June 29, 2020

Build Financial Resilience With AI and Automation

A common misconception is that people are rational beings and will always act in their best interest, especially when it comes to personal finance. That people with extra income would put their surplus into savings accounts so they can cover bigger expenses later in life, and coast through economic downturns like the one we are experiencing now. We know theoretically that saving is good for us.

But research in behavioral economics shows that, even though we know it is a good thing, we don’t always do it. Pioneering studies by Nobel Laureate and behavioral economist Richard Thaler demonstrate that when it comes to long-term financial planning, people do not always act in their best interest. What if banks, recognizing this challenge, offered a personalized level of trust-building service, almost like a private banker or advisor for each customer? Banks have so much customer data to work with. What if they use that data, leveraged by artificial intelligence (AI) and automation technologies, to make smarter decisions for customers than customers would make on their own.

The Goal for Banks: Help Customers Move Past the Limitations of Human Behavior

In the new global reality characterized by uncertainty and economic fluctuation, people would be wise to build financial resilience, to increase their preparedness to weather future storms. People understand on an academic level that to build resilience they need to increase savings, reduce debts, and spend responsibly. But a variety of behavioral and psychological factors limit their ability to follow through.

Overwhelmed by too much information, people process only a limited about at any given time, an attribute termed bounded rationality by economist and cognitive psychologist Herbert Simon. In response they use heuristics to simplify their decision-making, “simple decision rules that allow judgements of acceptable accuracy without integrating all the information available”, according to Martina Raue, PhD. Heuristics help us answer complex questions, like exactly how much we should save when we do not know exactly what the future holds. But they can also give way to a variety of information biases, for example deciding to save less because we have not personally experienced financial hardship in the recent past, even though that does not necessarily indicate a financially sound future.

To overcome biases and our bounded rationality, we can be nudged—pushed to make better decisions. In their 2008 book Nudge: Improving Decisions about Health, Wealth, and Happiness, Richard Thaler and co-author Cass Sunstein introduce the concept of choice architecture, the idea that human decisions are influenced by the way choices are presented, and that people can be ‘nudged’ to make decisions that address biases and positively impact their health—financial or otherwise.

Banks have the tools to use ‘nudges’ to overcome customer biases and bounded rationality, but they haven’t maximized their potential—yet. Existing banking services offer budgeting and savings tools that shift the responsibility to the customer to set savings goals, understand what funds are disposable and available to transfer, anticipate future spending patterns, and more. The customer needs to continually track money movement and avoid overdraft. And if the customer is at risk of entering overdraft, the onus is on them to remember to stop payments into the account. In another common scenario, because people lack a clear and aggregated picture of their financial situation across multiple accounts at different institutions, their ability to make informed decisions is limited (for example, thinking they have more to spend but forgetting about debt in an account with a different bank). The burden to manage finances is placed on the consumer instead of being placed on the bank and the consumer, bounded by bias, misses their full savings or investment potential.

AI-driven, automated financial wellness programs provide the ultimate ‘nudge’ by automating the steps in customers’ financial journeys where they are least likely to act in their own self-interest. These programs:

- Understand the customer’s financial situation

- Suggest goals for the customer based on their position in their financial lives

- Make decisions for the customer even in conditions of uncertainty

- Continuously engage the customer over time

- Adjust to help the customer form healthy habits

Automation is the lever banks can use to help customers change their financial reality in actual terms. It not only presents choices in a way that drives optimal decision-making, but it also takes action on behalf of the customer that encourages the formation of healthy financial habits, sustainable over time.

AI, Automation and Customer Journeys to Financial Resilience

AI and automated tools help customers achieve financial goals that may have been unattainable either due to real financial hardship or simply because of the limitations of human behavior. For instance, John’s bank offers him to join a monthly auto-savings program and put $200 a month into savings. John wants to join but worries that, should his financial situation change, the savings program contribution will lead him to overdraft. Like John, most people would be reluctant to join such a program in times like the present economic downturn.

But when a bank can use AI to continuously monitor and predict financial behavior and automatically change the amount or frequency of the transfers, the risk of going into overdraft is eliminated. The bank knows when to freeze the program or make adjustments because of lower cashflow, so John will not need to remember to freeze or adjust it on his own. By analyzing past transactions and John’s account status, AI allows John to continue saving with confidence that his program will automatically adjust should his financial situation change. This is an example of how AI-driven automation can optimize decision-making for customers, offering added value and contributing to their financial health and resilience.

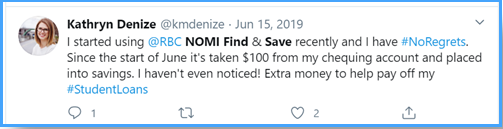

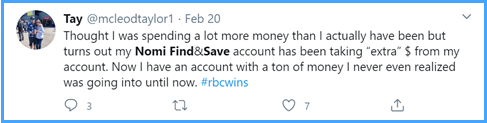

And this is already happening. Royal Bank of Canada’s NOMI Find & Save program analyzes customer transaction data and searches for surpluses. When it identifies extra money, it automatically transfers it into a savings account. Customers only need to sign up, and then watch the bank find them savings that they did not know they had. One customer said: “I started using RBC’s NOMI Find & Save recently and I have no regrets. Since the start of the month it’s taken $100 from my checking account and placed into savings. I haven’t even noticed! Extra money to help pay off my student loans”.

Others have cited the future vacations they will take and their increased emergency savings as a result of participation in the program. RBC customers are concretely improving their financial situation without having to take any proactive steps by themselves, and RBC is gaining their loyalty, leading to increase lifetime value and the potential for new product adoption as they build their savings.

Open Banking: An Opportunity for Greater Clarity and More Action

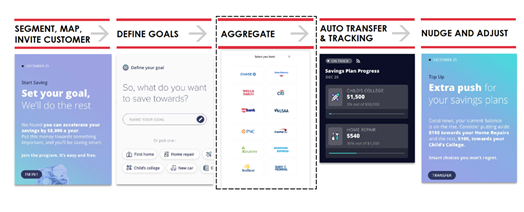

The growth in open banking technologies presents an opportunity to deliver even more accurate and holistic solutions for customers. An automated savings program that uses AI to identify saving opportunities between accounts within a single bank can save customers real money. With open banking, the bank receives access to significantly more data and can deliver even more for customers when it analyzes data across multiple accounts at different banks. The tracking and nudges become all the more accurate—more reflective of the customer’s real financial situation.

Combining automated offerings such as auto-savings and investment programs, auto-debt reduction, and auto budget management, with the capabilities of open banking can offer an unprecedented level of service. Like a private banker for all customers, programs driven by open banking can offer holistic cash flow oversight and control, recommend new products, goals, and attractive offers, and guide through their execution.

When a bank can see its customers’ financial data from other accounts, it can truly solve for the customer’s most pressing needs, offering preemptive suggestions to prevent future financial hardship. The more data, the more options, the smarter the automation will be, and the greater value it will ultimately provide customers toward their financial resilience, also justifying to the customer why they should agree to share their data with the bank in the first place.

Finally, the combination of AI, automation, and open banking presents unprecedented potential for banks. To build a more loyal customer base, see greater product adoption, from new accounts to new investments, reduce customer defaults and delinquencies, and ultimately gain higher lifetime value and wallet share from healthy, resilient customers.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook