April 4, 2024

Elevating Finance: OpenAI’s Role in Revolutionizing Banking

At a recent exclusive event, jointly sponsored by Personetics and Microsoft, over 60 senior executives of local banks were treated to a glimpse of the treasures buried within their very own banks’ transaction data. The debut of OpenAI, in which Microsoft has been a partner since inception, has spurred a huge amount of interest into how generative AI can help streamline business tasks and deliver value for customers.

Boston Consulting Group has stated that “leveraging AI to forecast and tailor future product offerings on the basis of customer needs and behaviors is rapidly becoming table stakes in many banking markets.” At the event, Personetics showed how banks can get ahead of the curve by addressing customer needs today, with valuable recommendations for enhancing their financial health in highly personalized ways.

Personalizing the User Interaction with AI

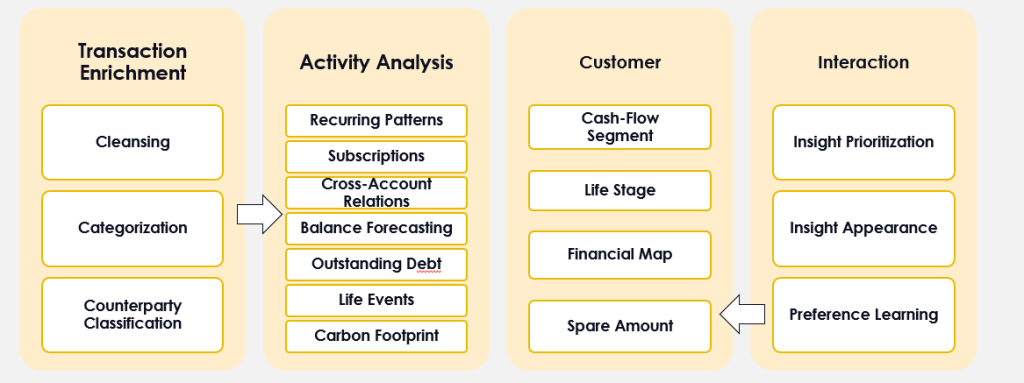

- At each operational layer, Personetics AI models address key business challenges

- Model outputs from each layer serve as valuable inputs for subsequent layers

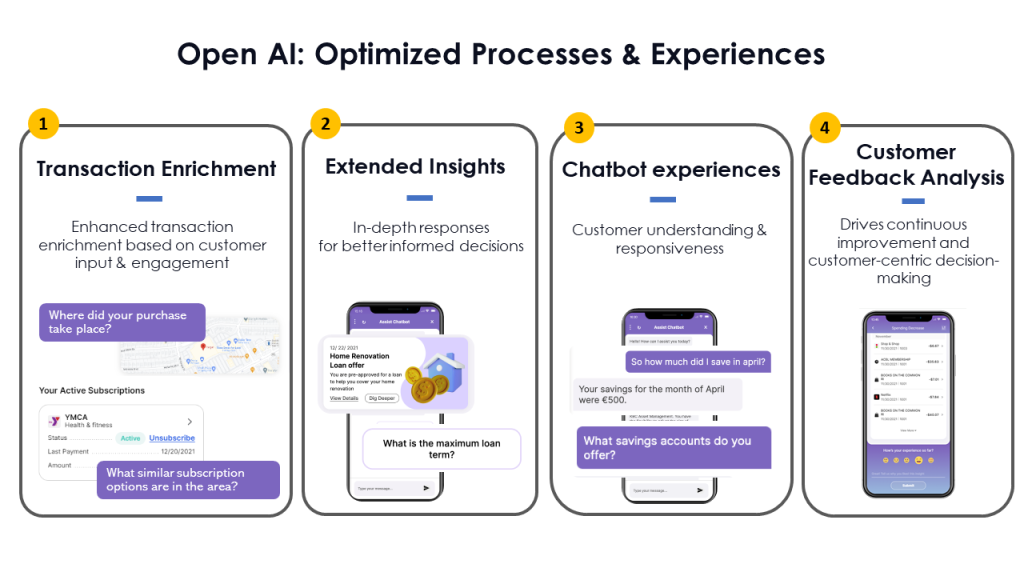

The sessions at the joint Personetics-Microsoft event focused on how Personetics’s proprietary AI analytics extracts the financial behaviors, activities and events documented (and sometimes hidden) in their individual customers’ data. The model then applies insight logic to recognize patterns and identify opportunities that can benefit their customers.

Personetics leverages generative AI capabilities to translate the opportunities that were identified into easy-to-grasp, personalized insights and actionable recommendations, creating the right offer for each customer at each given time. Via a bank’s app, insights are delivered in real-time to enable immediate action, on the fly. By adding context and creating messages that give consumers confidence to take action, Personetics’ white-label solutions empower banks worldwide to enhance the financial health of their customers, while increasing engagement and retention rates and sales conversion.

Personetics’ partnership with Microsoft extends well beyond AI collaboration. Personetics integrates with products ranging from Microsoft Dynamics 365, Azure and Power BI to enable banks to get the most value from personalized customer insights. For instance, integration with Dynamics 365 allows relevant bankers to be notified as soon as their customer’s real-time personalized financial events and triggers are identified by Personetics models. By empowering bankers to raise important issues with customers and offer advice in a timely manner, Personetics enhances bankers’ and advisors’ productivity and helps them foster deep and meaningful relationships with each of their customers.

Supporting financial well-being in a dynamic market

As residents of a country that is experiencing among the highest rates of GDP growth in the world, many Philippine customers are benefiting from new-found prosperity. While banking leaders see opportunity to grow their accounts and services, they are also committed to understanding their customers’ needs and supporting their financial maturity and long-term financial health.

By delivering personalization at scale, banks around the world have grown customer accounts, balances and loans, increased customer engagement and improved retention rates. But guests at the event did not need to take our word for it: Executives of two banks – Bank of the Philippine Islands (BPI) and Singapore-based UOB – joined us at the event and shared their banks’ and Personetics journey. These banks are successfully using Personetics to provide personalized insights and recommendations that increase customer engagement, retention and sales conversion.

Bank of the Philippine Islands (BPI)

BPI leveraged Personetics with a vision of supporting each customer by helping them make better money decisions. While their goal was to provide dedicated relationship managers for all customers, that was clearly not feasible. Instead, they launched what they call “Project Uno” as a way to communicate on a one-to-one basis with each customer and go beyond merely transactional assistance.

Using Personetics Engagement Builder to create custom insights, they created a variety of powerful, personalized insights that are delivered within the bank app. But BPI has gone beyond in-app use and integrated Personetics with their CRM system. By delivering hyper-personalized insights across numerous touchpoints, BPI reaches and engages a broader range of clients, including those who rarely log onto the app. Insights delivered via their CRM are not only personalized but are also based on customer account and credit card data.

Consider, for instance, a customer who opens an account but neglects to fund it, or one who accumulates large balances. Through their Personetics CRM integration, BPI can deliver data-driven personalized financial insights and recommendations that engage customers and encourage them to take action to get more from their money.

Conclusion

Fittingly, for a data-driven solution, the proof of success is in the numbers: Banks leveraging Personetics have increased sales conversion rates to 17% and seen customer engagement increase to 35%. Account open rates grew to 20%, balances for active users averaged $1200, and deposit leakage decreased by 2%.

Personetics and Microsoft are committed to empowering banks to support their customers with the right insights, offered the right way, at the most relevant moment, based on each individual’s financial data and powered by integrations covering Microsoft Dynamics, Azure, Power BI and of course, OpenAI.

Dorel was recently featured in an interview during the MoneyLive Summit Event, sharing insights on the future of AI-driven personalized engagement. Read his interview here.

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

The AI Implementation Reality Check

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.