Over the past years, a tidal wave of new digital banks has launched across the globe. These days, they come in many shapes, colors, and sizes. The common denominator: These new entrants relentlessly compete to win customers with better digital customer experiences than what traditional banks currently offer, embracing mobile to deliver more personalized customer experiences combined with relevant guidance and advice. You can read my report “Disrupting Finance: Digital Banks” for the latest update.

A new entrant is TMRW (pronounced “tomorrow”), a mobile-only digital bank launched by Singapore-based United Overseas Bank (UOB) on March 1, 2019.[i] TMRW aims to better meet the financial needs of ASEAN’s digital generation and change the banking experience for these hyperconnected consumers. The plan for the new brand is to build a customer base of three to five million in the next five years and contribute to UOB’s strategy to scale up its customer franchise across Southeast Asia.

We spoke with Dennis Khoo, regional head at TMRW Digital Group by UOB, about how the company aims to engage ASEAN’s Millennials and the digitally savvy with a data-driven banking proposition, starting in Thailand.

What were the drivers behind this new brand?

We debated for some time. UOB is a more than 80-year-old brand in Singapore, and it has been present in Southeast Asia for decades. The UOB brand stands as quite traditional: strong; trusted; in a way, a little bit conservative. With our digital bank model, we wanted to serve the needs of a very targeted segment — the digital generation — including young professionals. The question was whether we should go to market with a separate brand or launch our digital bank within the UOB brand. UOB had never done this kind of branding exercise before, so it was something very new for us. Of course, the decision had to go all the way to our group CEO [Wee Ee Cheong is deputy chairman and CEO at UOB]. We presented him with the idea of setting up a separate brand and doing things differently, and a few weeks later, we got the green light to go ahead as he told us: “If we don’t try, we won’t learn.” From a practical perspective, we figured out that going after Millennials would be ideal, as they are already comfortable with mobile-only digital services.

How long did it take from presenting that idea to launch?

I started in the new role on January 2, 2017. With more than 100 digital banks in the market, the temptation is always to act quickly. But we knew we needed to take time so that we’d design a digital bank model that is differentiated and meets the needs of the customers we want to serve. We also started from a blank slate. This made us realize that our primary focus should be on deepening customer engagement. Every interaction with TMRW is designed to be truly customer-centric.

We decided to launch in Thailand, a market in which UOB has a strong presence yet still offers a lot of opportunities for growth. Thai consumers are also comfortable with using digital services such as the mobile messaging app LINE.

To achieve this, we conducted extensive market research — both quantitative and qualitative. We spoke with consumers in Thailand to deepen our understanding of their needs, banking habits, and the type of service they expect from a digital bank. We found out that many banking customers wanted a better quality of service from their bank.

Over six months, we laid the groundwork to understand our customers’ lifestyle priorities and banking needs and learn from industry players to stay up to date on trends in digital banking and technology best practices. This helped us articulate our business and operating models and determine what technology capabilities we needed to achieve our goals, such as artificial intelligence and cognitive analytics.

We also trained everyone involved in building TMRW on design thinking — which helped us put a lens on the customer as we were designing our digital bank. We also set up many workshops with our local Thai teams to make sure we would consider market and cultural specificities.

The actual coding to build TMRW was actually very fast, as we could leverage UOB’s standardized regional technology systems. It only took us 14 months from the time we started coding and the launch of TMRW in our first ASEAN market: Thailand.

How did you decide on the operating model?

We set out to implement a low operating cost model. Today, the margin cost of servicing a new customer for TMRW is very small, and this is by design.

The next core component is the cost to innovate. The project never ends: You need to release new capabilities, there are regulatory changes you need to factor in, and so on. One decision we had to make was “build versus buy.” A lot of TMRW leverages UOB’s standardized set of core banking capabilities across the region.

The last core component in our operating model is the cost to compete. In the ASEAN region, it is difficult to compete on product proposition or fees, as the competition is intense. You don’t have many variables to play around with. To complement our product offerings, we are banking on customer experience and how we can use data to deepen customer engagement by personalizing the experience when customers interact with TMRW.

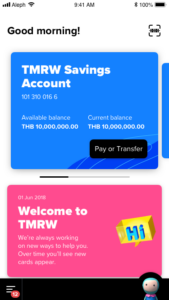

In Thailand, TMRW offers customers a transactional account bundled with a credit card. We wanted to sell a complete bundle right from the beginning so that we could actually maximize the relationship from the start and provide enough opportunities to transact.

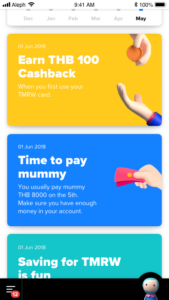

As customers engage more frequently with TMRW, we will be able to learn from their transaction data and use that data to increasingly personalize the TMRW experience.

What problem are you trying to solve?

We want to serve young professionals, and we know that building their savings is important to them. Our research showed that Millennials do not like feeling guilty about the way they’re managing their finances. But they appreciate receiving guidance that helps them manage their finances better. So we designed a money management tool using gamification to help them meet their savings goals in a fun way.

We also wanted to push simplicity to the fullest and create a very simple interface. This means no menu. Our goal is to learn from how each customer is using the app to adjust what they’re seeing in the app and bring upfront functionalities and information that are tailored to their needs. In the next iteration, we want to have a menu-less interface.

We have also partnered with Personetics to use its solution and personalize the TMRW experience for every customer. We found out about Personetics’ solution at a conference and thought it was really interesting: being able to provide customers with financial insights, alert them about unusual transactions, and recommend amounts to save.

We also designed the TMRW customer servicing experience around chat; that way, you can have a very low cost of service while still offering customer service. Within our digital chat service, customers can converse with our chatbot or be escalated to a live agent or else use the click-to-call function to speak to someone in our contact center. As chatbots need time to learn from each conversation and to be smarter in responding to customers, we have designed for the chat journey to be more dependent on live chat agents in the initial phase.