December 19, 2017

‘Tis the season to be predictive: who called it right in 2017?

As we head into the last days of the year, every industry pundit with an ounce of self-respect is rushing to come up with predictions for the new year. While we’d love to join the party, as an analytics company we take predictions very seriously. So before we rush to look into our crystal ball, let’s first see how some of the predictions for 2017 turned out…

The Year of AI: leaders and laggards

Publications like The Wall Street Journal, Forbes and Fortune have all called 2017 “The Year of AI.” As with every new trend, there is a gap between the hype and the reality, or more exactly between the early adopters and the laggards.

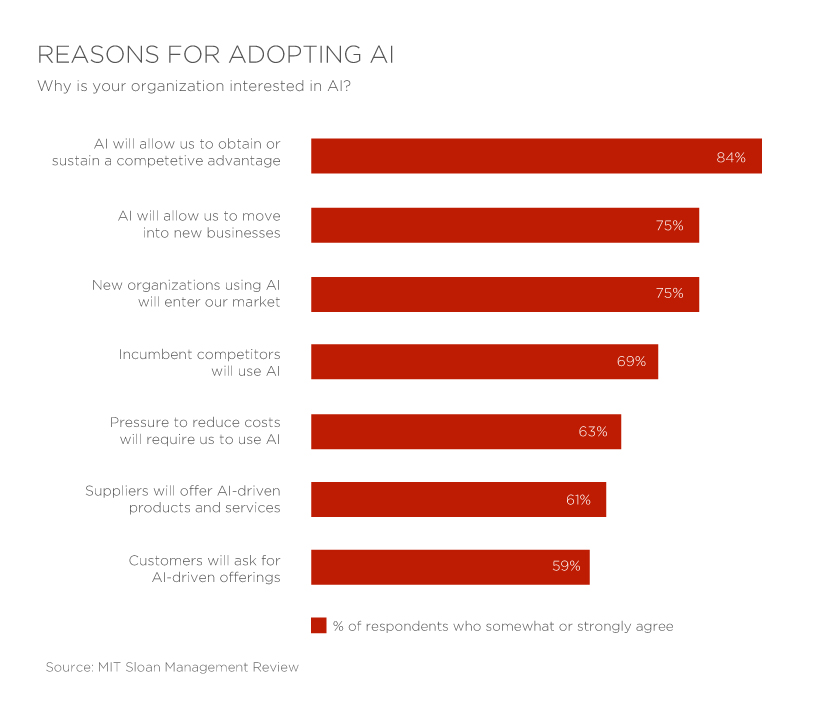

A survey of 3,000 business executives conducted by MIT Sloan in collaboration with the Boston Consulting Group found that 85 percent expect AI will offer them a competitive advantage. At the same time, only 39 percent have an AI strategy in place, and only 18% are actually using AI in some way today.

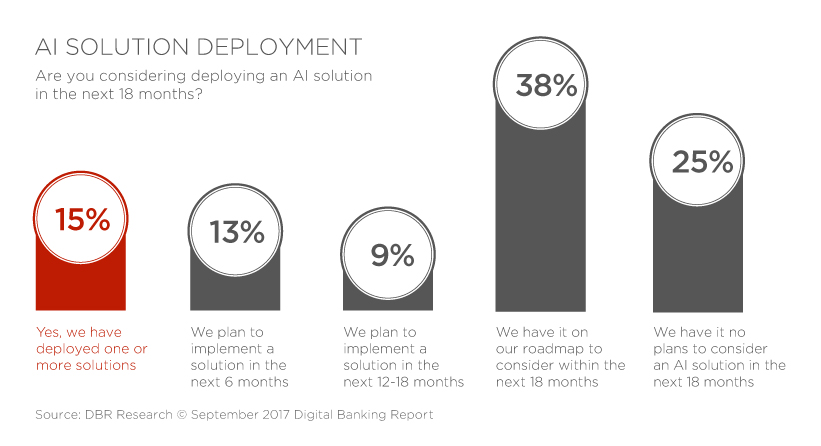

When it comes to banking, the picture is not very different:

As the leaders are getting ahead of the curve with AI implementations, there is a broad recognition of the consequences: 84% of the respondents to the MIT/BCG survey view AI as a source of competitive advantage.

