September 13, 2022

Personetics Launches “Express” Solution for Midsize Banks to Quickly Achieve Business Impact with Personalized Customer Experience

Personetics Express will help midsize financial institutions compete with enterprise banks by deploying financial data-driven personalization in as little as 12 weeks

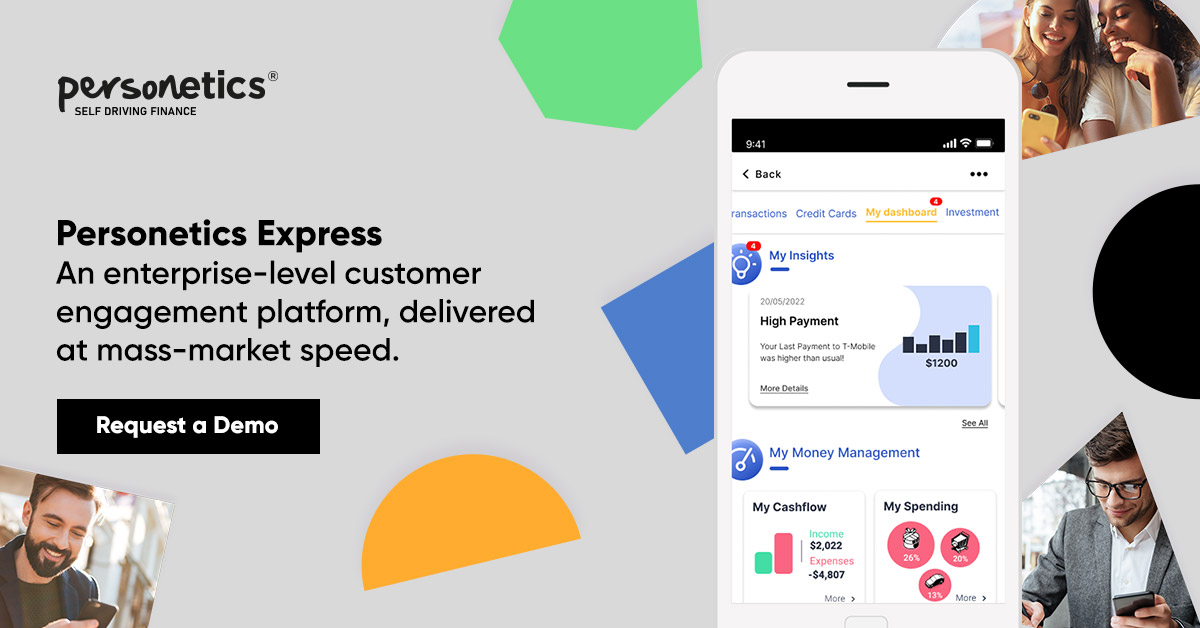

New York – 12 September 2022 – Personetics, the leading global provider of financial data-driven personalization, customer engagement, and advanced money management capabilities for financial institutions, today announced the launch of Personetics Express. The new offering is aimed at midsize financial institutions (those with $5B-$50B in assets), providing an out-of-the box, global winning solution that is powerful enough to compete with enterprise banks and delivers a quick business impact, while fitting smaller institutions’ budgets and timelines.

Today’s banking customers’ expectations are rising – they’re demanding a more sophisticated and personalized digital banking experience. A recent survey commissioned by Personetics found that 66% of banking customers want their financial institutions to become a financial coach, identify advance warnings of financial stress and offer solutions and advice.

But many midsize banks struggle to innovate, due to the constraints of legacy technology stacks. Midsize banks are struggling to keep up with the banking giants with huge technology budgets. The challenge for midsize banks in adopting real-time, financial data-driven personalization is not just driving value for the business, but the difficulty of implementing digital solutions with smaller teams and budget.

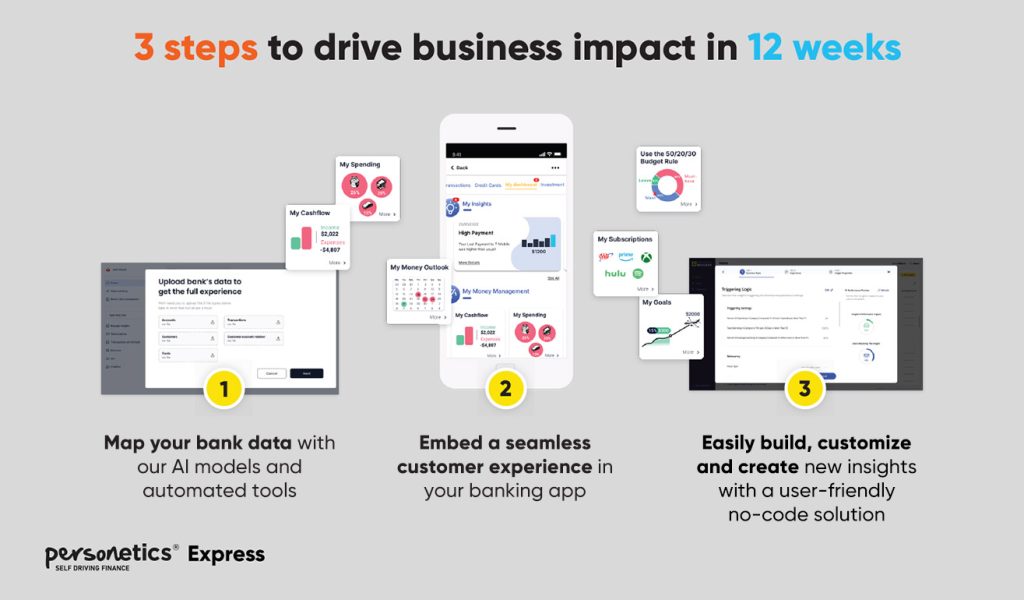

Personetics’ Express solution provides enterprise-level sophistication which can be up and running in as little as 12 weeks, and includes:

- A set of 60 out-of-the-box financial data-driven personalized insights and advice that are tested and proven by billions of customer interactions. These insights are embedded seamlessly within the existing digital channel

- Access to the Engagement Builder codeless creation and management console

- A quick SaaS implementation approach that enables rapid deployment – with turnkey widget, KPIs and dashboards

Express brings Personetics’ industry-leading AI and data analytics technology to this key segment of the U.S. banking industry, so midsize banks can easily and quickly deploy financial data-driven customer engagement and money management offerings.

Express provides solutions to a variety of personalization problems, from personal finance management, to engagement, to commercialization, by deploying a target package of content to customers. These time-tested insights and advice allow banks to express their creativity and brand promise to customers, helping them achieve rapid business impact and ROI.

David Sosna, CEO and Co-Founder at Personetics said: “We know how challenging it can be for mid-sized institutions to keep pace with customer expectations when working with smaller budgets and tighter timeframes. We are excited to make it easier for these mid-market financial institutions to implement Personetics’ global expertise in financial data-driven personalization and customer engagement, not just big banks.

“Customer engagement is the new battleground for financial institutions, but the feedback we’ve heard from mid-sized banks is that until now they’ve struggled to implement personalization at scale. With Personetics Express we want to make it faster and simpler to implement this technology, so mid-market institutions can unleash their creativity and build on their unique strengths to understand, advise and provide greater value to their customers.”

The new Personetics Express offering is now available on the Personetics platform and will be one of Personetics’ solutions showcased at Finovate Fall 2022. Learn more at Personetics Express.

Michal Milgalter, Head of Global Marketing

Michal.milgalter@personetics.com

About Personetics:

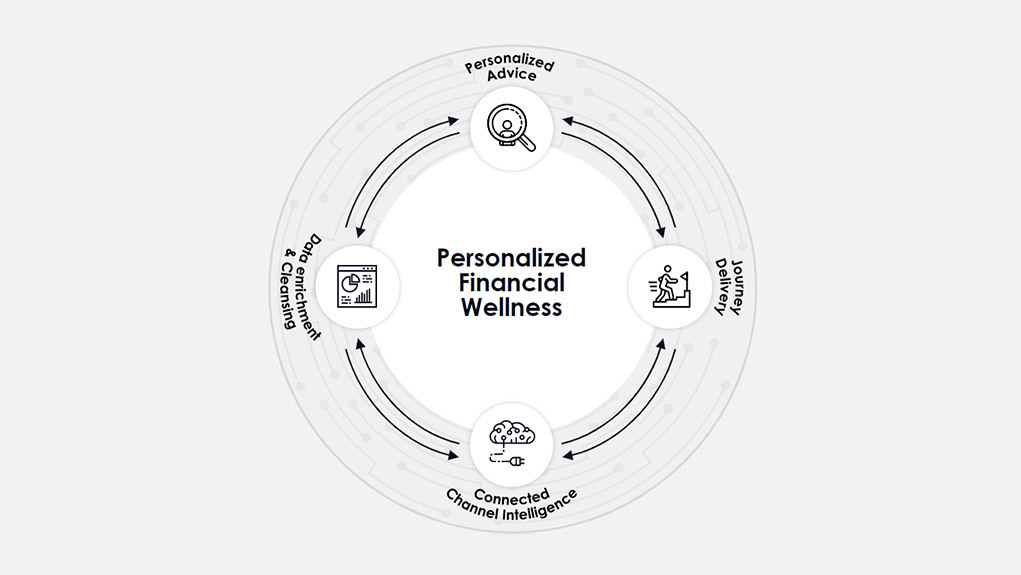

Personetics is the global leader in financial data-driven personalization, customer engagement, and advanced money management capabilities for financial institutions. Focused on enabling proactive engagement for banks, Personetics’ AI analyzes financial data in real time to understand customer financial behavior, anticipate customer needs and deliver a hyper-personalized experience. We are creating the future of “Self-Driving Finance,” where banks can proactively act on their customers’ behalf to help improve their financial wellness and achieve financial goals.

Our industry-leading data analytics solutions harness customer financial transaction data to provide day-to-day actionable insights, personalized recommendations, product-based financial advice, and automated financial wellness programs. Financial institutions use Personetics’ agile solutions to rapidly create their own personalization IP to serve the unique needs of their customers and differentiate themselves in the market. With Personetics offerings, financial institutions transform their digital banking experience into the center of the customers’ financial lives.

We offer solutions for mass market consumer banking, SMB banking, wealth management, and credit card issuers. Personetics drives business impact for financial institutions by improving relevant product targeting for accurate, efficient cross-selling and upselling. We help financial institutions deepen their customer relationships, increase core deposits and customer retention, expand share of wallet, and boost Customer Lifetime Value.

Personetics currently serves over 100 financial institutions spanning 32 global markets, reaching 130 million customers. We are backed by leading venture capital and private equity investors, with offices in New York, London, Tel Aviv, Singapore, Tokyo, Paris, Spain, and Australia.

Learn more at personetics.com

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Related Posts

4 Steps for Driving Impact with Personalized Financial Wellness

3 Critical Steps for Financial Institutions Fighting for Deposits

What the Personetics - Q2 Partnership Means for Your Financial Institution