January 30, 2023

How Behavioral Economics is Helping Banks Drive Better Money Management Experiences

In part 1 of our blog series on behavioral economics for banking, we outlined the key concepts of how behavioral economics is reinventing the banking experience. Now let’s see how the science-backed concepts of behavioral economics can help your financial institution support your customers with better money management tools.

How do people really make decisions about money? Do they research options, weigh the data and facts, and make a rational choice based on the best information available? Unfortunately, behavioral economics research shows that they do not. Often, people are not “rational actors” who make evidence-based decisions. Instead, people tend to be vulnerable to cognitive biases – little mental shortcuts, mistakes, and misunderstandings that prevent us from making the best choices about our money.

Let’s take a closer look at the most common cognitive biases that are derailing your customers’ financial decisions. By combining behavioral economics for banking with financial automation technology, financial institutions can help customers overcome these psychological barriers and build better financial wellness.

Overcoming “Present Bias” to Save for the Future

People often struggle to imagine themselves in the future, so the future doesn’t feel real. This is called “Present Bias,” and it can make it hard for people to save money. Why save for some invisible future, when there is the possibility of buying a new car, a video game console, and a delicious restaurant dinner right in front of your eyes today?

Financial institutions need to help customers overcome “Present Bias” by visualizing the future and by making it automatic to save for the future. By making saving automatic, customers can save more money than they might have realized was possible – without having to take any action, make any decisions, or feel like they are sacrificing from their present-day spending.

U.S.-based Huntington Bank’s Money Scout® is a great example of overcoming “Present Bias.” This automated, self-adjustable savings program finds available cash based on the customer’s transaction data and spending patterns, and then moves variable small amounts of money to savings via multiple intelligent transfers throughout the month.

Just after 4 months of launching, Money Scout already helped customers save $115 per month on average, totaling $1.7 million. The customer doesn’t have to set up a goal, time limit or an amount. Money Scout delivers a seamless, automated and smart business solution to increase the customer’s financial resilience.

By making saving automatic, people don’t have to worry about making painful decisions or sacrificing today’s enjoyment for an uncertain future tomorrow. Instead, they can just live their lives and automatically build savings with the help of their financial institution.

Beat the “Anchoring” Problem with Relevant, Influential Numbers

Another cognitive bias in money decisions is called the “Anchoring” problem. When people are researching a financial decision, they tend to remember the first number they see or hear. This first number then becomes the reference point or “anchor” for future decisions.

“Anchoring” can cause people to spend too much or save too little. If John tells his friend Charlie that John saves $100 a month, Charlie might assume that $100 is a typical amount of savings – even if Charlie can comfortably save more than that.

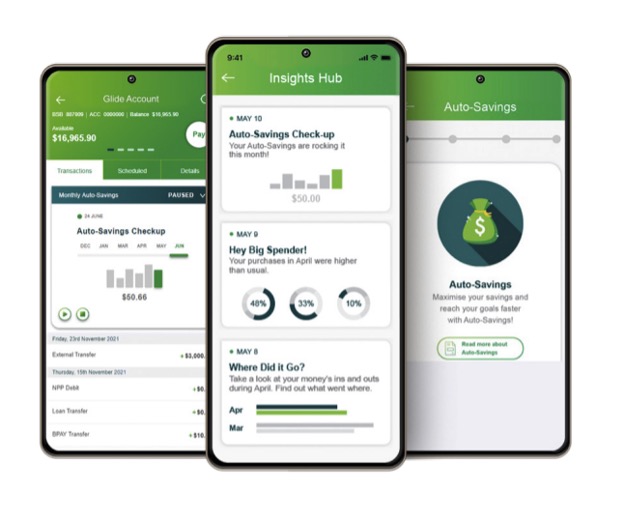

Australian digital bank MyState is helping overcome the Anchoring problem by showing customers exactly how much they can afford to save, based on each customer’s own transaction data and spending patterns.

With MyState Bank’s Auto-Savings, customers can visualize their true capacity to save – no guesses or rumors required.

Showing people relevant information based on their own customer transaction data is an important way that financial institutions can overcome cognitive bias.

When people see their true potential to save money and build financial resilience, they can make better decisions with the power of data.

Zeigarnik Effect: Help People Save Without Being Overwhelmed

Another psychological phenomenon from behavioral economics, the Zeigarnik Effect, shows that people don’t like doing open-ended tasks. When a job is never “done,” it disturbs us and creates tension in our brains. As a result, people tend to procrastinate on jobs that they know will take a long time to finish.

Saving money is one of the most common “open-ended” jobs to be done in finance. People often don’t know how to start saving, and they feel overwhelmed. So instead, they just keep spending.

Financial institutions can help people overcome the stress and mental tension of saving – by making it easy to open a new savings account.

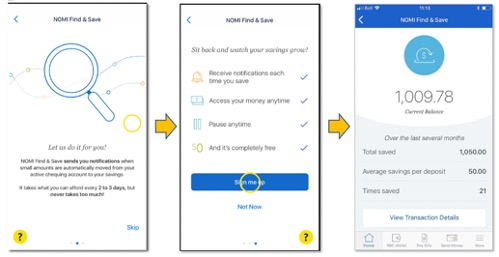

Canada’s largest bank, RBC, had great success with its NOMI Find & Save savings account offering, which makes it easy for customers to sign up with just a few taps of a button on the bank’s mobile app.

RBC’s attrition rate with Find & Save was just 2%, compared to an industry average of 7-8%. Find & Save customers are saving over $225 per month, and the bank has opened over 300,000 Find & Save accounts, 20% of which are new to RBC. This account has increased logins by 60% and boosted NPS by 35%.

Make it easy for people to start saving, and then keep them on track by giving them regular notifications about their savings progress. Relieving the mental burden of savings-procrastination sets customers up for better long-term financial wellness.

Reducing “Friction” for Financial Wellness

Another cognitive bias that harms people’s decision-making is called “Friction” – the little moments of de-motivating difficulty and distraction that cause people to quit. Friction can make people give up on applying for a loan, opening a savings account, enrolling in a retirement plan, or making complex decisions about their money.

RBC overcomes the friction problem by making it easy to sign up to start saving with a NOMI Find & Save automated savings account.

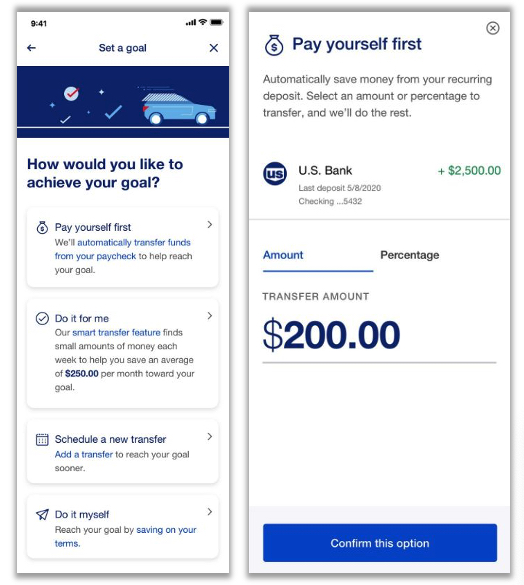

U.S. Bank also helps eliminate friction by taking key decisions off the customer’s mind. When setting a financial goal with U.S. Bank’s Pay Yourself First program, customers are offered the option to save money from every paycheck, or “Do it for me” with smart transfers. U.S. Bank was first to market in the U.S. with this patented Personetics solution, which helps its customers save automatically each month.

By removing friction, financial institutions can help customers start saving more easily, and keep saving for the long-term.

“Nudge Theory” for Banking: Guiding People to Better Money Decisions

“Nudge Theory” is another concept of behavioral economics that can help people make better choices about money. “Nudges” are a way of influencing people’s behavior in a positive, encouraging way – without restricting people’s freedom of choice. People often respond better to nudges than they do to strict rules or penalties – people like to be helped, not feel forced.

In the banking experience, financial institutions can use “nudges” by sending friendly reminders and alerts to their customers, such as notifying them that they are about to have a low balance in their checking account.

Nudges can also be used for saving. Canada’s RBC NOMI Find & Save capabilities send notifications to the customer whenever the bank identifies small amounts of money that the customer can safely afford to save – and then moves that money automatically to the customer’s savings account. This “nudge” reassures the customer that they can safely save money without causing their checking account balance to go too low.

Another aspect of Nudge Theory is the behavioral economics concept of “boosts.”

When people visualize their financial future, they tend to feel more motivated to save. “Boosts” can help train people in new ways of thinking about their financial futures.

When you give people a visual image of why they’re saving, they will be more likely to identify with that savings goal.

Behavioral economics researchers found that when people are shown a time-lapsed projection image of their own photo as a future retirement-aged person, people are more motivated to save for retirement.

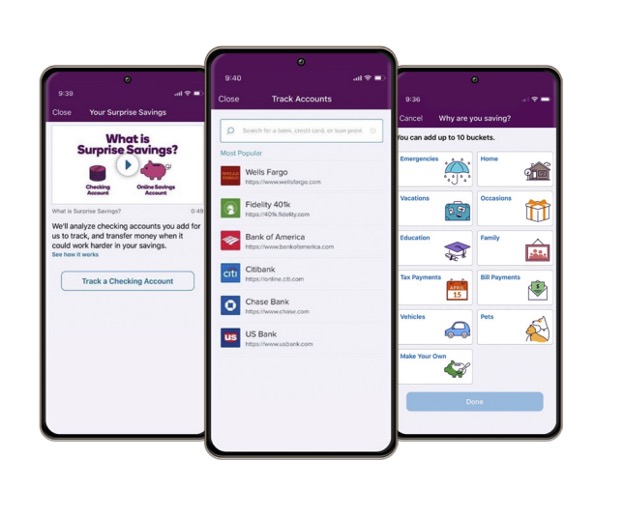

U.S.-based digital bank Ally Bank uses visual images to identify savings goals with its Surprise Savings program. Customers can choose up to 10 “buckets” to save for specific savings goals, such as vacation, education, pets, or vehicles.

Through Open Banking, Ally customers can also easily connect their other bank accounts so Personetics’ engine can identify safe-to-save money and automatically transfer it according to different cashflow prediction models.

This is another example of how Personetics and our partners are always looking out for the customer. Reminding people of why they’re saving helps keep them on track for financial wellness.

“Temptation Bundling” is another way to support people’s financial decision-making. This concept combines “carrots” (positive rewards) and “sticks” (negative consequences). By bundling positive rewards with less-gratifying but necessary activities – such as giving yourself permission to buy a new pair of shoes every time you reach a physical fitness goal.

Financial institutions can use Temptation Bundling to motivate people with specialized savings goals, personalized offers from business partners, customer-specific rewards programs, and more. By understanding the psychological concepts that affect people’s financial decision-making, you can use behavioral economics to design a better banking experience.

Ready to learn more about behavioral economics for banking? Check out our new eBook: “How Banks Can Use Behavioral Economics to Improve Customer Financial Wellness and Drive Business Impact.”

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

The AI Implementation Reality Check

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

David Sosna

Co-Founder & CEO

David Sosna has more than 20 years’ experience in the financial services arena. Prior to founding Personetics, David was co-founder and chief executive officer of Actimize, the leading provider of financial crime, risk and compliance solutions. Under his leadership, Actimize was recognized as a global leader in the financial services market and was acquired in 2007 by NICE Systems. Prior to Actimize, David founded Gilon Information Systems, which grew under his leadership to become Israel’s largest business intelligence company. David graduated from the Department of Industrial Engineering and Management at Ben-Gurion University.