May 22, 2025

Showing the Human Side of Digital Banking: Insights from Desjardins’ Nathalie Larue

By Jody Bhagat, President Global Banking, Personetics

Our recent Banking on Innovation podcast featured Nathalie Larue, Executive Vice President and Head of Personal Banking at Desjardins Group, North America’s largest financial cooperative with nearly 8 million members and over $480 billion in Canadian assets. In this enlightening conversation, Nathalie shared how Desjardins is approaching digital banking with a distinctly human touch; making technology serve people rather than the other way around.

Putting Members at the Center

As a cooperative with a 125-year history, Desjardins operates with a different mindset to many financial institutions. “Our members mostly feel that the purpose of our group is to always do what’s best for them,” Nathalie explained. “Being a cooperative, members and clients are really at the center of everything that we do.”

This member-first approach has helped Desjardins rise dramatically in customer satisfaction rankings. Five years ago, they ranked eighth out of nine financial institutions measured in NPS benchmark studies. For the past two years, they have consistently ranked in the top three every quarter.

Rising Expectations in a Digital World

Without a doubt, Desjardins has noticed that the bar has been raised in terms of customer expectations. “Most of our customers don’t compare us to other banks,” Nathalie noted. “They’re comparing us to other service providers they do business with.”

With this comparison to digital-first companies, members expect the same level of convenience and personalization they receive from leading technology companies, combined with the security and trustworthiness of a financial institution.

The challenge is meeting these expectations while maintaining the human connection that has always been central to Desjardins’ identity, especially as branch visits decline and digital interactions become the norm.

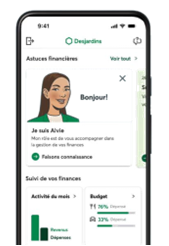

Introducing Alvie: Making Digital Personal

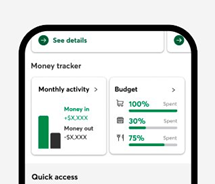

One of the most exciting developments in Desjardins’ digital strategy is Alvie, their app’s AI-powered virtual assistant. Nathalie shared how Alvie came about after she challenged her team to explore personalization capabilities similar to what Personetics offers.

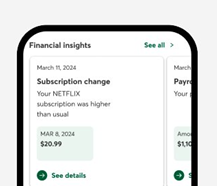

“The concept was generally very well received,” Nathalie explained, “allowing for better control of our members’ own finances.” What’s particularly interesting is how members perceive this technology: “Respondents felt monitored by Desjardins, but this monitoring was perceived very positively, as if respondents felt supported by us.”

This positive reception demonstrates that members value personalized guidance when it feels like genuine support rather than intrusion. As Nathalie put it, “You’re monitoring me in a way that the information you’re giving me back is helping me make better life decisions and better financial decisions.”

Early Results and Member Response

Despite being relatively new, Alvie is already making a significant impact. Though Desjardins is newer to this space than competitors with more mature solutions, they’ve been active in creating tailored insights for members. By the end of last year, they had 23 different insight types in production, with members receiving an average of seven insights per month.

And they’re asking for more.

“We were kind of pushing Alvie, and I think now members are pulling on Alvie and making it important for us to continue to provide the best insights possible,” Nathalie said.

This adoption has also energized Desjardins’ frontline staff. Initially concerned about losing touch with members who migrated to digital channels, advisors now see how digital insights can enhance their in-person interactions.

“When members are going to call you or come into a branch, they’re going to come with very good questions,” Nathalie explained. “High tech and high touch; you need to make sure that you provide high tech, but you also need to make sure that when you’re in touch with the people afterwards, you make it worthwhile.”

The Results Speak for Themselves

Desjardins’ digital transformation has garnered impressive results. Online sales increased from 25% in 2021 to 40% today across checking accounts, savings, mutual funds, credit cards, loans, and mortgage renewals – putting them 14 percentage points ahead of the Canadian banking average.

The key questions guiding their management committee conversations reflect this progress: “Are we working on the right things? Are we going fast enough? And is our frontline able to manage change with our customers at the right pace?”

Throughout this transformation, Desjardins has remained focused on ensuring that digital channels don’t just offer convenience, but also genuine guidance.

Balancing Digital Adoption with Physical Presence

As digital adoption increases, Desjardins is thoughtfully adjusting its physical footprint. By the end of 2024, teller services made up just 1% of transaction volume, while ATMs accounted for only 3%. This shift has put them on the path to reducing their branch network by approximately 30%, as part of a plan to better serve members based on how they interact with Desjardins.

These decisions aren’t made lightly. Local “caisses” (credit unions) in Canada, with their elected boards of directors, make the final call on closing service centers or removing ATMs based on usage data. “Not abandoning any members,” Nathalie emphasized, “we have solutions that help them continue doing business in a regional manner.”

This thoughtful approach to branch rationalization reflects Desjardins’ commitment to meeting members where they are, while responsibly managing resources to invest in the future.

Looking Ahead: The Promise of Open Banking

When I asked Nathalie how open banking might change the landscape for both customers and banks in Canada, she highlighted the potential benefits for the entire ecosystem: easy and secure access for consumers to their full financial portrait; better integration between accounting software and banking data for businesses; as well as increased innovation and competitiveness for the economy as a whole.

Nathalie acknowledged the security concerns with current screen-scraping methods and emphasized the need for a thoughtful, regulated approach that protects customer data and privacy.

Beyond Money: Supporting Members’ Dreams

Perhaps most compelling was Nathalie’s vision for customer expectations over the next three to five years—a question that I like to put to all my podcast guests.

Her answer without hesitation: “Stop worrying about numbers and money and start worrying about their dreams, about their ambitions, and making sure that we provide support for that.”

This perspective aligns with recent research showing that financial wellbeing ranks among consumers’ top life goals, alongside strong personal relationships and good health. It underscores the vital role financial institutions can play in helping people achieve their broader life goals.

“This is how we’re going to stay relevant in everybody’s life,” Nathalie concluded, “if we can focus on better understanding why people get up in the morning and what they hope to do during their day and making sure that their finances are there for them to just fulfill their dreams.”

Moving Forward with a Strong Ecosystem

Desjardins’ journey, communicated so passionately by Nathalie, shows how financial institutions can successfully navigate digital transformation while staying true to their core values. By combining powerful technology with a deep commitment to member wellbeing, they’re creating a banking experience that feels both advanced and deeply human.

As Nathalie acknowledged, this progress happens best within a strong ecosystem of partners. “Personetics has helped us along the way, and you’ve pushed us to go faster and to do things in a very agile way,” she noted. “We’re better with a strong ecosystem around us.”

(Author’s note: Desjardins launched Alvie within just four and half months of contract signing with Personetics SaaS deployment in partnership with Microsoft Azure).

Watch the full Banking on Innovation episode with Nathalie Larue: https://youtu.be/Ajpssmm7yLs

For a complimentary consultation session to learn how Personetics can help you enhance your customers’ digital banking experience, feel free to Contact Us.

How can you listen to the podcast?

Please tune in and join me and my guests on this journey.

You can access new Banking on Innovation podcast episodes here: Spotify, Apple, and YouTube.

Connect with podcast host Jody Bhagat on LinkedIn: https://www.linkedin.com/in/digitalbusinessgrower

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President Global Banking

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.