October 8, 2020

It’s Time for Personalized, Digital Investment in Small Business Banking

Banks have underinvested in digital services for small business, missing opportunities to leverage customer data, and failing to offer value and help SMBs build stronger, more resilient businesses. As customers across the board demand greater personalization and meaning in their banking, Personetics’ solutions can help banks fill this gap.

To meet increasing customer demands for remote service, banks are investing heavily in developing digital tools, with one top ten American bank saying digital sales jumped 30% to 50% during the pandemic. And with customers expecting their bank to take care of them, the banks’ role is evolving to be stewards of customers’ financial resilience.

SMBs are major economic drivers and represent significant revenue streams for banks—comprising one fifth of all global banking revenues, according to McKinsey. But for years, banks have underinvested in digital services for small and medium businesses (SMB) while focusing efforts on selling loans rather than creating value for the small business.

To truly support SMB customers, banks need to create value around their broader financial needs. Value means streamlined business management, proactive insights and relevant recommendations that SMB customers would otherwise miss or struggle to find, all leading to loyal customers, greater product adoption, and increased revenue. Bank stands to gain valuable business outcomes, too: up to 8% improvement in customer retention, 17% CTR in sales-generating actions, and a 35% increase in customer engagement.

A “Digital CFO” in the SMB’s Pocket

To capitalize on the opportunity ahead of them, forward leaning banks have partnered with Personetics for financial data-driven personalization at scale. Personetics’ engagement platform for SMB assists banks in quickly boosting their personalized engagement and impact with small business clients. We do that by providing an end-to-end suite of solutions designed to meet the needs of small businesses, driving smart money management for the business and greater value and ROI for the bank.

Small business owners generally juggle multiple, siloed bank accounts, with any single bank serving only part of their many needs. Forrester found that SMBs list the ability to see holistic financial alerts near the top of the digital tools they need. But while 78% of customers want to receive digital financial insights, only 12% currently do.

Personetics accesses and understands real-time financial transaction data and can integrate with Cloud Accounting Software including QuickBooks, Sage, Xero and others as well as pull in data from financial data and payment APIs. It then takes the unified data and analyzes it using AI and predictive analytics models to unify and understand a small business’ full financial performance. With a single view of the data, Personetics presents relevant and personalized insights about account trends as well as actionable recommendations that help the business better optimize their finances.

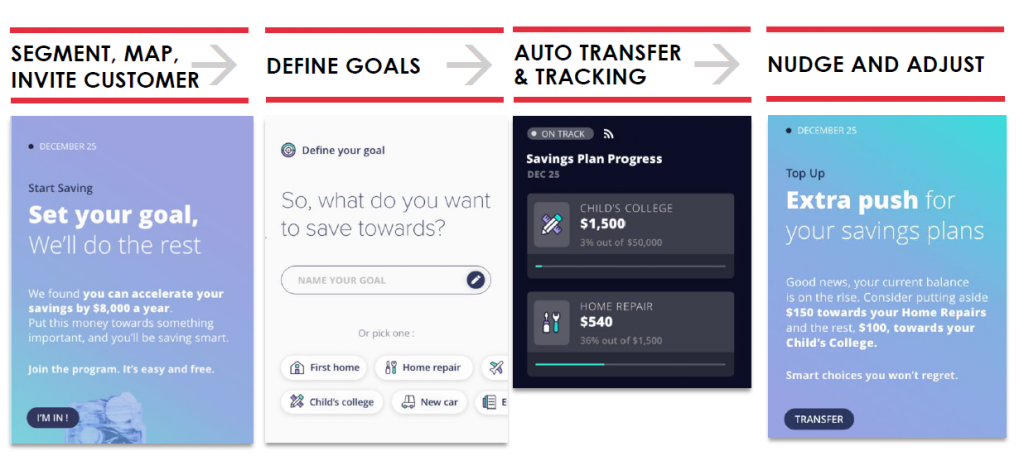

Once trust has been established through intimate and timely interactions, Personetics’ Automated Financial Wellness Programs are an opt-in, long-term option that identifies ‘pockets of available funds’ and shifts them to more attractive options including saving more, paying down debt or investing more.

Personetics Engagement Platform to Support the SMB Lifecycle

Personetics’ engagement solution answers questions that all SMBs share:

- What does my business need?

- How is my business doing?

- What should my business do?

- Can my bank do it for me?

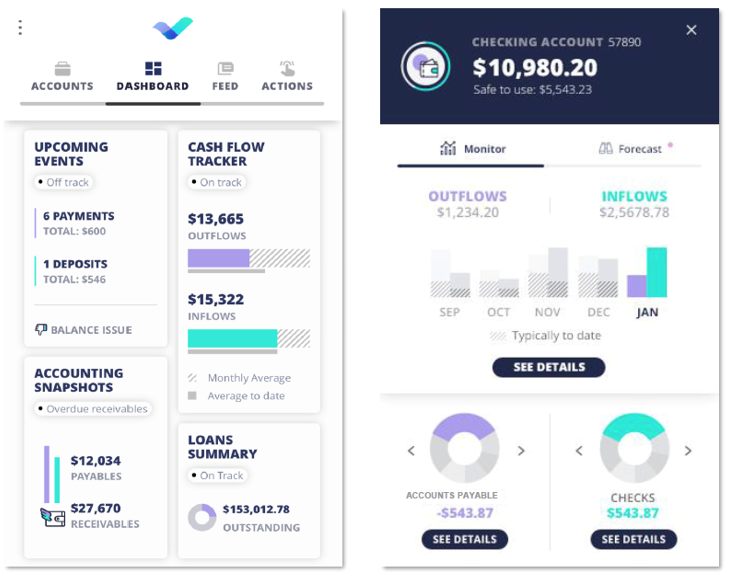

Let’s walk through these. Personetics aggregates data across multiple accounts, cleans, and categorizes it according to SMB-minded categorization—marketing expenses, taxes and licenses, payroll, and inventory, for example—to provide a big-picture view of what a small business needs. When a customer checks their mobile banking app, they first see a holistic view of the financial state of the business, including cash flow, accounting information, and upcoming payments and deposits, as well as detailed forecasting.

Timely Insights

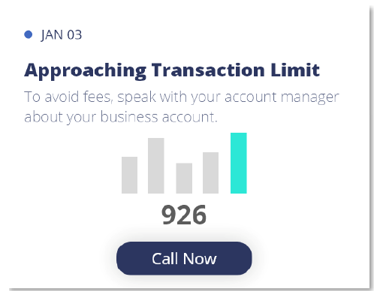

Timely insights and business management advice bring attention to account activity that the business owner wants to know about but may not have time to proactively seek out in their hectic day to day, to answer the ongoing question of how the business is doing. Personetics offers banks a library of over 300 out-of-the-box insights, like the transaction limit alert below. The Engagement Builder allows banks to build countless more custom insights and bring them to market in a matter of minutes.

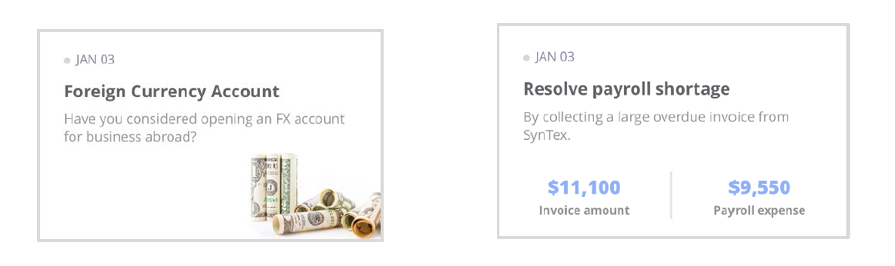

Insights also promote new product adoption and make actionable recommendations, like suggesting a forex account after identifying a growing number of foreign transactions fees or recommending the collection of an overdue invoice to resolve forecasted balance issues.

By offering valuable information that would likely be inaccessible to customers in other ways, insights show SMBs that the bank is genuinely looking out for their financial wellbeing.

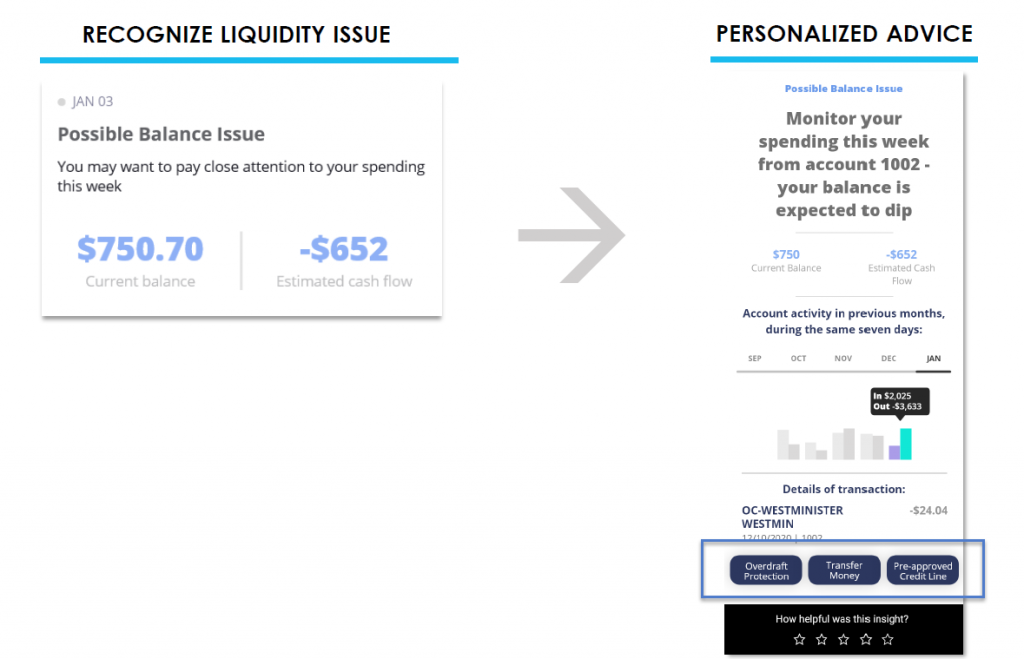

Contextual Digital Sales

Once trust has been established, the bank can deepen its relationship with the SMB by offering actionable advice. Personetics’ algorithms evaluate a customer’s real-time eligibility for a product or service and, through contextual digital sales, presents it when it is needed.

Below, the bank notifies the business owner of an unexpected charge that could cause cashflow issues. The bank immediately assesses that this customer is eligible to split the payment and makes the offer. Due to their hyper-personalized nature, these contextual service offerings have achieved a minimum of 17% click-through rate and can lead to quick growth for the bank. A Personetics analysis found that lending penetration offered contextually grew by 11% in just several months.

Automated Financial Wellness Programs

Say the small business decides to act on one of the bank’s offers, for instance opening a savings account. With Personetics’ Automated Financial Wellness Programs, the bank moves from a trusted advisor to a small business CFO of sorts, not only suggestion action but actually acting on the SMB customer’s behalf.

In this program below, the bank informs the customer that they’ve found $1,500 to set aside in a savings program today. If the customer joins the program, the bank will continue to evaluate the customer’s balance and cash flows, transferring additional funds as the algorithm deems them available—and only when they’re deemed safe, to prevent overdraft.

Without noticing or acting on its own, a small business can amass significant savings in this way. And the bank can increase the customer’s share of wallet: Personetics found that 31% of funds transferred into automated savings programs originate in account that are external to the original account.

Personalization Drives Growth for SMBs and Banks

The opportunity of digital investment for banks lies in how well they use data intelligently and innovatively to change financial realities for their small business customers. The more data banks can view and aggregate, the more holistic money management solutions they can offer. Solutions that deepen customer relationships over time.

Personalized insights and advice increase digital engagement—banks that implemented Personetics’ platform saw a 7-point increase in their NPS. Additional offers based on real customer need improve cross-selling and conversion, with 20% growth in new accounts. Automatic financial wellness programs, such as auto-savings, grow balances in both primary accounts and new accounts. Gradually, customers build wealth and reduce debt, leading healthy financial lives for themselves, and increasingly profitability for the bank.

The ability for banks to better understand their customers and offer products and services to match is the ultimate promise of personalized digital banking. Customers feel better cared for, because they actually are cared for more accurately. The bank can pinpoint their needs and serve them more precisely than ever before, growing product adoption, share of wallet, and loyalty. For small business and banks alike, data-driven personalization is a winning solution.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue