The Solution: Harnessing Personetics' Financial Data-Driven Personalized Engagement Platform to Increase Financial Growth

BMO’s journey toward creating a solution that guides customers in achieving real financial progress spanned five years, during which the strategy and approach continually evolved.

2019 – “Understand My Finances”:To increase engagement, the bank turned to the Personetics Engage product, which uses AI-powered hyper-personalized insights and advice. Customers received personalized insights to help them understand their financial situation, make smart financial decisions, and increase engagement.

2020 – Cashflow Management: BMO integrated Personetics’ solution with its in-house AI-powered cashflow prediction model to offer real-time, context-sensitive financial insights and actionable advice.

2021 – Product Recommendations: As personalized insights gained popularity and built trust and loyalty, the bank began using Personetics Engage to present hyper-personalized product offers to customers, including loans.

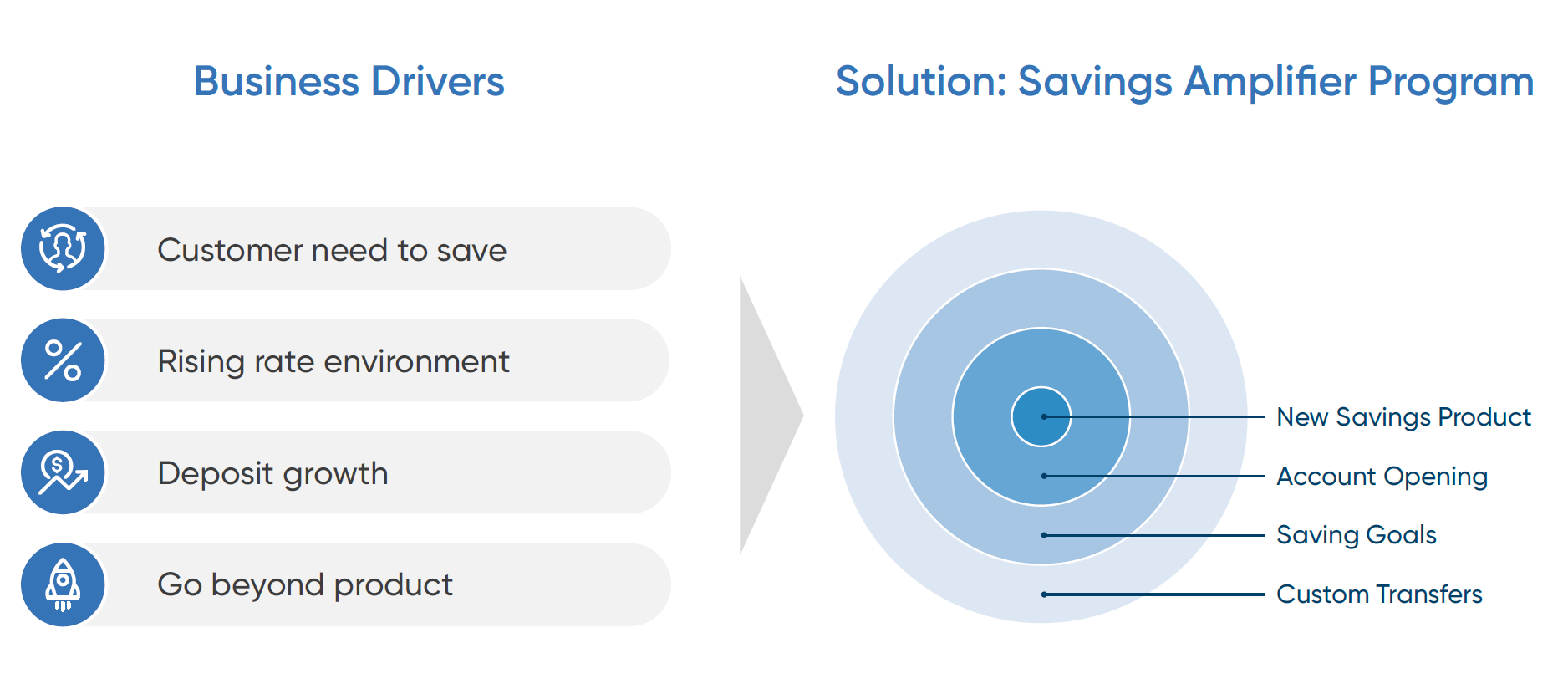

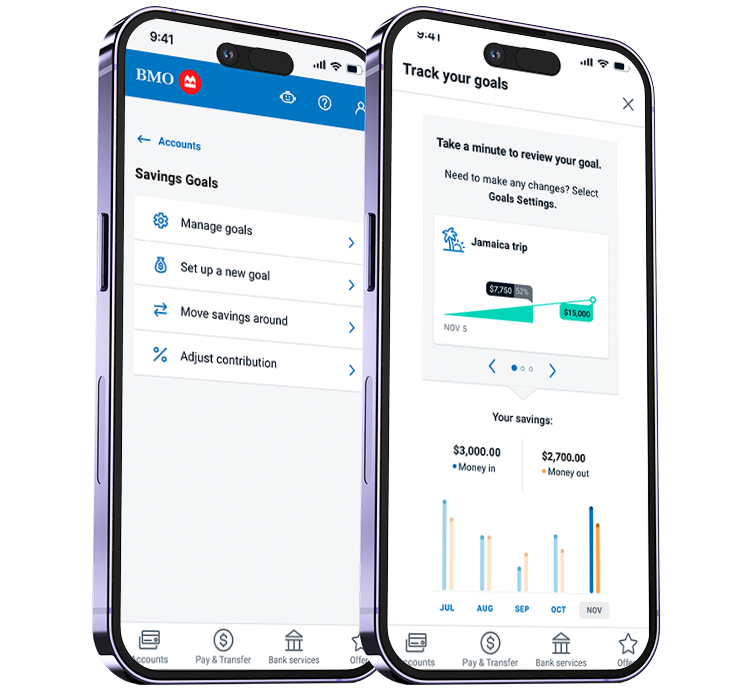

2022 – “Help Me Save”: Anticipating rising interest rates, BMO deployed the Personetics Act product. This innovative program helped customers save part of their income, and automatically allocate funds toward savings goals. The solution combined the Personetics Act product to power savings goals, with BMO’s own home-grown capabilities to drive product recommendations and enable custom transfers. BMO enabled customers to set up a savings account quickly (within 2 minutes) through the bank’s mobile app. The account, known as Savings Amplifier, allowed each customer to define multiple personalized savings goals (education, vacations, buying a home, etc.) and fund these goals with automated transfers from another account. Customers could then track their progress on these goals through the mobile app.