features Will Be Must-Have?

Peter and his Forrester team identified a short list of mobile banking features that they believe will be “must-haves” or “differentiators” in the next three years.

5 must-have mobile banking features that Forrester believes will have a major impact by 2025:

1. Autonomous savings tools: Forrester found that 54% of U.S. banking customers believe that it would be “useful” or “very useful” to have automatic savings tools that predict how much money they can safely save, and automatically move that money to savings for the customer.

2. Customer-facing data dashboards/data management tools: 56% of U.S. banking customers said it would be “useful” or “very useful” to have more control over how their customer data is shared with the bank.

3. Automatic budgeting: 48% of U.S. banking customers said it would be “useful” or “very useful” to have digital banking tools that automatically set up and track progress toward budget goals and take the cognitive load off them.

4. Carbon footprint tools: 41% of U.S. banking customers said it was “useful” or “very useful” to have help to monitor and reduce the carbon impact of their consumer spending decisions.

5. Personalized “just-for-you” feeds/Personalized money coaches: 43% of U.S. banking customers said it was “useful” or “very useful” to see the latest important information about their financial life, such as transactions, advice, insights and tips.

Not every customer wants every mobile banking feature. But Forrester has identified two customer segments that are especially likely to demand these emerging mobile banking capabilities:

- Younger consumers (under 36 years old)

- Non-bank experimenters (people who are willing to consider a non-bank company to provide money management solutions)

The challenge for banking executives is clear: choosing the right mobile banking features is just one part of the overall journey to redefine your banking relationship model. Let’s see an example of a framework for how banking leaders can accomplish this.

The Mobile Banking Experience Redefined: Helping Customers with Financial “Jobs to Be Done”

Customer transaction data is the most valuable asset that banks have. Banks often struggle, however, to convert this data into actionable customer intelligence, customer engagement, and digital sales. The new competitive battleground in the industry will be data-driven personalization.

“90% of bank executives believe that their data is below average.” It’s a bit tongue in cheek and sounds like a quip from Yogi Berra, but it does reflect the numerous conversations I’ve had with bank executives about their data environment. The reality is that you don’t need to do a multi-year data transformation to deliver business value. If you can cleanse and enrich your customer transaction data, you can uncover significant findings on customer financial needs – and become central to that customer’s life by helping them accomplish their “jobs to be done.”

Our industry often looks at the banking relationship model in terms of products and transactions. A customer “jobs to be done” framework describes the various tasks customers are trying to achieve such as: Saving for a Goal, Managing Spending, Building Emergency Savings, Making a Big Purchase, or Growing Wealth.

Let’s see how this “jobs to be done” framework aligns with Forrester’s must-have mobile banking features:

1. Autonomous Savings Tools and 2. Customer-facing Data Dashboards

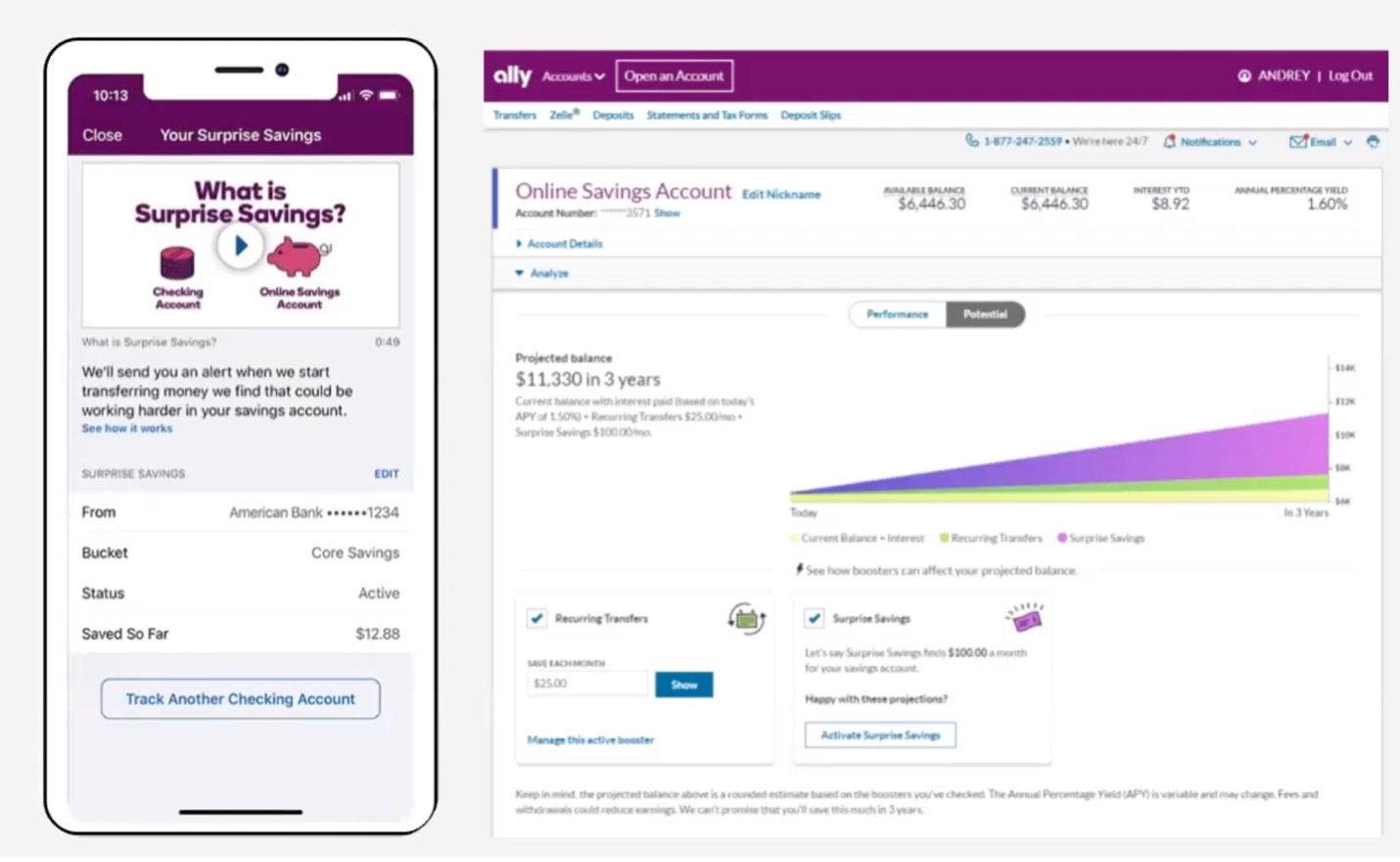

Ally Bank’s “Surprise Savings” program monitors linked external checking accounts to identify safe-to-save money. This program gives customers the power to share their own banking data with Ally to help save more money, and has helped customers save an average of 10x the amount of money that they would’ve amassed with interest alone.

3. Automatic Budgeting

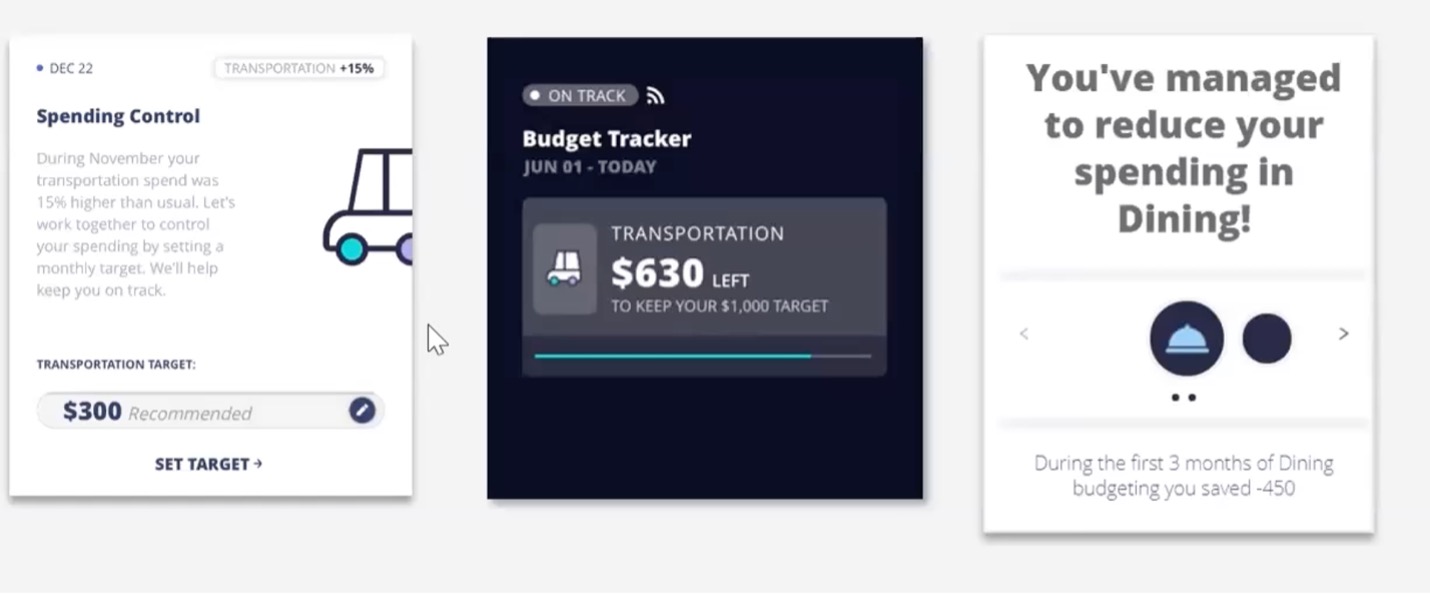

Many banking customers would like to spend smarter and budget better, but don’t know where to start. By analyzing customer transaction data, Personetics can help banks reach out to customers proactively – based on changes in customer spending behavior – and offer to set up a smart budget program.

For example, customers can be shown a specific category of spending (Dining, Transportation, etc.) where they might want to control their spending. The bank can show the customer how much money they have left to spend each month, and celebrate progress.

4. Carbon Footprint Tools

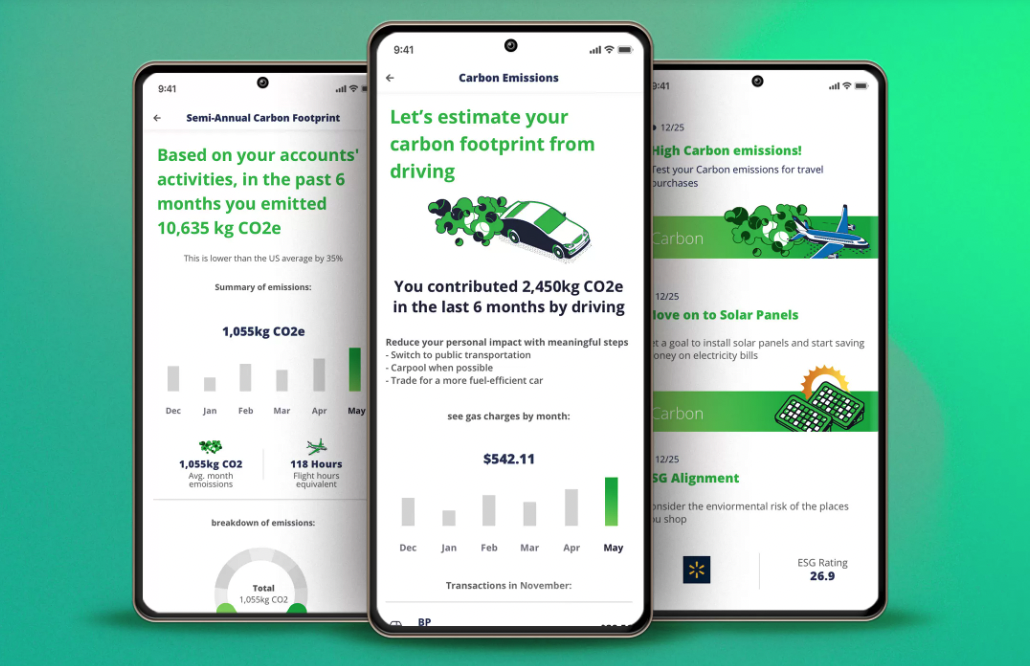

Personetics Sustainability Insights goes beyond just tracking a customer’s carbon footprint; our solution empowers customers to make greener spending choices and recommends green banking products, such as a savings account to buy solar panels or an auto loan for an electric vehicle.

5. Personalized Money Coaches

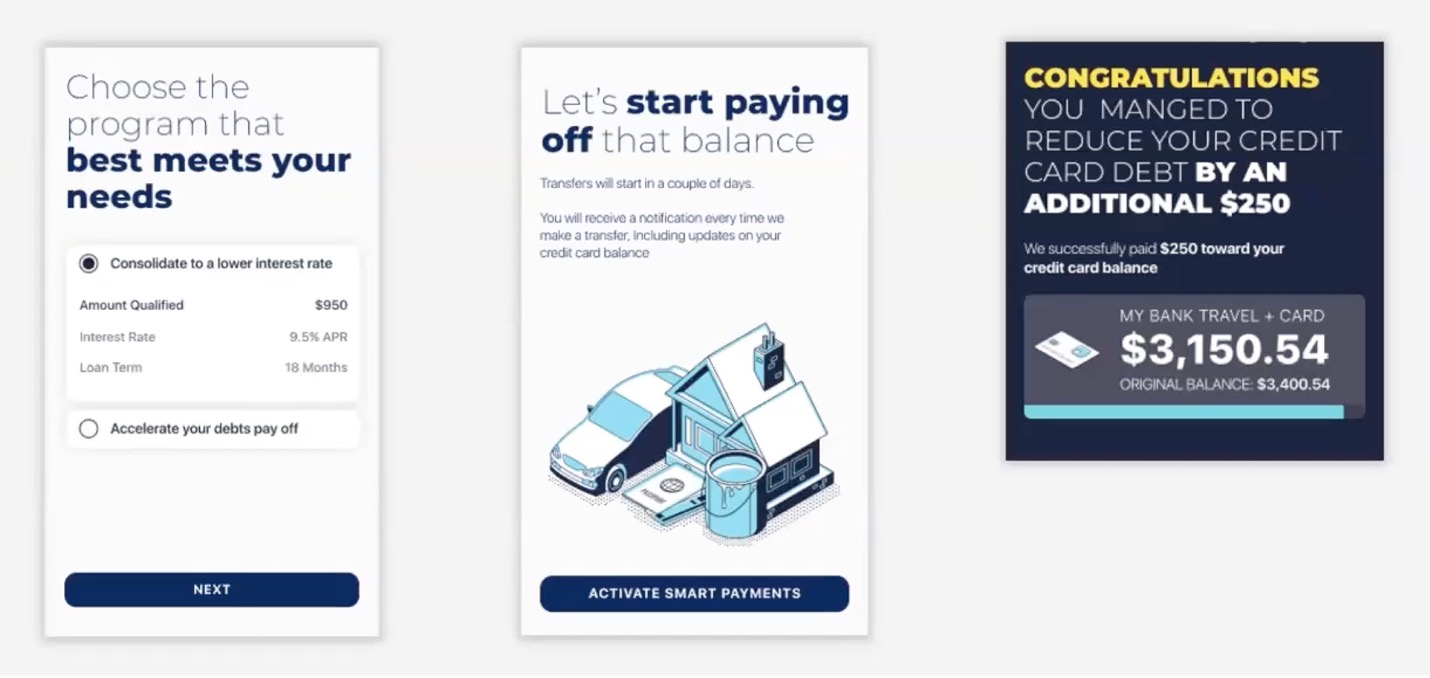

By looking at customer transaction data, Personetics can help identify opportunities where a banking customer has excess cash to put toward an external debt – and can proactively encourage and coach that customer to make progress toward that financial “job to be done.”

Forrester’s top-rated emerging mobile banking features are well aligned with the Personetics vision of advanced money management and Self-Driving Finance. As banks continue to evolve their relationship models, we’re going to see increasing adoption of data-driven personalization, personalized insights, and a mobile banking experience focused on higher-value advice based on each customer’s unique needs.

With a wider range of capabilities available in the mobile app, and a customer-focused relationship model based on jobs to be done, banks can fulfill the same role they’ve always played: to Know, Value, and Advise the customer.

Ready to learn more? Watch our recent webinar with special guest Peter Wannemacher from Forrester, “Mobile Banking: What Role Should a Bank Play in a Customer’s Life.”

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

Jody Bhagat

President of Americas

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.