November 18, 2021

BMO Introduces New AI-Driven Insights to Help Customers Make Real Financial Progress

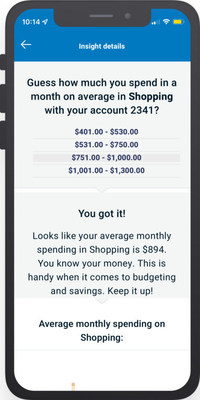

Available through the BMO mobile banking app, BMO Insights uses AI technology to provide automated, personalized, and in-context insights to customers based on their day-to-day banking behaviour. Since its launch in 2019, BMO Insights has generated over 110 million insights to customers and currently has a total average customer satisfaction rating of 4.6/5.

“The introduction of these eight new insights builds on our digital and data-driven approach to money management by providing customers with a holistic view of their financial activity and spending patterns,” said Mathew Mehrotra, Chief Digital Officer, BMO Financial Group. “By meeting customers where they are and providing automated, personalized, bite-sized insights, we’re continuing to help customers make real financial progress.”

The new Insights allow customers to better understand their spending habits and budget accordingly by providing:

- ‘Where You Spend’ & ‘Spending Category’ Mini-Quizzes: Customers can learn more about their spending behaviour at frequently visited merchants, and in categories such as dining.

- High Daily Spending & New Spending Insights: Large increases in daily purchases and spending at all new merchants within the last month will be flagged to customers.

- Duplicate Transfer & Duplicate Charge Insights: Customers will be informed when duplicate transactions and duplicate transfers take place to flag potential errors.

- Salary & Cheque Deposit Insights: Customers will be notified when they receive a paycheque and cheque deposits, highlighting changes to account balances.

The new insights build on BMO’s commitment to offering a leading digital customer experience, including the recently launched Selfie ID Verification that provides customers with a convenient way to apply to open personal bank accounts and credit cards from their personal devices.

To learn more about BMO mobile banking and to download the BMO mobile app, visit: https://www.bmo.com/main/personal/ways-to-bank/get-started/mobile/

About BMO Financial Group

Serving customers for 200 years and counting, BMO is a highly diversified financial services provider – the 8th largest bank, by assets, in North America. With total assets of $971 billion as of July 31, 2021, and a team of diverse and highly engaged employees, BMO provides a broad range of personal and commercial banking, wealth management and investment banking products and services to more than 12 million customers and conducts business through three operating groups: Personal and Commercial Banking, BMO Wealth Management and BMO Capital Markets.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook