December 12, 2024

From Raw Data to Touchdowns: How Enriched Transaction Data Drives Business Value

Picture this: It’s the fourth quarter of the first game of the season. The star quarterback steps up to the line, scanning the field. In a split second, he processes a wealth of information – the defensive formation, his receivers’ routes, the play clock ticking down. With precision and confidence, he calls an audible, snaps the ball, and threads a perfect pass – through coverage for a game-winning touchdown.

Now, imagine if all your bank’s stakeholders could have the same level of information and understanding. Picture your bank’s customers having that same level of clarity and decisiveness when they open their banking app. Each transaction is crystal clear – no more puzzling over unfamiliar store abbreviations or vague descriptions. Instead, they see neatly cleansed and categorized data, complete with familiar logos and precise location details. Meanwhile, your marketing team is crafting laser-focused rewards programs that customers want, and your data analytics department is uncovering valuable data insights that drive real business growth.

While the value of enriched transaction data is widely recognized in the banking industry, the real challenge lies in selecting the right partner to lead your transaction enrichment journey. In a recent webinar, my colleagues and I at Personetics explored the critical factors that banks should consider when choosing a transaction enrichment solution. Let’s dive into the key takeaways and discuss why careful evaluation of enrichment capabilities is crucial for forward-thinking financial institutions across North America. We’ll guide you through the essential criteria to ensure you partner with a provider that can truly unlock the full potential of your transaction data.

The Importance of Transaction Data Enrichment

Transaction data is arguably the most valuable asset within a bank. However, in its raw form, this data is often difficult to interpret and utilize effectively. The key challenge lies in making sense of this data and ensuring its quality, accuracy, and consistency across various bank systems. Transaction enrichment transforms this raw data into a powerful resource by:

- Unifying the data into a single common dataset

- Cleansing and normalizing descriptions

- Categorizing transactions

- Adding supplementary merchant information

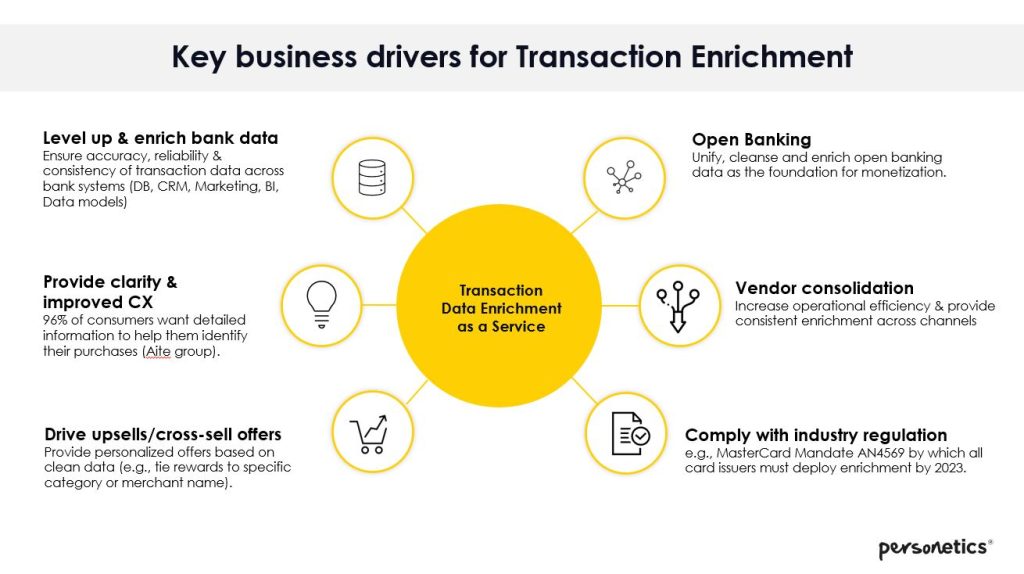

Key Business Drivers and Outcomes

These enhancements create a unified, easily interpretable dataset that can power various business initiatives across the enterprise. Key business outcomes include:

- Improved Customer Experience: Clearer transaction descriptions and detailed merchant information reduce confusion, support calls, and customer disputes, leading to improved customer satisfaction.

- Data-driven Campaigns and Targeted Rewards: Personalized campaigns and offers based on clean merchant names or categories. Accurate categorization enables banks to create precise merchant and category-level offers, increasing the relevance and effectiveness of their loyalty programs and promotional campaigns.

- Personalized Insights: Enhanced ability to provide personalized and actionable insights to customers, based on their financial activity. Enriched data powers sophisticated financial management tools and tailored advice, helping customers better understand and manage their finances while deepening their relationship with the bank.

- Increased Operational Efficiency: Ensuring accuracy, reliability, and consistency of transaction data across bank systems (database, CRM, marketing, bank models) optimizes business workflows

- Improved Analytics: By feeding cleansed, normalized data into various bank systems and models, institutions can uncover deeper insights into customer behavior, risk profiles, and market trends, informing strategic decision-making across the organization.

By leveraging enriched transaction data, banks can drive customer engagement, personalization, and operational efficiency across numerous use cases, fueling business value throughout the organization.

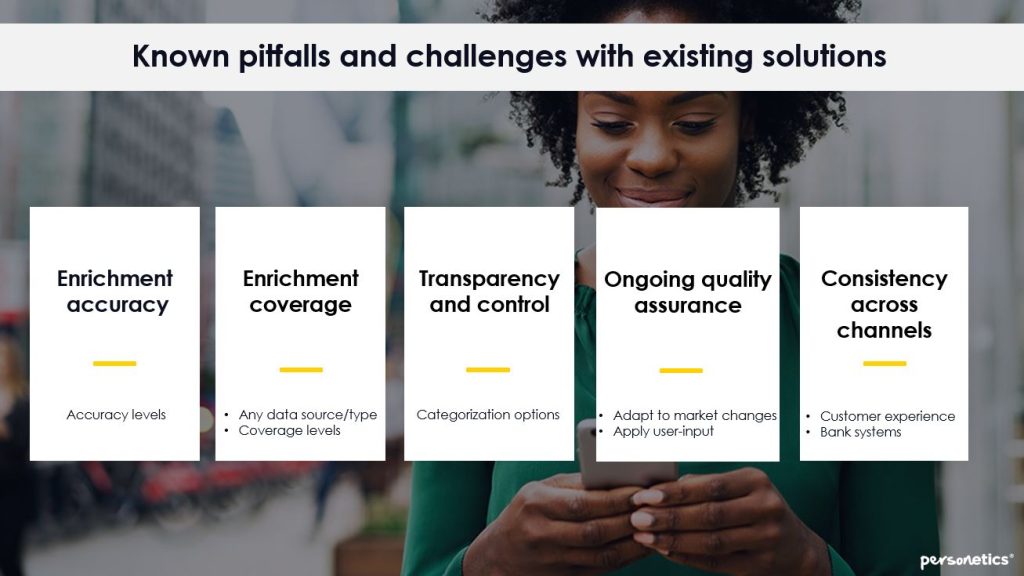

The 5 Challenges of Transaction Enrichment

While many banks recognize the potential of enriched transaction data, several challenges often arise:

- Enrichment Accuracy: Banks must maintain high standards across large datasets, ensuring that enriched data is reliable and precise enough to inform critical decisions for the bank and end-customers alike.

- Enrichment Coverage: Financial institutions need to ensure all data sources and transaction types are included in the enrichment process, including open banking, as well as transaction types beyond credit and debit, such as manual and automatic transfers, cash, check fees, ACH transfers and everything in between.

- Transparency and Control: Many transaction enrichment solutions act as a “blackbox” that cannot be viewed or influenced by banks. For categorization, it’s important that banks have full transparency to the categorization mapping, in addition to the flexibility to influence and customize enrichment outputs, adapting the categorization mapping to their unique needs and market conditions.

- Ongoing Quality Assurance: Transaction data is inherently dynamic, requiring enrichment models and assets are maintained and evolve over time. This includes adapting to new categories (e.g., cryptocurrency), changes in transaction descriptions, new merchant codes, companies going out of business, logo changes, and other market shifts. Banks must implement enrichment solutions that can keep pace with this revolving landscape to maintain data accuracy and relevance over time.

- Consistency Across Channels: Providing a unified experience across all customer and bank touchpoints is crucial, ensuring that enriched data appears consistently whether displayed within the bank’s CRM system, targeted campaign, budgeting tool, or customer statement.

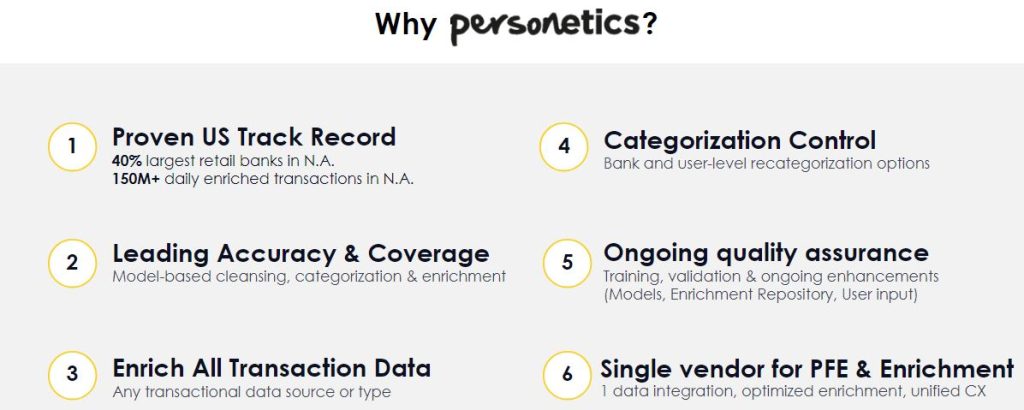

6 Key Reasons Why North American Banks Turn to Personetics to Enrich Their Transaction Data

While these challenges may seem daunting, Personetics Enrich offers a comprehensive solution that addresses each of these concerns. By choosing Personetics for advanced transaction data enrichment services, banks can benefit from the following advantages:

- Proven Track Record in North America: Personetics has established a strong presence in the North American market, with its enrichment models deployed at scale across diverse financial institutions. Serving over 75 million end-customers in North America, including 40% of the largest retail banks, Personetics enriches more than 150 million transactions daily in this region alone. The company’s models are specifically trained and validated on North American market data, ensuring high coverage and accuracy for transaction data enrichment in US and Canadian banks, credit unions, and regional institutions.

- Leading Accuracy and Coverage: Personetics’ model-based enrichment ensures high coverage and accuracy rates, consistently maintained over time. With high accuracy rates across various transaction types and merchant categories, Personetics sets the industry standard. This level of precision is crucial for reliable insights and decision-making, enabling banks to confidently leverage enriched data for customer-facing applications and internal analytics.

- Comprehensive Data Enrichment: Unlike vendors focusing on limited data types, Personetics enriches both internal and external data sources, including transactions beyond debit/credit, such as automatic and manual transfers that can account for up to 40% of data traffic.

- Categorization Flexibility and Control: Personetics provides banks with categorization options for maximum flexibility, allowing customization at both bank and user levels. Banks can access and influence categorization mapping, including the option to review, rename, and remap categories, and even create their own custom categories – to align with their specific business and local needs.

- Ongoing Quality Assurance: Recognizing the dynamic nature of transaction enrichment, Personetics deploys processes to ensure consistent quality and performance. Models are continuously tested and validated. Personetics’ enrichment assets repository is enhanced and updated based on market dynamics and user-input analysis. This ongoing optimization ensures that the enrichment solution stays relevant, and aligned with the evolving financial landscapes, maintaining high accuracy and coverage over time.

- Unified Enrichment Experience: By addressing key challenges in transaction enrichment and offering a comprehensive, flexible solution, Personetics empowers banks to fully utilize the potential of their transaction data, driving business value across the organization while enhancing customer experiences.

Tying it All Together

Remember our Game 1 quarterback from the beginning? Like a star athlete reading the field, your bank can harness enriched transaction data to make winning decisions that benefit both your institution and customers.

This enhanced data becomes your playbook for success, influencing every aspect of your organization. From improved customer experience and satisfaction to supercharging analytics and crafting resonant rewards, it empowers your team to perform at its best.

Since building this capability in-house presents significant challenges, partnering with experienced providers can be invaluable. With proven enrichment models processing millions of transactions daily, Personetics can help financial institutions build a strong foundation to their data strategy. This not only drives value across the organization but also strengthens customer experiences through improved clarity and personalization.

So, don’t underestimate the power hidden within your customers’ transaction data. Unlock its potential and watch your financial institution score big.

Ready to unlock the full potential of your transaction data? Contact Personetics today to learn how our advanced enrichment solutions can transform your bank’s digital strategy.

Watch our webinar for an in-depth look at the power of enriched transaction data or schedule a demo using the form on this page to see our platform in action.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Engagement Marketing Masterclass:

Engagement Marketing Masterclass: Taking Data-Driven Personalization to the Next Level

Understanding AI’s Impact on Banking

How AI is Elevating Customer Engagement at Central Bank

Scott McQuilkin

Data and Analytics Transformation Leader

Scott has built artificial intelligence products at more than 20 financial institutions over the past 15 years, including 3 of the top 4 U.S. banks. Having managed AI projects with more than 300 stakeholders, Scott has seen first-hand how these undertakings can quickly grow exponentially without a deep understanding of the nuances of AI in the compliance and regulatory environment that banks and credit unions live in. His primary focus is on packaging Personetics products to provide the most value in the least amount of time for our bank partners.