June 12, 2025

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

By Ruth Shabbat, Director of Product Marketing, Personetics

Explore our latest product features and innovations, designed to help financial institutions amplify their marketing with contextual, needs-based offers, deepen customer relationships and brand differentiation, and accelerate AI innovation.

What’s New?

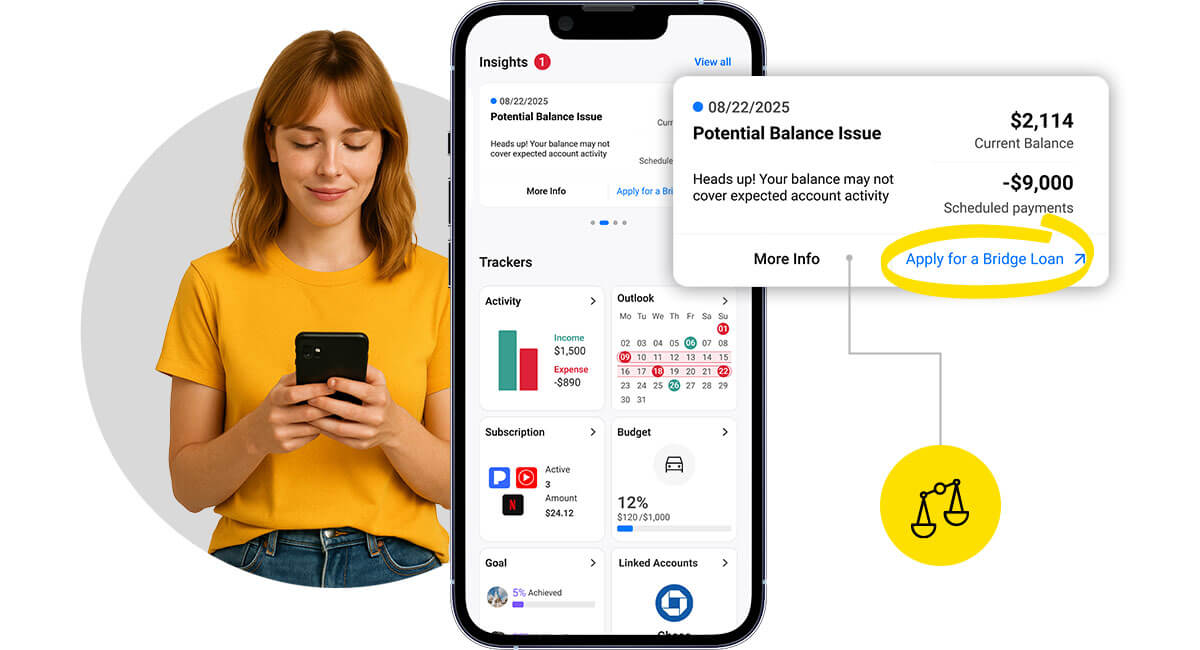

Boost Campaign Performance with Integrated Marketing Offers

PERSONETICS ENGAGE

Deliver real-time, contextual marketing offers—based on each customer’s financial activity and your own campaign data—to improve targeting and increase conversion.

- Easily integrate your bank’s marketing data into Personetics’ Enriched Data Model.

- Create integrated marketing offers to deliver the right campaign, in the right financial context, with Personetics Engagement Builder’s intuitive, no-code platform.

- Promote bank products and services with Insight Wizard templates for loans, credit cards, partner offers, and more.

- Track and optimize performance across your offers, campaigns, and products.

