November 30, 2021

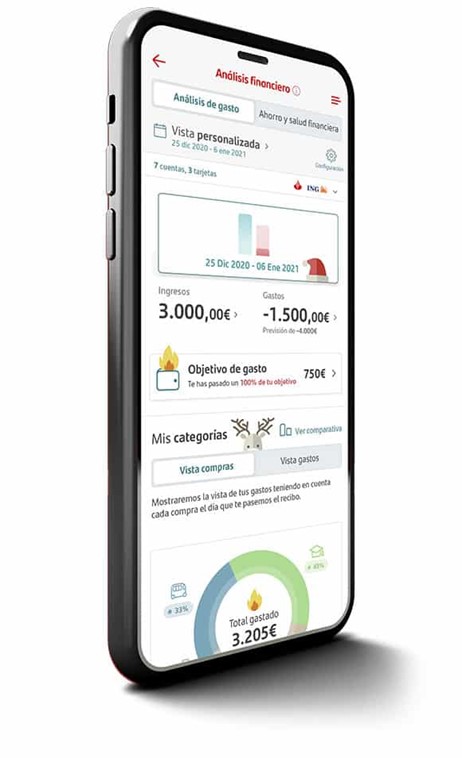

Santander Spain – Self-driven Finance: AI driven data to create engagement

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook