Senior Vice President of Consumer Digital Channels Experience at

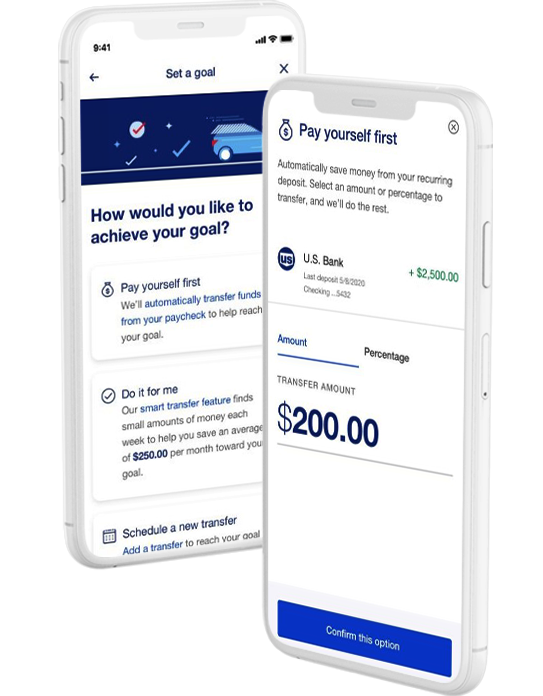

Personetics Act solutions enable banking customers to automatically save an average of $250 per month.

Benefits include:

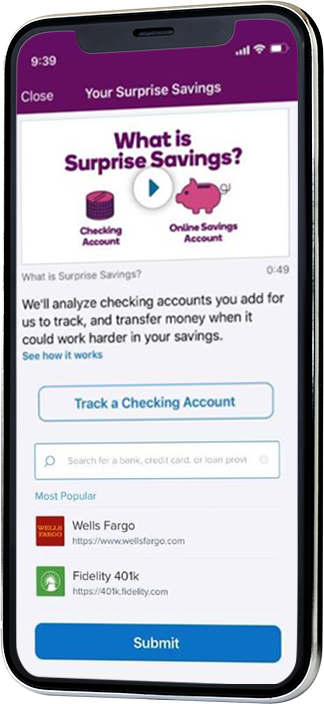

Automated, self-adjustable wellness solutions enable Banks' customers to reduce debts, save or invest funds towards one or multiple

Cloud-based, white label solution that integrates with the banks' offerings tailored to the individual ability to save or invest at any given

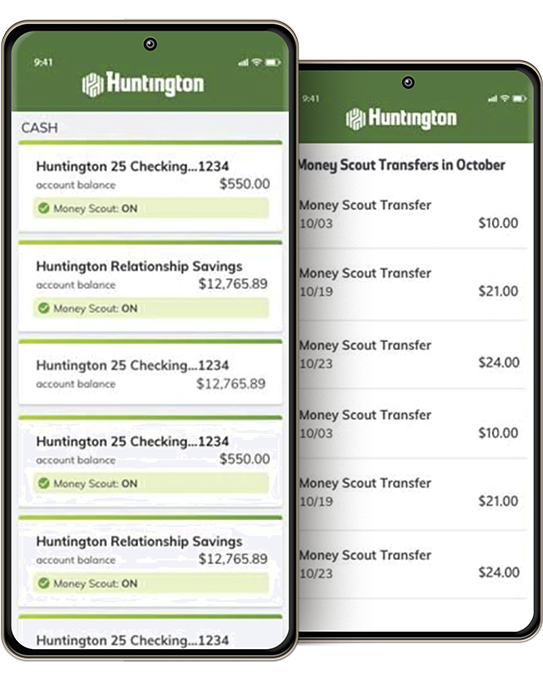

Manages goals using virtual envelopes, eliminating the cost of dedicated accounts for

Fast deployment and embedded service, including Open Banking and external money transfer capabilities

Amounts are Personalized to each customer's ability save

Engage customers with push notifications and periodic insights, in turn, deepen customer retention through the service