April 8, 2016

Personalization or Personalisation? Either way, people (and banks) are taking notice.

The critical role of personalization in shaping Banking-to-Consumer relationships is becoming evident. Recognized for our leadership role in enabling the personalization of digital banking, Personetics is a proud member of the FinTech50 list, announced this week at Money20/20 in Copenhagen.

“If robo-advice was the most popular theme, personalization struck me as the most important one.” –this was an observation made by Forrester’s Benjamin Ensor following this year’s Finovate Europe.

The reason, according to Ensor: if financial institutions fail to deliver relevant advice and recommendations, other companies will start doing it using their customers’ financial data. That’s a polite way of saying they’ll start eating FI’s lunch.

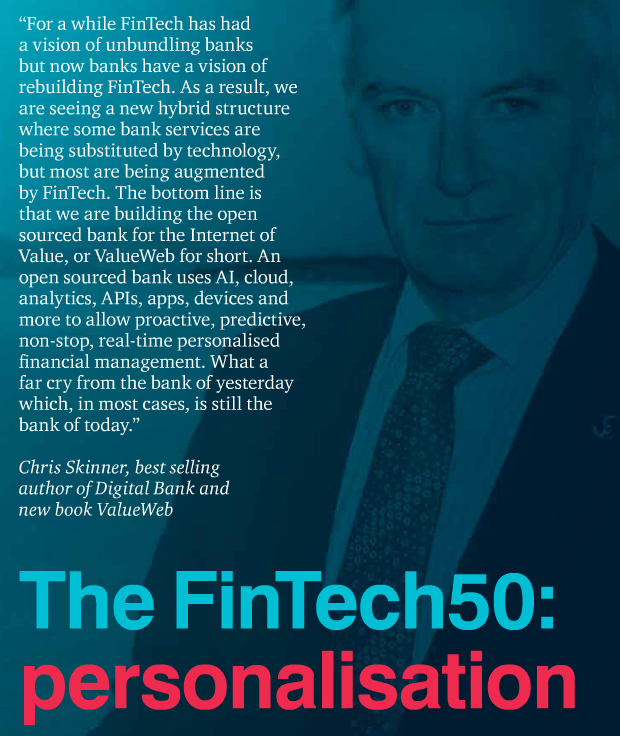

With PSD2 (Europe) and Open Banking (UK), this new reality is right around the corner. The banks are taking notice. A growing number of them are also taking action. Those that don’t, do it at their own peril. Chris Skinner recently said it better than ever:

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook