September 18, 2024

Beyond PFM: The Rise of Impactful Personal Financial Engagement (PFE)

The Problem with Traditional PFM

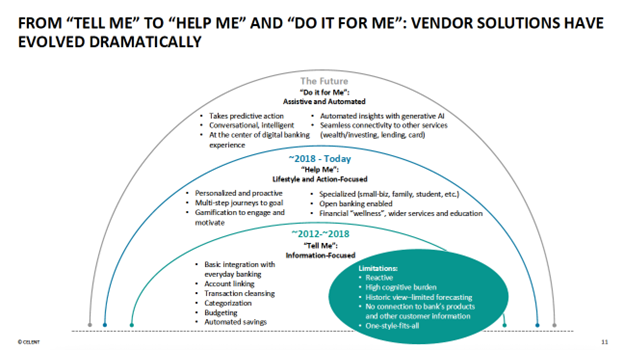

Traditional Personal Financial Management (PFM) tools have shown limitations in delivering lasting value. These standalone applications often struggled to provide meaningful, personalized insights due to their disconnection from users’ real-time financial data and lack of predictive models and actionability. The generic advice offered frequently failed to account for individual goals or circumstances, resulting in low engagement rates.

In place of static pie charts and basic budgeting tools, a new breed of intelligent, hyper-personalized financial guidance is turning heads in the banking world. This shift represents a move from one-time value propositions to a model of continually delivering value through proactive, digital engagement.

At the heart of this transformation is an emerging operating model: Engagement Banking. This approach operationalizes proactive, personalized, and actionable customer-first interactions, featuring experiences that blend automated and human elements tailored to customer preferences.

Introducing a New Report from Celent

A new report from Celent provides compelling insights into this shift and recognizes Personetics as the global leader in this space. “Personal Financial Engagement Solutions for Retail Banking” highlights a significant evolution in the Personal Financial Management space, demonstrating how traditional PFM is transforming into Personal Financial Engagement (PFE).

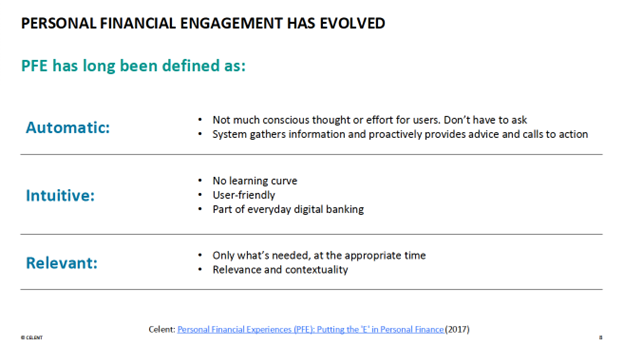

What’s Different About PFE?

In essence, Personal Financial Engagement is a product, data, and communications strategy for supporting a customer’s financial wellness to:

- Deliver personalized financial advice at scale.

- Automatically track and guide progress toward customer financial goals.

- Offer proactive guidance based on individual financial behaviors and patterns.

- Provide tailored product recommendations that align with each customer’s unique financial situation.

As the Celent report emphasizes, “Customer engagement is becoming the primary way banks deliver ongoing value to their customers delivered continually through highly personalized and often proactive engagement.”

How Banks Can Deliver Value Through Ongoing Customer Engagement

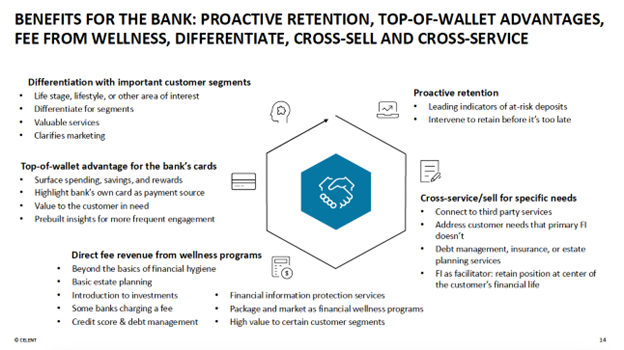

The paradigm shift from PFM to PFE represents a strategic opportunity for banks to position themselves as indispensable partners in their customers’ financial lives. This transition goes beyond simply offering tools; it’s about creating an ecosystem of ongoing personalized, proactive financial guidance.

For customers, the benefits of advanced PFE solutions are substantial. These platforms offer automated, personalized financial guidance without requiring manual input. By providing tailored financial advice, early warnings about potential financial issues, and product recommendations that align with individual needs, PFE tools can significantly improve customers’ financial health.

The capabilities of leading PFE solutions allow banks to implement sophisticated strategies that drive business outcomes while delivering value to customers. These include:

- Implementing financial AI-driven insights to identify and address potential financial challenges.

- Leveraging predictive analytics to offer timely, relevant product recommendations.

- Creating personalized financial wellness programs that adapt to changing customer needs.

- Utilizing real-time financial data analysis to provide contextual guidance during significant financial events.

Personetics: Leading the Way in PFE

Celent’s recognition of Personetics as the global market leader in PFE highlights the practical impact of its AI-powered impactful engagement platform. The report notes that “Personetics has been a leader in proactive customer engagement and enrichment of the digital banking experience for over a decade,” and that its “offering is tightly focused on ROI for banks, supporting a number of

By using advanced AI, Personetics helps banks move from simply reacting to customers’ financial needs to offering proactive, hyper-personalized guidance and advice. This approach allows banks to:

- Predict customer needs and provide timely, relevant financial advice.

- Tailor financial guidance to each customer’s unique situation.

- Promote better financial habits that benefit both customers and banks.

- Achieve concrete business results through increased customer engagement and product use.

The effectiveness of this strategy is clear from the experiences of major banks like BMO, U.S Bank, Santander UK and UOB. After implementing Personetics’ PFE platform, these institutions saw significant improvements in engagement rates and sales conversion rates.

Personetics adds value for banks in several critical ways:

- Accelerated Speed to Market: With a library of pre-configured financial insights and the ability to create custom insights rapidly, banks can deploy personalized insights via a pre-built SDK, APIs and widgets in days rather than months, without being hindered by release cycles.

- Flexible Implementation: Personetics offers deployment options that meet each bank’s unique needs, whether on-premises, in a private cloud, or as a SaaS solution, without requiring PII.

- Cost Efficiency: Personetics’ platform and its engagement builder console enables large-scale financial personalization with significantly fewer resources, making it an attractive option for banks looking to maximize ROI.

Looking Ahead: The Future of Financial Guidance

As banking continues to evolve, the move from traditional PFM to more sophisticated PFE solutions marks an important turning point. This shift isn’t just about new technology; it’s about rethinking how banks can better serve their customers.

The Celent report clarifies that banks need to reconsider how they help customers manage their money and improve business results. Those who embrace this new approach of personalized, proactive guidance will likely gain a significant edge in today’s increasingly digital and customer-focused banking world.

Want to Learn More?

To stay ahead of this trend and learn how your institution can leverage the power of PFE, we invite you to download the full Celent report. Discover how Personetics’ platform can help your bank become a leader in Personal Financial Engagement and drive a quick measurable business impact.

The future of banking lies in providing smarter, more personalized and actionable financial guidance. By embracing this change, your bank can not only simplify money management for your customers but also cultivate growth and loyalty in an increasingly competitive landscape.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

The Emergence of Cognitive Banking at This Year's Financial Brand Forum

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.