June 8, 2018

Countdown to customer engagement: The 10-second banking experience

This post was originally published in BAI

When was the last time you made an impulse purchase?

You must have bent the knee once for the $79.99 speakers or $299.99 outdoor grill from Costco. But were those splurges well-deserved treats—or irresponsible budget-busters? Chances are you lacked a clear answer during the 10 seconds you debated your decision.

By optimizing their apps to capitalize on those 10 seconds of influence, banks can dramatically boost customer engagement. The apps become pocket companions that help customers routinely make smarter financial decisions.

According to research by Facebook, millennials check their phones on average 150 times a day. They rely on smartphones to talk to friends, text, schedule activities, pay bills, cruise social media and catch up on news. This adds up to hundreds of brief moments to help millennials make monetary decisions.

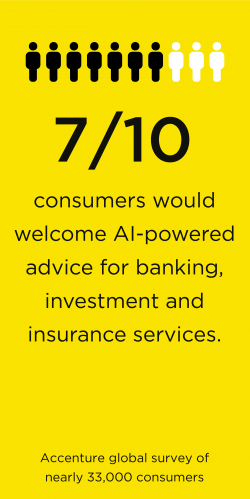

And millennials are open to it. In a recent survey, 85 percent of American millennials (and 79 percent of adults overall) indicated they believed AI-powered banking solutions could help them better manage their finances—while 62 percent of millennials (and 53 percent of respondents overall) said they liked using mobile banking apps to access their accounts anytime, anywhere.

But are banking applications useful when it comes to those split-second purchase decisions we encounter every day? Optimizing their apps for a 10-second customer engagement is counterintuitive for many bank executives. Traditionally, banking apps aimed to draw outengagements. A common bank-led user experience is: first, present account balances; then show recent transactions; and finally, offer money movement options.

Banks pack applications with features, hoping users stay engaged minutes, not seconds. But recent reports—as well as common sense—suggest that prolonged interactions are not the best way to promote customer engagement. Short, targeted interactions actually work better.

For example, several banks offer pre-login information on mobile. Upon launching this feature, Citi found that customers who use the feature access their accounts three times more than non-users. Even more striking is RBC’s engagement uptick from targeted personalized insights. In a recent case study on RBC’s mobile app NOMI, users presented with insights interacted with the app 20 percent more than the control group.

The bottom line: The financial services organization that offers customers personalized, accurate recommendations in seconds will emerge as the mobile banking leader.

But just like the art behind Google’s simple-yet-powerful homepage doodle, a meaningful 10-second experience is surprisingly difficult to create. Here are the four critical components to creating a truly valuable experience:

- Real time: Customers expect that the data presented is accurate and up to the minute; delayed data and old insights prove not only inaccurate but is also potentially harmful. The first time a customer acts on a bank’s recommendation with outdated information is the last time the customer will want to use the service.

- Cashflow data: Trustworthy recommendations are based on a comprehensive view of a customer’s cash flow activity. After all, the 10-second experience falls short if a customer needs to check three different banking apps to determine whether he can afford an impulse purchase. The cash flow analysis must also reflect sophistication. For example, duplicate transactions analyzed, internal transfers excluded: A simple breakdown is not good enough anymore. And when the bank app provider is not the customer’s primary bank, aggregation services to capture checking and credit accounts become paramount to making accurate recommendations.

- Artificial intelligence: Useful predictive recommendations requires robust back-end algorithms. Cognitive analysis, personalized decision-making and curation represent three areas where AI can support financial recommendations. Banks can build data-driven profiles on customers to understand their behavior, as well as that of similar customers. Banks can also predict a customer’s future cashflow based on historical patterns. Best-in-class providers can even understand and sensitize data for the variability in income and spending. The combination of these data points with best practices from financial experts creates the recipe for personalized decision-making. Finally, AI can curate the most important, relevant information in the moment. Ten seconds leaves time for only the very best.

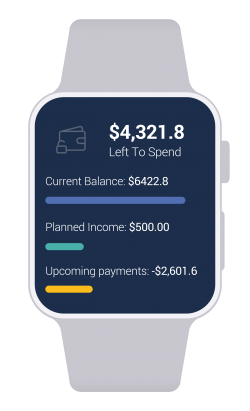

- Simple user interface: Optimize interfaces for quick, clear and actionable performances. Ideally, the 10-second experience integrates into the bank app’s pre-login screen. Customers simply need to click on their bank app icon to get relevant advice. If you expect customers to return multiple times a day (as they do with Citi Mobile Snapshot), then the user interface should follow a simple, clean pattern to help customers easily navigate and process the information. Finally, avoid the common personalized financial management pitfall: negativity. Chances are that if a customer’s account balance is negative, he knows it. Be careful not to dissuade him from returning frequently because of a guilt-ridden user experience.

Personalized insight displays how much the customer has in his bank account available to spend.

The 10-second experience offers a starting point for a successful customer journey. The goal is to turn a few daily app interactions into a habit of seeking financial advice. The business motivation is clear: Frequent users become engaged customers, who statistically bring 37 percent higher annual revenue than disengaged customers.

What’s more, customers who trust the bank’s advice are more open to other types of products and services recommended by the institution. With the right set of valuable advice and support, a customer with a single credit card can be motivated to open a checking account, refinance his student loan and even sign up for a micro-savings account, all at his primary bank.

So, if you want to play a role in the customer’s everyday decisions, prioritize the $299.99 grill from Costco—empower customers with the ability to understand their data and advise on whether they can truly afford to splurge on that purchase today. As for stocking up on barbecue sauce, that’s probably a safer bet, especially if it’s on sale.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

The AI Implementation Reality Check

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation