April 6, 2020

How Banks Can Help Customers with Automated Financial Wellness Programs in Times of Need

COVID-19 has taken the world by storm, with the number of confirmed cases increasing daily, countries in near-full lockdown and a rapidly evolving economic crisis.

While there is still much that we don’t know about the long-term ramifications of the pandemic, a few things that are clear:

- People in all countries and all socio-economic backgrounds are being affected

- Lower and middle-income families are more likely to lose incomes and to have insufficient emergency savings

- SMEs will be hit the hardest by lack of customers and cash to sustain themselves for weeks, let alone quarters

- The economic downturn will far outlast COVID-19.

- Financial recovery for families and businesses will mean adapting to more conservative behavior

Prior to the pandemic, most of us were all too familiar with the fact that 40% of U.S. adults did not have enough savings to cover an unexpected $400 emergency expense. Now, with all too many losing their jobs, incomes and livelihoods, people need a much more robust emergency cushion to keep themselves and their families afloat.

Leading Customers on a Long-Term Path Toward Financial Wellness

While “financial wellness” may seem like an elusive concept, in a tangible sense it means that your debts are payable, you have ample emergency, college and retirement funds, and that you feel good about your financial health – now and in the future. It means that you are prepared, even when a global financial crisis hits unexpectedly.

From what we have seen so far, it will take many months, if not years, for people to fully recover from the economic setback caused by COVID-19.

It is in times like these that banks play a vital role in helping customers manage financial uncertainty by:

- Offering access to all banking services online

- Reevaluating risk policies and procedures to make sure that customers have access to cash even when it was previously not possible through digital channels

- Creating liquidity, specifically for SMBs, as more customers and businesses need unsecured credit lines

- Proactively, rather than reactively, reaching out to customers to offer assistance

- Offering “smart programs” to help customers get back on track after financial setbacks

Automated Financial Wellness Programs to Help Customers Reach Financial Goals

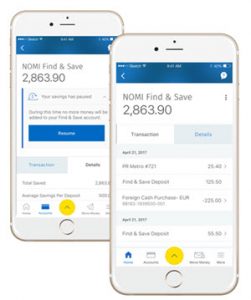

Leading banks around the world have already introduced Personetics’ AI-powered financial wellness solutions that make it easier for customers to manage their day-to-day finances and save for times of financial and economic distress.

|

||

|

|

|

The benefits of auto-savings programs have been tested and proven – helping millions of people around the world boost their savings and augment their emergency cushions.

“Smart” Recovery Solutions

Given the current financial environment, most customers have experienced some type of income loss. It is incumbent upon financial institutions to address that strain and work with customers in order to start the recovery process, as long and as difficult as it may be.

In order to do so, banks must understand each and every one of their customers in a deeply personal way. They must understand their financial behaviors, aspirations, and capacities to save, and proactively make suggestions and recommendations based on an aggregated and holistic understanding of the individual.

For example, when customers experience income disruptions, such as decreased salary deposits, banks should have the tools in place to proactively recognize the disruption, offer payment reminders to keep the customers informed about their financial activity and offer recommendations to cut excess spending and help them stay on track. These “nudges” not only help customers, but also enable banks to maintain an ongoing and long-term dialogue with their customers, thereby increasing customer engagement, satisfaction, and retention.

While the financial recovery for consumers, SMEs and mass affluent, alike, will be slow and challenging, banks need to anticipate their customers’ needs and offer relevant banking services to reduce financial stress and help them reach financial recovery.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

How to Maximize SaaS Value and Future-Proof Your Platform

Truist's Performance Marketing Journey: From Merger Challenges to Million-Dollar Results

How Asia Pacific Banks Are Redefining AI-Driven Engagement