January 23, 2025

3 Banks’ Secrets to Deeper Customer Relationships: Data-driven Personalization

By Jody Bhagat, President of the Americas, Personetics

Globally, 73% of the world’s interactions with banks are done through digital channels according to McKinsey & Company. In the U.S. alone, there will be 217 million digital banking users in 2025. For a banking industry that has traditionally relied on a relationship-based model to drive customer profitability, how should one adapt to an environment where most customer interactions are done digitally?

This is perhaps the most important and consequential challenge for banks, creating clear separation for those leaders that are embracing advancements in data and AI. A key part of the solution is in reframing customer relationships around personalized engagement in the digital channel.

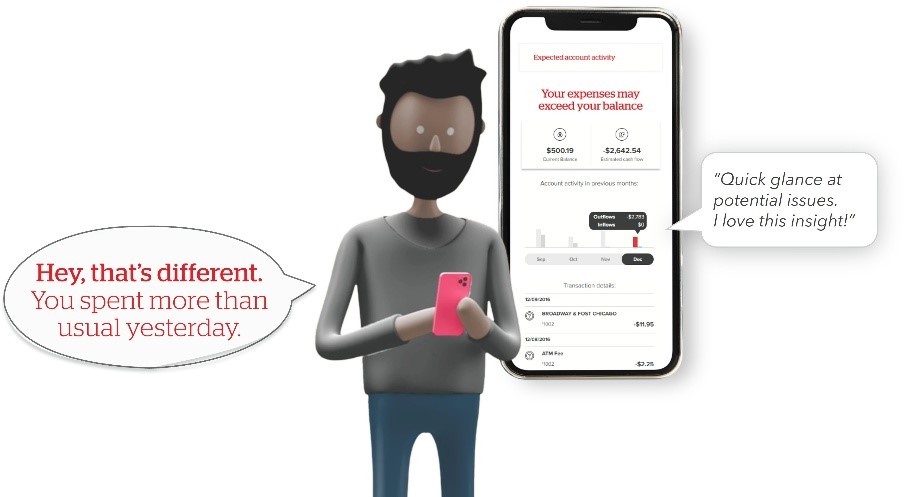

By offering usefully personalized transaction insights, banks can build trust and offer actionable, tailored support. Let’s take the example of helping customers anticipate cash flow issues. The technology is available for banks to help customers anticipate over 70% of cash flow issues through analytics. Banks should embrace and tout this capability to their customers as evidence that they are looking out for them.

At a recent Consumer Bankers Association webinar, I explored this reality together with leaders from three forward-thinking banks—Huntington National Bank, Bank of Hawaii, and Synovus—to learn how each one is applying these principles in practice. Over the next few weeks, I will post details of our discussion with each bank. In the meantime, here’s a short overview of all three discussions.

Huntington National Bank: Scaling Personalization

Huntington—a regional bank headquartered in Columbus, Ohio with $200+ billion in assets and a Personetics client of approximately five years—demonstrated how personalization can work at scale. The bank delivers 14+ million insights monthly across 96 different use cases, maintaining an impressive 4.7/5 customer satisfaction rating.

Joe Proudfoot, Huntington’s SVP of Digital Product and Capabilities, explained how they leverage information from Personetics to improve the customer experience by focusing on three main tenets:

- Show me information that’s accurate, complete, and intelligible

- Dig through my data for what I need to know so I don’t have to

- Help me understand my financial wellness and how to improve it

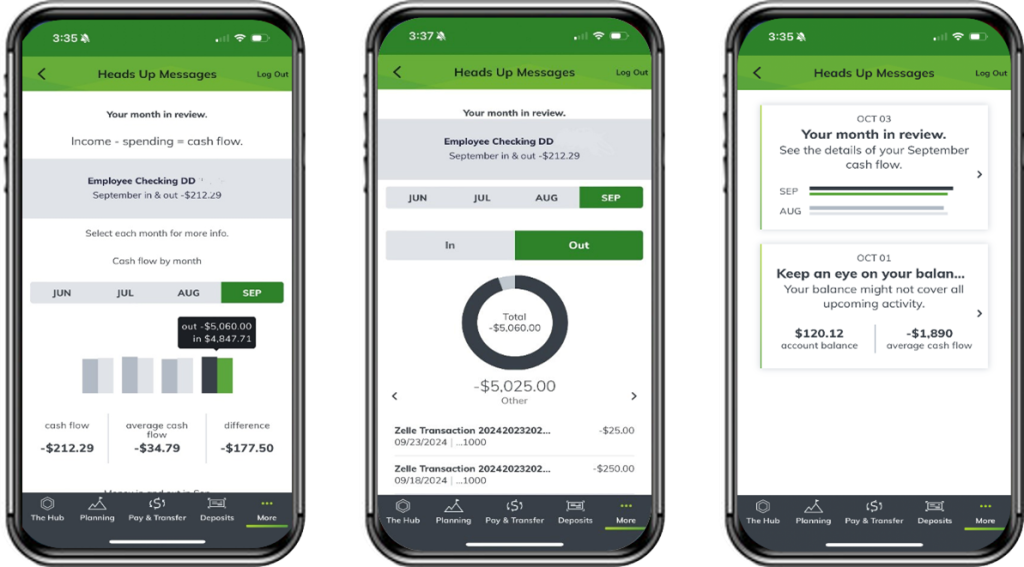

Proudfoot demonstrated several key UX examples, including Huntington’s heads-up display that shows customers their money flows, spending patterns, and balance trends, while proactively surfacing alerts about potential low balances along with specific recommendations for action

Popular features include alerting customers to new merchants they’ve transacted with and flagging high-dollar transactions with unfamiliar vendors; both helping prevent confusion before it leads to customer service inquiries.

Huntington’s focus on data enrichment has yielded practical benefits beyond customer satisfaction. “We look at the number of customers who actually call in to file a claim on a transaction they don’t recognize, only to find out when they talk to a claim specialist that they actually did make that transaction; they just didn’t recognize what it was because the data wasn’t good enough,” Proudfoot explained.

Looking ahead, Proudfoot revealed that “the bank is now migrating to a new SaaS solution to “keep us nimble” … and “take us to the next level”.

Watch Joe Proudfoot’s full contribution to the discussion.

Bank of Hawaii: Building Trust Through Actionable Insights

For Bank of Hawaii — a very strong $23 billion community bank — success starts with a clear framework built on four principles: value me, know me, advise me, and inspire me. David Hall joined our discussion as a FIS customer leveraging Personetics through their core banking platform integration. As SVP and Director of Digital Experience, Innovation and Technology, Hall explained, “While consumers may not be financial experts, they know that we know a lot about their finances. They expect us to translate that knowledge into smart recommendations and meaningful guidance.”

Though early in their FIS and Personetics implementation, Bank of Hawaii is already seeing strong engagement. Their integration with FIS has proven particularly valuable, allowing them to leverage over 50 insights while maintaining rigorous risk management standards. “The insights portal gives customers something to come back and look for,” Hall noted. “Where customers may not normally log in frequently, this gives them something more meaningful to come back for.”

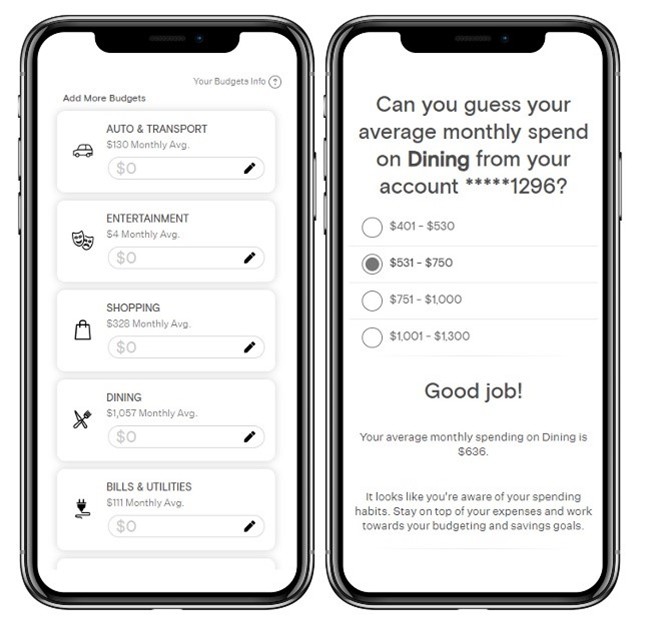

The bank has been careful to avoid turning their insights platform into just another sales channel. “We’re being very thoughtful about how we want to use insights because we don’t want it to ever feel to the customer like it’s just another place for us to be pushing products and services, even if they are meaningful and insightful,” Hall said. Instead, they focus on practical guidance, like showing customers how their spending in specific categories compares to similar customers – an approach Hall has seen drive real behavioral change.

Watch David Hall’s full contribution to the discussion.

Synovus: Making Digital Banking Personal

Synovus, one of the largest and most respected banks in the Southeastern US with around $60 Billion in assets, has focused on making digital banking feel more relational, emotional and personal. One example that Lee Sessions, Chief Consumer Product and Client Solutions Officer, offered was how different customers respond to different approaches: “Some customers like a witty tone, others might like more of a serious tone. Some customers might want a graphic image, others might like a lifestyle image.”

This attention to personal preferences has paid off. The bank’s 60-plus custom insights achieve a 20% engagement rate and a 4.3 out of 5-star average rating. More importantly, engaged customers showed a 10-point increase in satisfaction with financial guidance and maintained larger relationship balances.

“Personalization makes customers feel valued and understood,” Sessions noted. “That leads to more engaging and satisfying experiences when you’re creating the connection with them.” This approach has proven particularly valuable in building what Sessions called “persistent advisory experiences” across all channels.

Watch Lee Sessions’ full contribution to the discussion.

Looking Ahead

While customer needs and behaviors will continue to evolve, the message from these three institutions is clear: we are investing in capabilities to better understand our customers and deliver personalized guidance.

Whether comparing spending patterns to similar customers at Bank of Hawaii, delivering precisely timed insights at Huntington, or matching communication styles to customer preferences at Synovus, each bank has found their own way of leveraging customer data thoughtfully, to support their customers’ financial well-being.

They do this not to simply add features but as an accelerant around a desired outcome, experience, or brand promise that they are making.

The results speak for themselves: higher engagement, increased satisfaction, and stronger customer relationships. As virtual assistants evolve and AI capabilities expand, the opportunity to help customers make better financial decisions will only grow.

During the coming weeks, I will delve into each of these enlightening discussions in more detail. In the meantime, you can watch the full discussion on-demand.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President of Americas, Personetics

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.