October 12, 2020

The Hyper Personalization Trajectory as the Foundation of Customer Engagement

What is customer engagement? A simple question with a myriad of answers. Ron Shevlin proposes “Customer engagement is a series of interactions that strengthens a customer’s emotional connection to a product or company,” in his recent Forbes article entitled How Banks Can Grow Like Bank Of America, Chase, And Wells Fargo: The Reacquisition Imperative.

And while true, the definition still leaves a lot for interpretation. What types of interactions signify engagement? How do you measure emotional connection or an increase in emotional connection? What are the steps that take a customer on an engagement journey that will result in a deeper emotional connection? And most importantly, why should we care?

At Personetics, we take personalized engagement very seriously and have developed a visual trajectory that explains the customer journey and how hyper-personalization establishes trust which encourages enduring engagement which in turn means an increased bottom line for the bank.

- Data – Forward-leaning banks are capitalizing on their greatest asset — customer financial-transactional data — to better “know” their customers financial behavior and deliver personalized experiences that will boost engagement, trust and banking business metrics. Data-driven personalization appears to be at a tipping point, accelerated by the actions of leading banks and the growing body of evidence that these solutions are being embraced by customers and delivering strong returns for banks. It demonstrates to customers that their bank really “knows” them and is looking out for their financial well-being. Consequently, it increases the value of interactions between banks and their customers, enhancing trust and deepening relationships.

- Insight – Personetics’ data-driven personalization engine analyzes customer transaction data in real time, applies machine learning and AI algorithms to deeply understand an individual’s financial behavior; past, present and future, to determine what’s important, and delivers personalized insights and advice to customers. Insights provide customers with a view of their finances, from spending habits to savings opportunities and focuses on the anomalies that might have otherwise been missed. Not every insight bares the same importance, and by only pointing out the relevant and value add insights, customers become more trusting of the messenger.

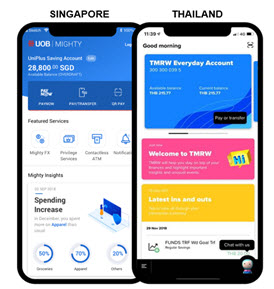

UOB Singapore and UOB Thailand have added real-time insights to their UOB App with over 100 custom built insights developed to address their target market while creating differentiation through proprietary personalization. With the launch of this initiative, UOB has seen:

- 4x increase of customer engagement

- 2/3 of new customers referrals from existing customers

- 4x increase on NPS

- 50% click through rate on presented insights

- Advice – With real-time data and relevant insights at hand, banks will gain their customer’s trust, build loyalty and increase customer satisfaction by focusing on their customers’ needs. This shift means providing customers with personalized, relevant experiences – what we call contextual advice – each time they interact with an institution. Building loyalty and trust will benefit more than just customers. Executed well, contextual insights represent revenue growth and productivity opportunities for all types of financial institutions.

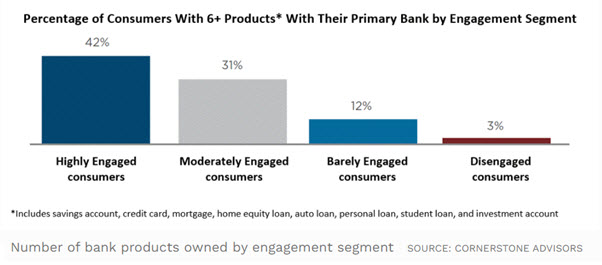

According to Cornerstone Advisors, more than four in 10 Highly Engaged consumers have six or more products with their bank. Among Disengaged consumers, that percentage is just 3%.

- Autonomous – Beyond insights and advice, leading banks are offering innovative automated financial wellness programs. These are opt-in programs in which the bank may save, invest or pay down debt on a customer’s behalf.

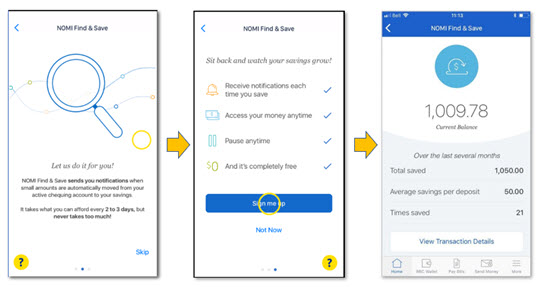

Royal Bank of Canada, recently launched NOMI Find & Save, an innovative program that grows customer savings using intelligent, automated, cashflow-based algorithms that act on a customer’s behalf. The proposition targets a growing segment of customers that are embracing automated solutions and expressing delight with the experience.

These compelling wellness solutions give customers a helping hand to navigate various financial situations — whether creating greater customer financial resilience or building greater wealth. The payoff for customers is increasingly evident based on satisfaction and engagement scores.

These compelling wellness solutions give customers a helping hand to navigate various financial situations — whether creating greater customer financial resilience or building greater wealth. The payoff for customers is increasingly evident based on satisfaction and engagement scores.- Find & Save Clients are saving over $225 per month

- 265,000 Find & Save Accounts

- 20% of Find & Save accounts are new to RBC Savings

- Increased Login by 60% and NPS by 35%

In Conclusion

When a bank takes the time and steps required and commit to knowing their customers, delivering proactive advice, and looking out for them with personalized solutions that improve their financial resiliency and well-being, they will be rewarded with a stronger customer franchise including higher satisfaction, deeper relationships, and greater profitability.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

The Emergence of Cognitive Banking at This Year's Financial Brand Forum