May 17, 2022

Overdraft Response as a Competitive Advantage: How to Drive Business Impact with a Proactive Customer-centric Approach

The banking industry is shifting rapidly to support customers with improved overdraft solutions and reduced fees, while balancing economic impact to the bank. We applaud the recent changes as a significant step forward, but there remains a bigger opportunity: reinventing how banks anticipate and ameliorate customers’ potential cash flow issues. In the near term, the potential for competitive advantage exists for forward leaning banks that can innovate and deliver customer-centric solutions.

The industry has a unique opportunity to support customers with creative solutions to overdraft conditions. By changing the way they respond to overdrafts, financial institutions can reinforce their role as trusted advisor, and help customers better manage their money. Situations where customers may have a pending overdraft condition become occasions to engage, understand customers’ cash flow on a deeper level, and create moments of truth for advice and tailored solutions.

Let’s look at a few key takeaways from my conversations with banking leaders during the recent GFMI Retail Deposit Optimization and Strategic Management conference, and what “Customer-centric Innovation on Overdrafts” means for your institution.

Understanding Root Causes of Overdrafts

Before we can solve the problem of overdrafts, it’s important to understand the root causes of overdraft, and what customer profiles are most vulnerable to falling into overdraft conditions.

According to survey data recently presented by the Financial Health Network, 25% of households can’t pay their bills on time. However, this is not necessarily caused by not having enough income; only 14% of households spent more than they earned last year. 33% of households said that their incomes varied occasionally or quite often from month to month, suggesting that overdraft conditions are often caused by income volatility.

Overdrafts Cause Big Challenges for Customers…and Banks

While there is a clear customer need to help overcome near-term liquidity issues, overdraft is not an ideal short-term liquidity solution. Overdrafts tend to be high cost for the customer and the bank, resulting in high servicing costs for customer calls and complaint handling. More importantly, overdrafts can have a material impairment to customer satisfaction and increase the likelihood to attrite for certain segments.

I asked the audience of banking leaders at my presentation what aspects of addressing overdrafts are most challenging for their institutions. The overwhelming response: “personalizing treatment for customers.” Rather than simply focusing on the cost of overdraft penalties, banks can drive even greater value for customers’ financial well-being with a more proactive approach.

Watch highlights from Jody’s presentation at GFMI Retail Deposit Optimization conference 2022: “Customer-centric Innovation on Overdrafts”

Customer-friendly Changes from Banks: the “4 Ps” of Overdraft Response

In the past few months, several major banks and credit unions have announced customer-friendly changes to overdrafts. We call these changes the “4 Ps” of overdraft: changes to policy, price, process, or product. Many institutions are eliminating or reducing overdraft fees, some are reducing the number of overdrafts that can be charged, and some are offering a longer grace period or negative account balance buffer. A few leading banks have taken a more creative approach introducing a new product or feature, such as Truist One or Huntington’s Standby Cash.

These responses represent a big step forward for the industry. There remains, however, an even bolder opportunity for banking leaders to take a customer-focused stance. We call this the 5th P: Proactive.

There are three critical enablers to proactively engage customers with personalized treatments:

- Understand the customer situation

- Anticipate the overdraft condition with cash flow models

- Determine a tailored treatment that addresses near term issue and supports financial wellness

Improving Day-to-Day Banking: Proactive Balance Forecasting

When banks can proactively forecast their customers’ cash flow, they can anticipate overdraft conditions before they happen, and offer treatment proactively. It’s critical that banks have cash flow models that are effective at predicting an overdraft condition. Through back testing with millions of transactions, Personetics has shown its models can accurately predict 70% of overdraft conditions.

With proactive balance forecasting, Personetics analyzes customer transaction data, inflows and outflows, and predicts upcoming activity based on historically recurring and patterned payments using both short term (7 day) and medium term (30 day) timeframes to predict risky balance date ranges.

As importantly, banks should recognize the customer profiles or personas of the customer that it identifies as likely to overdraft. Personetics data has found that 5-6% of checking account customers overdraft monthly, and 55% of these are habitual overdrafters.

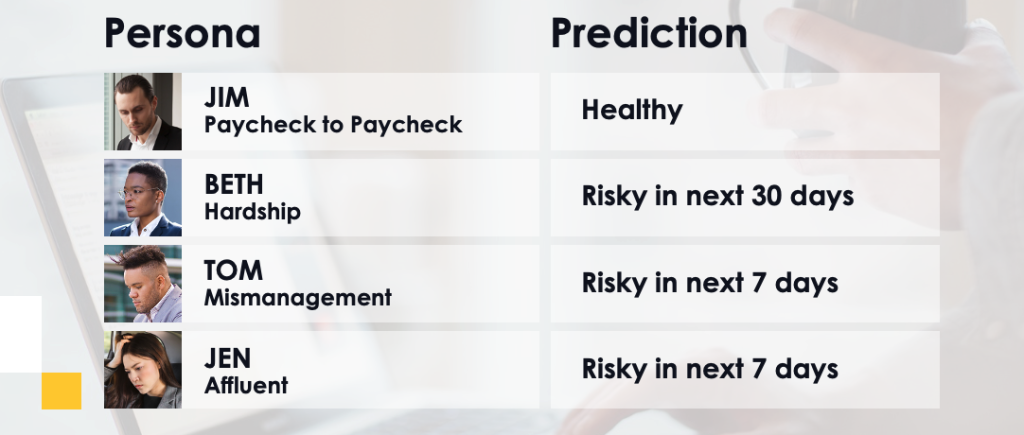

Personetics has identified four main personas who typically experience overdraft:

- Paycheck-to-paycheck: Customer is living at the margin financially. Income may be volatile, not enough income to cover expenses

- Financial Hardship: customer is creditworthy and has responsibly managed their finances, but they have experienced a financial hardship – possibly their employment was impacted, had a medical expense, changes to debt repayment patterns.

- Mismanagement: has enough income, but mistimed their payments or deposits

- Affluent Mistake: has more than enough money in other deposit accounts, but unwittingly experienced an overdraft on their checking account

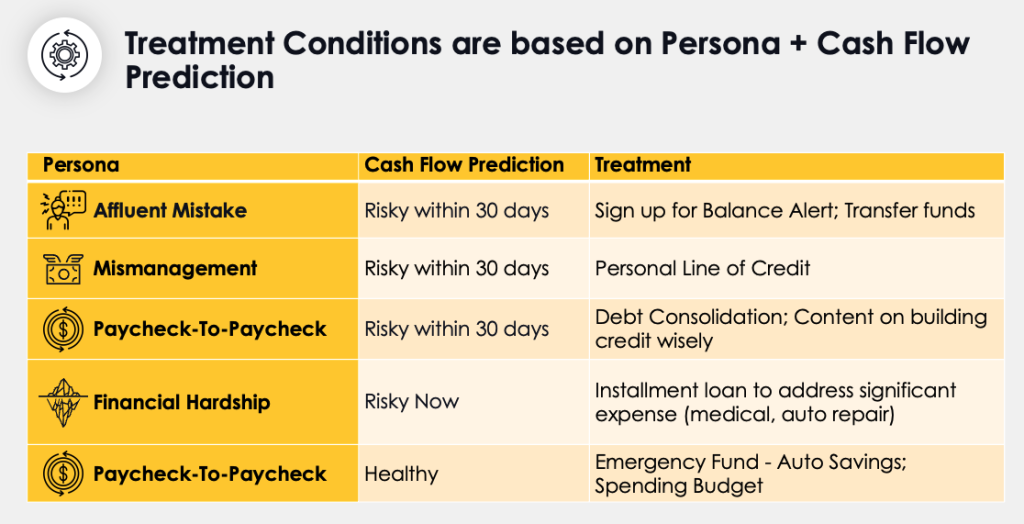

Real-Life Examples: How to Treat Overdrafts for Various Customer Personas

As part of my presentation to the group at the Retail Deposits conference, we did a group exercise with some real-life examples of customers in overdraft situations. I asked the banking leaders to offer some creative ideas for how the bank could respond with personalized treatments for each of these situations.

This is a good illustration of how personalized support with Proactive Cash Flow Management would work in real-world banking situations. It shows how understanding the customer persona combined with predictive cash flow modeling can unleash the creativity of the bank to deliver personalized treatments.

Jim – Paycheck to Paycheck: Jim has a “Healthy” near term outlook for his cash flow, based on predictive analysis, but he has previously experienced overdrafts.

How to help Jim: Recommend that he set up an emergency savings account and start to save with auto-savings. Set up a smart budget to help him keep his spending on track.

Beth – Hardship: Based on cash flow analysis, Beth has experienced financial hardship and is at-risk for an overdraft right now.

How to help Beth: Offer an installment loan to address her major recent expenses; provide her with options the bank may have to defer a payment, recommend alternative funding like a CD-secured loan.

Tom – Mismanagement: Tom has had a mistiming of his deposits and payments; he is likely to be at a Risky balance level within 30 days.

How to help Tom: Offer a personal line of credit, provide smart budgeting tools with a target for a specific category, and transaction reminders to better align his spending with cash flow.

Jen – Affluent Mistake: Jen has plenty of money deposited across her entire banking relationship, but based on current cash flow, in 30 days she will be at a Risky balance level in her checking account.

How to help Jen: recommend that she sign up for balance alerts and overdraft protection solutions to transfer money proactively from savings to checking.

Reshaping Overdraft Response, Driving Business Impact

This can be a watershed moment for the banking industry: reimagine overdraft response with proactive cash flow management. Not only is this proactive approach more effective and valued by customers, but it can also create strong payback for the bank.

With a proactive approach to overdraft, your institution can…

- Reduce attrition: what percentage of customers are you losing each year because of frustrations about overdraft fees? Fintechs and challenger banks often market themselves as “no overdraft fee” alternatives to traditional banks.

- Lower operational costs: how much of your customer service call volume is dedicated to servicing overdraft complaints and deciding whether to forgive fees? What if you could free up those resources for other operational priorities?

- Increase the depth of relationship: What if overdraft conditions – instead of being a one-size-fits-all situation – could become a moment of opportunity to engage with customers in a personalized way, to offer relevant products and deepen the customer relationship with lending, savings, or budgeting solutions?

- Higher customer satisfaction and loyalty: What if your institution could bring overdraft “out of the shadows,” and become not just a fee or line of fine print, but a point of pride and an enduring competitive advantage?

We had energizing conversations about overdraft response with banking leaders at the Retail Deposit Optimization and Strategic Management conference. The industry is ready to embrace new ways of managing overdrafts with a range of inspiring customer-friendly solutions – and the future of overdraft response is likely to be even more proactive and personalized.

Ready to learn more about how to be a leader in overdraft response? Read about Personetics’ new “Proactive Cash Flow Management” capabilities or Request a Demo.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President of Americas

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.