Banking is (finally) going to be about the Customer.

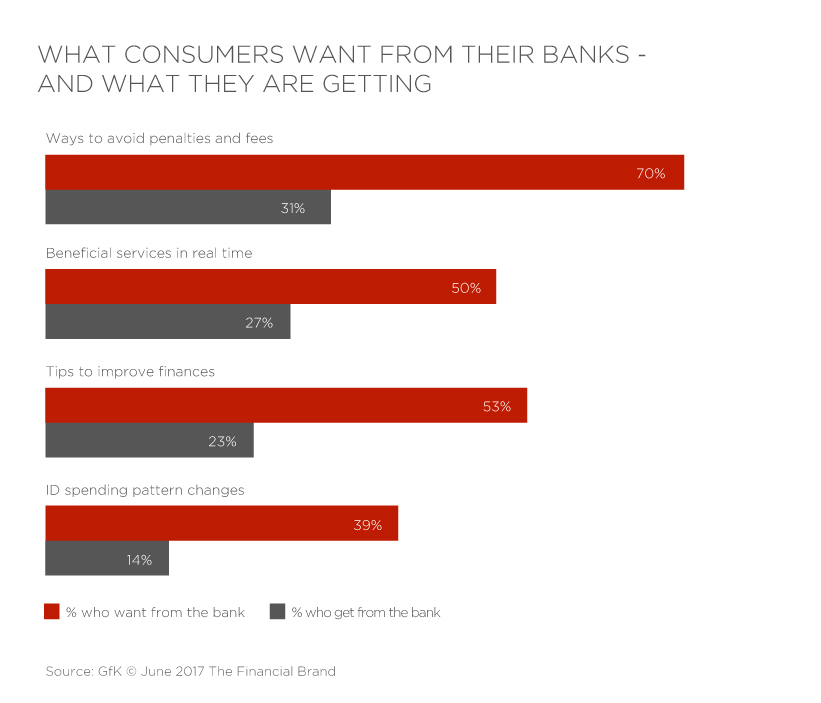

In his past year’s predictions, John Fishback, Principal Executive Advisor at CEB (now part of Gartner) said: “In 2017, banks need to test their assumptions about what ‘banking’ is – it’s not about opening a checking account or completing transactions. It’s about creating products that assist with all of the steps customers must complete in order to achieve their financial goals.”

Such predictions only highlight how far most banks are today from fulfilling customer needs:

Bradley Leimer echoed this prediction, noting the big role AI will be playing in the transformation:

“Banking apps will deliver personalized financial advice by leveraging aggregated financial data across a consumer’s providers in the future. Forget robo-advisors for investments only … our entire financial life will have a robo-component. And we will be better off for it.”

And Ron Shevlin, Director of Research at Cornerstone Advisers, correctly predicted the coming of the next-generation PFM in this context: “The upshot of recent scandals will be that banks will seek to prove that they have their customers’ best interests in mind when marketing and cross-selling to them. The result will be a focus on “we’re here to help you improve your financial health,” and a positioning of PFM-related tools and apps as ways to measure and improve financial health.”

Looking ahead: glass half full or empty?

Looking ahead to 2018, Forrester is predicting that financial institutions won’t see half of their customer, as consumers put a higher premium on their personal time and digital engagement becomes easier. In this increasingly digital universe, contextual engagement will become a primary source of differentiation, according to Forrester.

The lack of face-to-face contact with half the customer base is just one of the signals the banking business model is under attack. In 2018, Forrester expects more than 50% of banks will fail to exploit open banking, marching down the path towards the painful prospects of becoming an invisible utility.

How fast will the pace of change be and what we are going to see in 2018 is a question we will leave for the pundits. What is clear is that with the perfect storm of changing customer expectations, open banking, and the coming of AI, banking as we know it today will not be the future of banking.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook