September 26, 2024

How Banks in Mexico can use Advanced PFM to Grow Market Share

By Dror Gross, Head of Sales, Mexico

“Customer financial data is probably one of the most valuable assets of banks but turning that data into practical, actionable advice is what really creates an advantage.” This was how the Personetics team recently started their presentation at the Revolution Banking and Retail event in Mexico. The challenge of converting transactional data into impactful business outcomes for the Mexican financial industry, while boosting customer engagement and enhancing customer financial wellness is what I focus on every day at Personetics.

The Challenges and Opportunities Faced by the Mexican Banking Industry

The Challenges

The Banked, the Unbanked and the Partially Banked

The Mexican banking industry faces a unique set of challenges. Mexico is the second largest economy in LATAM, and second-largest e-commerce market by gross merchandise value, reflecting the country’s high level of digitalization. At the same time, Mexico continues to be a heavily cash-based economy with about 40% of merchants not offering any digital or credit card payment options at all. According to the World Bank, approximately 50% of the adult population in Mexico are unbanked. Of the banked population, 22% have a mobile bank account, and of those, more than half have multiple bank accounts. In addition, many of the banked population are not fully banked. They may for example, have a digital wallet but they won’t have a standard checking account, making principality an issue.

Neobanks

Neobanks have set their sights on Mexico and are investing tremendous resources in an attempt to increase their market share. Since neobanks are, by definition, based on modern and wholly digital systems, they are able to easily introduce advanced capabilities and harness customer data. Traditional banks need to find a way to compete with neobanks on an even playing field, otherwise they run the risk of losing market share to them.

How to Engage with Transactional Data

Many traditional banks and financial institutions in Mexico are starting to enrich and categorize transactional data. However, most banks are either attempting to do this in-house or are using basic techniques and static databases to do so. Both of these approaches deliver results that have limited to no value for both the bank and the customer.

The Opportunities

Transactional Data – The Asset That’s Hiding in Plain Sight

As Mexico moves towards a more digital economy, banks will start to play a more critical role for millions of new and existing customers. Customers need to see their banks as trusted financial partners that are fully committed to building their customers’ financial wellness and providing an excellent and personalized customer experience.

By leveraging advanced PFM and engagement solutions that are based on the customers’ own transactional data, banks will be able to provide the type of personalized service and solutions that customers increasingly demand, and that will enable them to stand out from the crowd. We know from our proven global experience that Personetics’ partners are able to achieve customer engagement rates of up to 35%, sales conversion rates of up to 17% and a 9% year-on-year growth in digital deposits.

By deploying these advanced solutions, traditional banks will be able to compete with the growing popularity of neobanks and other fintech offerings, grow their own business impact and create new sources of revenue through much higher sales conversion rates.

Personal Financial Management – The Key to Understanding Your Customer

Personetics provides banks with the ability to understand what their customers want, why they want it and when they want it. Internationally recognized as a global leader in personal finance engagement (PFE) and proactive customer engagement by Celent, the leading research and advisory firm focused on technology for financial institutions, Personetics is committed to enabling banks to create stronger relationships with their customers while enhancing their own business impact. By delivering invaluable insights into customers’ financial behavior, Personetics’ advanced solutions offer personalized, proactive, actionable financial advice and insights in real time. These provide customers with the information they need to make smarter, more timely decisions that achieve their financial goals, optimize their budget management and promote their overall financial wellness.

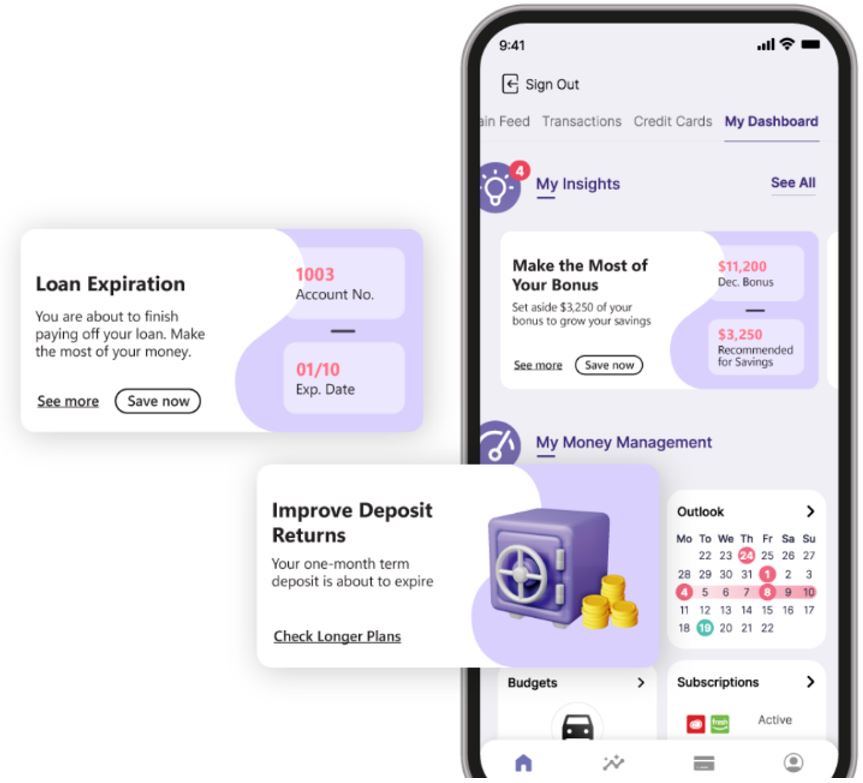

For example, based on transactional data, banks know when their customers are due to finish paying back loans, and can proactively advise them on different savings or investment options for that ‘spare’ cash. This not only highlights that the loan is expiring for the customer, but also enables them to take a further step towards achieving their overall financial goals.

Another example of the personalized actionable insights enabled by Personetics’ is savings plans. Based on financial data, banks can provide their customers with hyper-personalized, actionable insights and offer easy methods for them to track their savings goals. This promotes customers’ overall financial wellness and helps them to be more focused on achieving their financial goals.

Summary

There are tremendous opportunities available in the Mexican Banking industry for those banks that are ready to seize them. The banks that have the confidence to invest in advanced PFM solutions and maximize customer value with data-driven personalization, forge stronger customer relationships with enhanced customer engagement and drive their own business impact with tangible growth strategies, will be those that pull ahead of the competition, grow their market share and emerge victorious.

If you would like to learn more about how our solutions can help you take advantage of the huge opportunities in Mexico, please contact us using the form.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Dror Gross

Director of Sales LATAM

Dror Gross brings over 6 years of experience in sales and technology consultancy within the financial services industry in Latin America. Before joining Personetics, Dror led sales for several fintechs in the region, where he successfully guided banks in meeting business, risk management, and compliance KPIs by tailoring software solutions to their specific needs. During the last 2 years, Dror has been leading sales for Personetics in Latin America.