April 18, 2024

How AI is Elevating Customer Engagement at Central Bank

By Jody Bhagat, President of the Americas, Personetics

In a recent webinar hosted by Finovate, I was joined by Dan Westhues, EVP and CMO at Central Bank, to discuss how banks can capitalize on the confluence financial wellness, artificial intelligence, and personalized engagement.

Our conversation centered on Central Bank’s transformative digital journey, emphasizing how the bank is reshaping their interactions with customers to deliver greater value. Dan explained how regional banks like Central Bank face a double threat: competition from national banks and the rise of fintech companies. To stay relevant, they need to innovate and deliver a hyper-personalized customer experience.

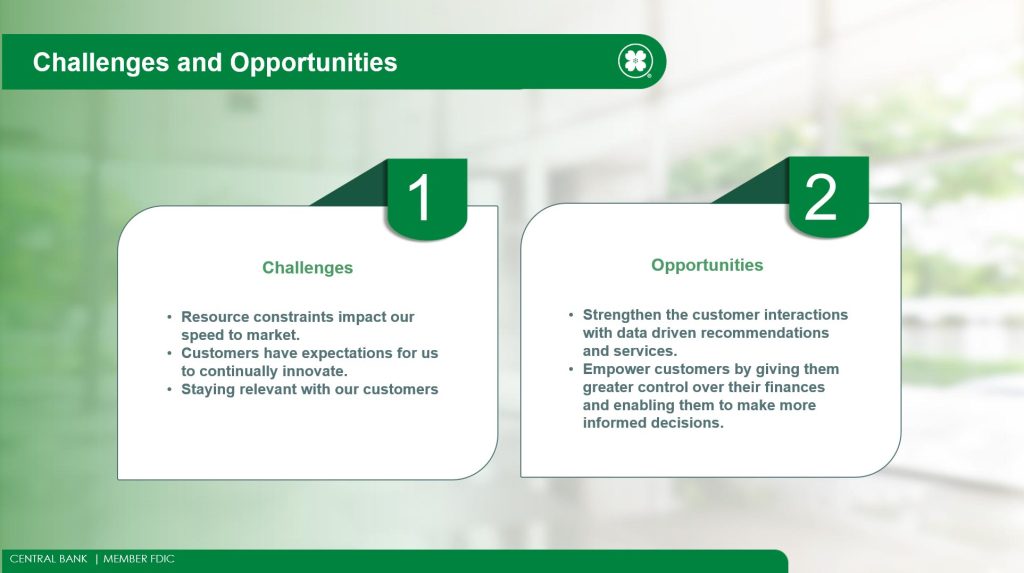

Navigating Macro Challenges in Banking

First, we discussed the economic factors putting pressure on regional banks like Central Bank to innovate and prove their value proposition.

“Traditionally, Central Bank has dominated the Midwest markets, competing mainly against other regional and community banks,” Dan explained. “However, with the entry of national banks into the region, the competition has intensified. This dynamic landscape in the Midwest has required us to focus even more on strategies and innovate further, stepping up our game that much more.”

Dan emphasized the emergence of fintech companies (like Venmo, Robinhood and Zelle) that challenge traditional banking services, along with the challenge of customer loyalty being spread across multiple institutions – creating a more crowded and competitive landscape for Central Bank.

As the banking industry evolves amidst rising interest rates, accelerated digitalization, and the emergence of open banking, regional banks like Central face a complex landscape of opportunities and challenges. Dan pointed out the realities encountered by institutions like his, where the need to adapt to changing customer behaviors and technological advancements is all-important.

Dan said Central Bank sees an opportunity to provide customers with valuable financial advice, helping them achieve their financial goals. This, in turn, strengthens their relationship with the bank, encouraging them to use the bank for more of their financial portfolio.

However, the journey towards digital transformation is not without its obstacles, Dan explained, with resource constraints, legacy technology, and customers’ expectations for the bank to continually innovate and stay relevant all posing significant hurdles.

The Role of AI in Enhancing Customer Experience

Recognizing the need to strengthen customer relationships and deliver personalized experiences, Central Bank embarked on a strategic partnership with Personetics. The goal: leverage AI to provide customers with timely, relevant insights and deepen relationships.

