February 17, 2022

Why Personalized Advice at Scale is the Next Evolution of Wealth Management

The CEO of Charles Schwab has recently said that “Personalized investing is coming at all of us like a freight train,” and that investors want to get the same level of personalization from their wealth managers that they get from ride-hailing or food delivery apps. What does “personalized investing” mean for the world of wealth management? How can wealth management teams adopt strategies to deliver personalized advice at scale, based on insights from their customers’ financial transaction data? And what business impact metrics benefit from this?

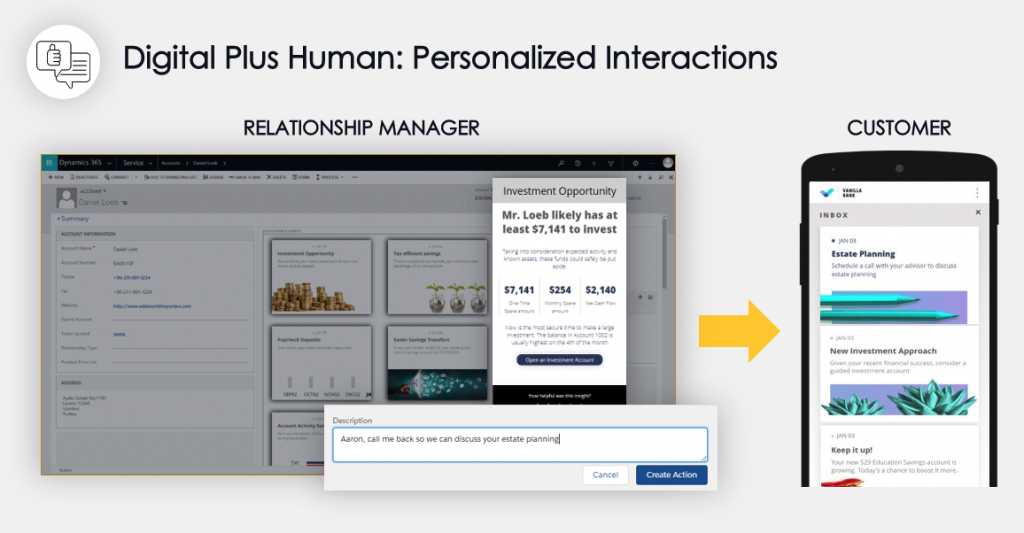

Delivering personalization at scale in wealth management requires a combination of Digital Plus Human interactions for more effective targeted engagement with clients, empowering your relationship managers to offer the right advice at the right time. It also increases your organization’s efficiency and conversion in servicing and selling to customers.

We believe that personalization can help wealth management teams serve more clients more efficiently, deepen their client relationships, and grow Assets Under Management (AUM).

Here are a few key insights and trends about how personalized advice at scale for wealth management can become a reality for your institution, and why you should make it a priority.

Competitive Landscape: Wealth Management Needs a Digitized, Personalized Operating Model

The traditional wealth management and private banking space has tended to focus on High Net Worth households, with wealth managers offering a highly personalized level of service to this affluent market.

However, in recent years, the industry landscape has shifted rapidly. A wider market of mass affluent investors is looking for better financial advice, sometimes using a Do It Yourself (DIY) approach, or working with robo-advisors, to manage their investments.

There is an opportunity now for forward-leaning wealth management organizations to adopt a more digitized, personalized operating model. A recent report from McKinsey suggests that “Wealth managers are unlikely to be able to serve modern clients effectively without a digitized operating model,” and recommends two approaches:

- Serve clients across the wealth continuum

- Embrace personalization aligned to client life stages and goals

People’s expectations for the service that they get from financial institutions are changing, and these expectations are heavily influenced by the experiences they get from apps. One recent example of this trend was UBS’s acquisition of Wealthfront, with the strategic goal of expanding the firm’s reach in delivering digital wealth management services to affluent investors from the Millennial and Gen Z age cohorts.

Consider the consumer experience of ride-hailing apps, food delivery apps, or online shopping. The company knows you and caters to your needs, based on your prior transaction data. Just like Amazon or DoorDash knows your prior purchases and makes relevant recommendations based on your customer transaction data, your wealth manager should know how guide your financial life in ways that are personalized and data-driven.

This is how data-driven personalization for wealth management can help: when you know your customers better, you can offer relevant advice and investment opportunities at the right time, based on a deeper understanding of each customer’s needs, life changes, and evolving financial goals.

3 Big Challenges that Personalization Can Solve for Wealth Management Teams

Here are a few top-of-mind examples of big challenges that wealth management teams are facing.

1. Lack of visibility into the client’s overall financial life

Too often, wealth managers only have visibility into their clients’ investment portfolios that are under their management. They don’t know when their clients’ needs have changed – such as a life event, career change, or other big life changes. What if your client has received an inheritance, received a promotion at work, or had other significant changes in their finances? What if their investment goals or risk tolerance have changed?

2. Clients have multiple holdings/portfolios

All wealth management clients tend to have multiple financial relationships, such as retail banking accounts, 401(k) accounts from previous jobs, robo-advisor or brokerage accounts, and more. As a wealth management team, your clients might not be showing you their entire portfolio. You might not know how all of their money is invested, you might not be able to see their overall asset allocation and performance.

3. Challenging to deliver advice at scale cost effectively

The traditional “direct” wealth management model is highly personalized, but more so for higher net worth clients. There is a growing market of mass affluent consumers who need personalized advice, but may not get the same attention and will benefit from a hybrid model of “Digital Plus Human” to manage their investments, with fewer touchpoints than a traditional wealth management relationship.

How to Overcome These Challenges: Open Finance and Data-Driven Personalization

What if you could see your clients’ entire financial lives, including their day-to-day banking transaction data? What if you could get powerful analytics tools to help understand your clients’ cash flow, identify opportunities for them to invest and put aside more money for retirement, and create a more personalized approach to engaging with each client and building financial plans for them? Now you can.

Wealth management and financial advisors have an opportunity to use the power of AI and analytics to know their clients on a more personalized level. These technologies and the emerging capabilities of Open Finance to share customer transaction data across external accounts will allow financial advisors to understand customers’ needs more holistically and deliver more personalized recommendations.

Open Finance for Wealth Management

Open Finance is the next evolution of Open Banking, and it’s already underway. With Open Finance, customers are in control of sharing their data, and financial institutions create an ecosystem to deliver on customers’ financial needs.

With Open Finance, financial institutions can get a more holistic view of their customers’ evolving needs. For wealth management, this means: your institution (with your clients’ permission) would get visibility into your clients’ banking data, and other client accounts – robo-advisors, brokerage accounts – to get a broader view of your customer’s overall financial life.

Instead of being limited to just the portfolio of assets under management, you could get a real-time broader view of your customers’ financial lives: with advanced analytics capabilities to show how your clients spend, when their income changes, when they have excess liquidity, and when they might be in a good position to hear from a financial advisor.

Open Finance helps wealth managers play a broader role in understanding the customer’s financial needs to deliver advice and product recommendations at the right time.

Data-Driven Personalization for Wealth Management

Data-driven personalization helps your institution in several ways:

- Serve more clients, more efficiently: expand your service offerings to mass affluent customers, not just High Net Worth

- Identify occasions to engage: Based on customers’ spending patterns, income changes, and other everyday banking transaction data, you can identify the right moment to engage with customers to offer investment advice and relevant product

- Combine Digital Plus Human interactions: Support your advisors to help them do more of what they do best, by driving touchpoints with digital channels.

- Increase Customer Lifetime Value: grow AUM, expand your client relationships, increase client loyalty

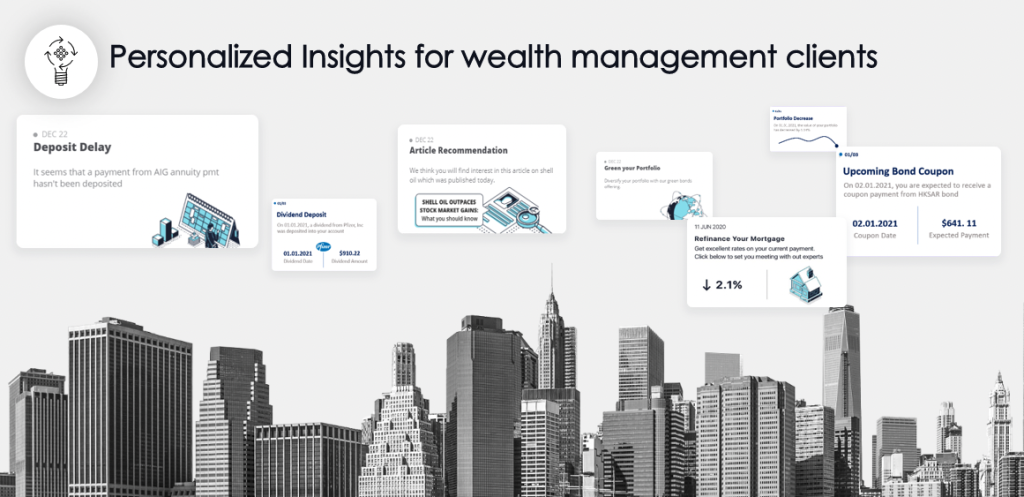

Personetics’ solutions help wealth management teams provide personalized insights and advice to wealth management clients.

We help you get a holistic view of your clients’ financial lives, powered by real time financial transaction data, so your relationship managers can find the right moments to engage. Digital Plus Human interactions give your team the insights and opportunities to engage with clients in a relevant, targeted way, based on the latest changes in your clients’ finances.

Customers’ financial lives are dynamic. Wealth management teams need to be constantly learning about what’s going on in their customer’s financial lives to stay relevant and know when and how to reach out to those customers with investment opportunities and financial advice.

How Personetics Helps Wealth Management Teams

Personetics helps financial institutions provide personalized wealth management advice at scale. Our data analytics solutions create proactive engagement with your clients based on the clients’ financial transaction data.

Personetics’ AI analyzes bank customers’ financial transaction data in real time to understand customer financial behavior, anticipate customer needs and deliver a hyper-personalized experience. We help wealth management teams offer day-to-day insights, personalized financial advice, and automated financial wellness programs to their wealth management clients.

We recently gave a presentation on this topic at the American Bankers Association (ABA) Wealth Management and Trust Conference virtual event, Feb. 15-16, 2022. Watch our presentation here: “Delivering Personalized Advice at Scale for Wealth Management.”

Ready to learn more? Request a Demo.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

The AI Implementation Reality Check

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Jody Bhagat

President of Americas

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct-to-consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.

Nicole Meyers

VP Strategic Account Management

Nicole brings over a decade of experience in consumer banking strategy and operations. In her role, Nicole is responsible for building and growing client relationships, ensuring each project achieves impact. Prior to joining Personetics, Nicole was a consultant at McKinsey & Company, where she advised financial services clients on digital enablement, regulatory compliance and strategic planning. Nicole led the World Economic Forum’s initiative to promote global financial inclusion, in partnership with the World Bank Group. Nicole also served as the Director of Strategic Partnerships at Grameen America, a micro-lending credit union, where she built and managed savings programs with Wells Fargo, Citibank and Capital One. Nicole holds a B.A. in International Relations from Bucknell University.