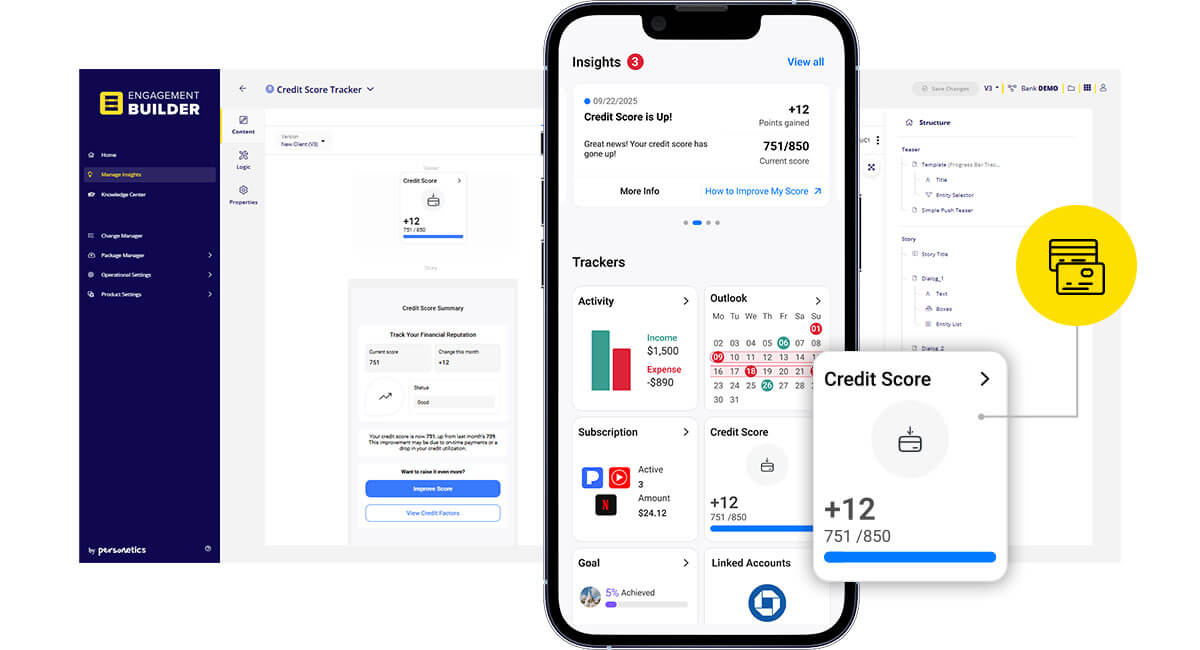

Gain Control & Stand Out with Custom Trackers

PERSONETICS ENGAGEMENT BUILDER

Enhance customer experience and drive differentiation with your own custom-built trackers.

- Leverage pre-built tracker UI components such as progress bars, line charts, icons, and more.

- Deliver unique, data-driven experiences using your bank’s custom data entities or Personetics financial data intelligence.

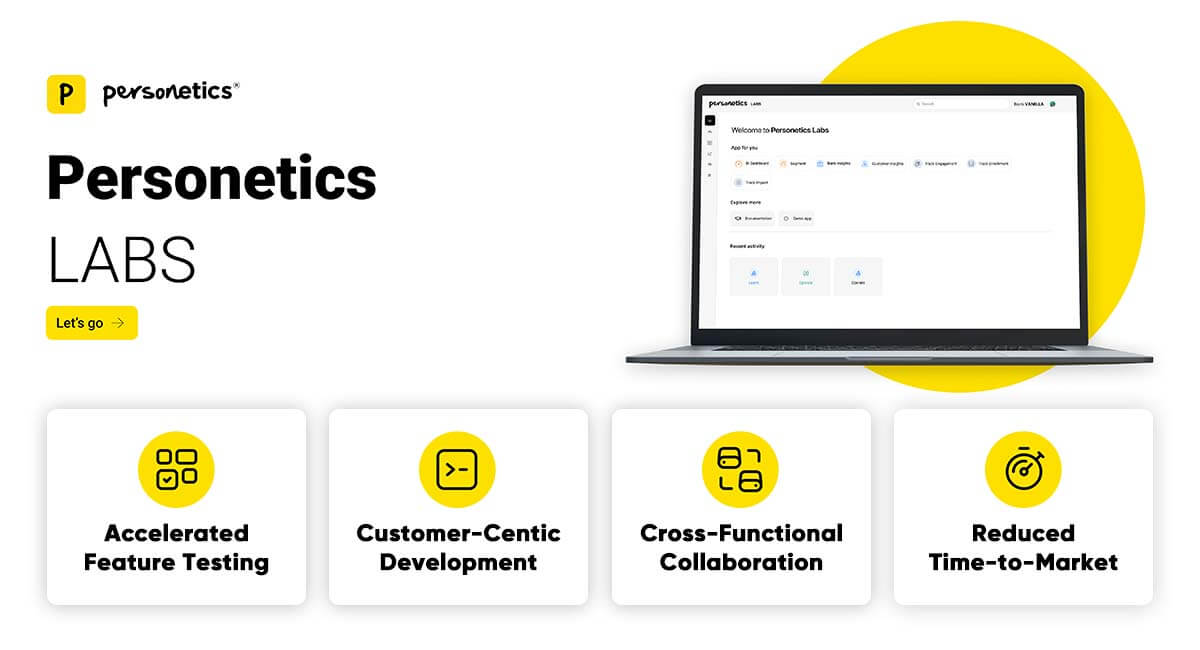

Accelerate AI Innovation with Personetics Labs

Explore and experience innovative AI applications with your real customer data, to boost bank productivity.

- Join our exclusive design partnership program to validate and test AI applications safely, without impacting your production environment.

- Evaluate insights before going live with Insight Reach Simulator:

-

- Test your insights based on actual user data

- Adjust insight logic and simulate reach impact

- Assess and optimize audience segmentation

Ready to take your financial institution to the next level?

Request a demo to see our latest product innovations in action.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Ruth Shabbat

Director of Product Marketing, Personetics

Ruth brings 20 years of strategic hands-on experience in product marketing, brand strategy, and sales enablement across global tech companies and startups. She has a strong background in leading B2B SaaS go-to-market strategies in industries including fintech, technology software, and more. Ruth holds an MBA with a marketing major, and a BA in Communications and Sociology.