Dan shared a few examples of how Personetics’ AI is directly improving the customer experience at Central Bank. For instance, they’re piloting a system that monitors call center conversations for frustrated customers, enabling managers to intervene in real-time. Additionally, AI helps identify patterns in call center inquiries, allowing Central Bank to proactively address issues like fraud or outages.

These initiatives align with Central Bank’s mission of being a trusted partner, integrated within the community, and helping customers manage their financial journeys.

“As a community bank, we have resource constraints that make it tough to match the big players,” Dan said. “But by partnering with specialized fintechs like Personetics for AI, we can dip our toe in the artificial intelligence waters to meet customer expectations set by industry leaders.” Dan said AI allows leaner teams to provide personalized, high-touch service augmented by cutting-edge AI technologies that they couldn’t build alone.

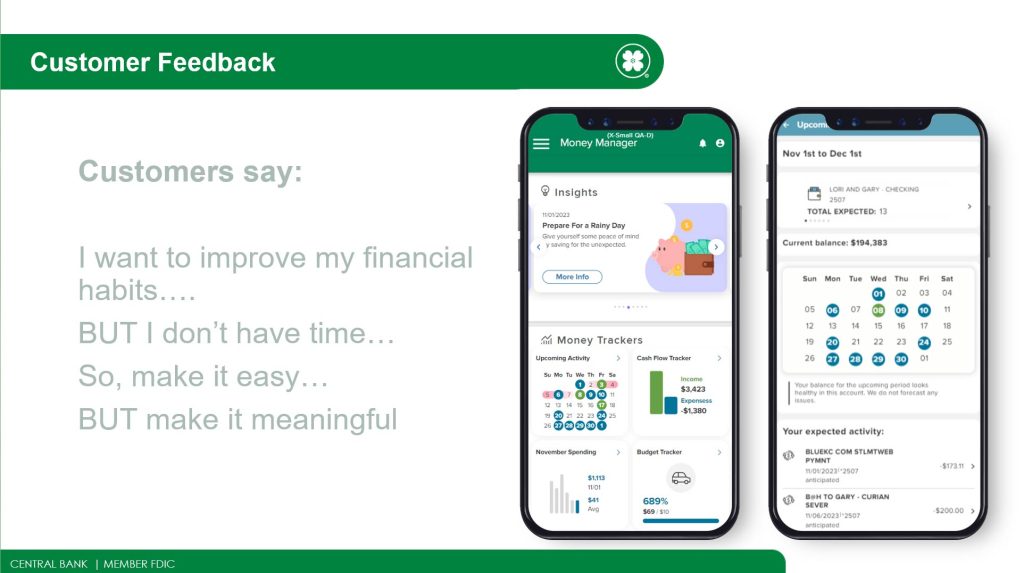

Driving Personalization through Data

“Traditional money management tools put the onus on the customer to do all the heavy lifting,” Dan said. “We’ve had goal setting, cash flow analysis, and account aggregation capabilities for a long time. But those were very customer-driven – meaning the customer had to manually input everything. With Personetics’ AI, we’re flipping that model. We can now analyze real-time transaction data and customer behaviors to proactively surface tailored insights and recommendations. The data does the work, not the customer.”

Dan emphasized how this data-driven approach allows Central Bank to deliver a level of personalization that improves outcomes. “Instead of generic product pitches, we can make contextualized recommendations tied to a customer’s actual financial situation and needs. If we see a customer made a large payment, we can suggest redirecting rewards into a specific savings goal. By understanding individual circumstances, we can facilitate smarter money decisions.”

“The traditional product cross-sell tactics are antiquated,” Dan reiterated. “By analyzing real-time transaction data and customer behaviors, Personetics’ AI allows us to anticipate individual needs and have contextual, insightful conversations tailored to each customer’s unique financial picture.”

Dan gave an example of a customer who has a credit card. “Instead of a generic credit card offer, we can make a personalized recommendation that creates real value – like saying ‘I see you just made an $8,000 payment on that card. That equates to X amount of rewards points, which we can now deposit into your savings account tied to a specific goal.”

By analyzing real-time transaction data, the bank can anticipate customer needs, offer proactive guidance tailored to their circumstances, and facilitate smarter financial decisions that improve overall outcomes.

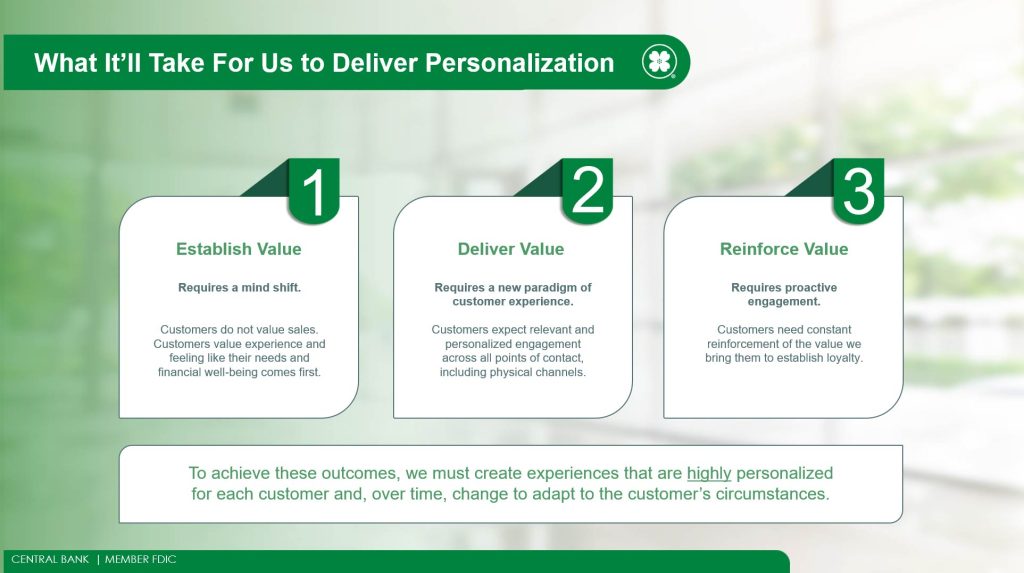

Delivering Value through Hyper-Personalization

As Dan explained, the goal of Central Bank’s collaboration with Personetics is to transcend traditional banking and deliver true hyper-personalization:

“I want to align the strategy of the company to technology,” he said. “We know how to work with customers one-on-one, hand-to-hand combat, but the technology needs to help us with that. Through insights on upcoming transactions, optimizing cash flow, goal-based savings recommendations – we’re trying to add real, tangible value to our customers’ financial lives.”

This translates to having insightful dialogue and elevating their financial lives in meaningful ways the customer didn’t even think to ask about.

By seamlessly integrating these hyper-personalized AI insights into the bank’s digital channels and reinforcing them through personalized outreach, the bank can solidify customer relationships and drive long-term loyalty.

Evolving Mobile Banking into the Future Branch

Dan said the focus on hyper-personalization extends to the mobile app, which they envision as the bank’s future branch. In the process, Dan emphasized the importance of evolving beyond basic transaction capabilities. “Mobile banking is becoming our branch of the future,” he said. “We have to move past that teller line experience and recreate that high-touch, consultative experience digitally.”

By integrating AI-powered personalization and insights, mobile banking becomes almost a personalized advisory service from Central Bank that replicates the high-touch consultation experience traditionally offered in branches.

“The real goal is to get customers in front of a person, sit down and consult with them,” Dan said. “What I need to be able to do is recreate that in the mobile space. That’s how you become the branch of the future – you get past just showing balances and make it a true personalized experience.”

Through this strategic alignment of technology and human-centric service, Central Bank is doing just that – leveraging AI and embracing hyper-personalization to profoundly improve customer engagement while building long-lasting loyalty within an increasingly competitive banking landscape.

Don’t Miss Out!

- To watch the full webinar, click here

- To read the joint announcement, click here

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President of Americas, Personetics

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.