Personetics on AWS

Personetics on AWS

Personetics on AWS

Personetics on AWS

Banking customers have found themselves ill-equipped to handle the economic fluctuations and look to their bank for guidance and advice. Banks have both an obligation and opportunity to offer products and services that foster their customers’ financial resilience but are being leapfrogged by tech-savvy companies that put personalization at the center of their business models. The banks that will win their customer’s loyalty will proactively engage customers with personalized advice and automated programs - few banks can develop this functionality internally; most will partner in order to survive.

Personetics proactive, personalized insights, advice and automated programs help banks better support their customers’ ability to reach financial goals and survive economic fluctuations.

Proactive and personalized insights, advice and financial programs help banks support their customers with automated and real-time guidance

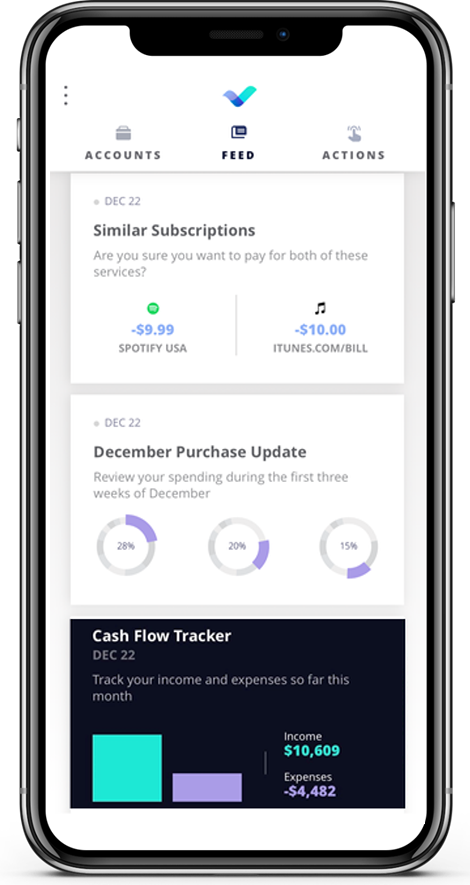

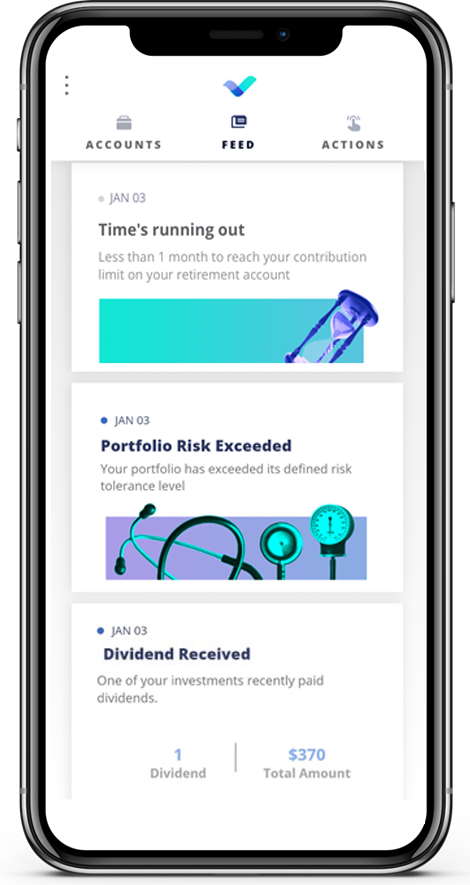

Personalized Insights

- Deep analysis on transactional-level data - Proactive personalized insights, recommendations and guidance

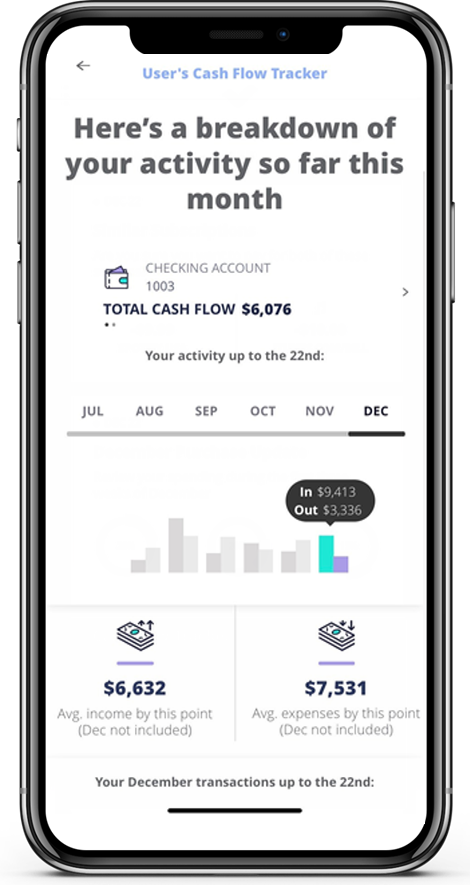

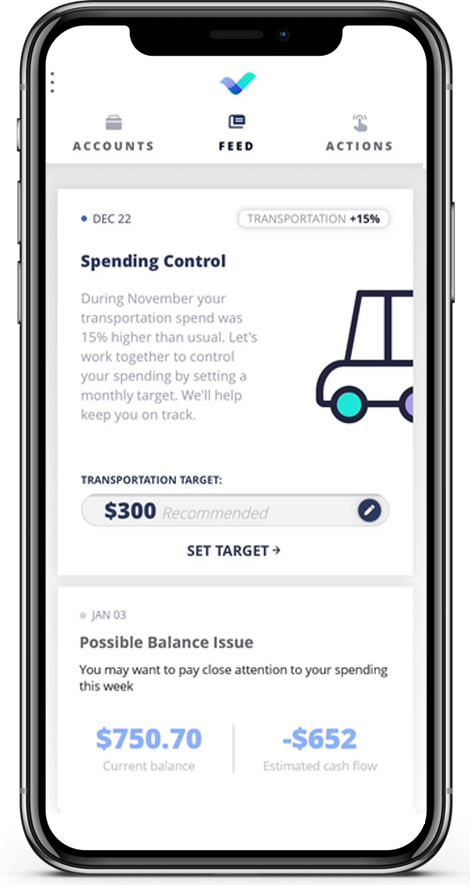

Automated Financial Wellness Programs

- Advanced segmentation and automation to shift away from the one-size-fits-all approach - Personalized financial programs that help manage cash flow, reduce debt, build savings and control spending over the long run

Banker Enablement

- Empower Relationship Managers and Call Center Agents with transaction-level data insights - More effectively understand opportunities, identify cross- and up-sells and foster deeper and meaningful relationships

Engagement Builder

- Build your own Insights with out-of-the-box tools connected to your attributes, quickly execute your own proprietary financial interactions with end customers and deploy across different bank channels

Personetics on AWS

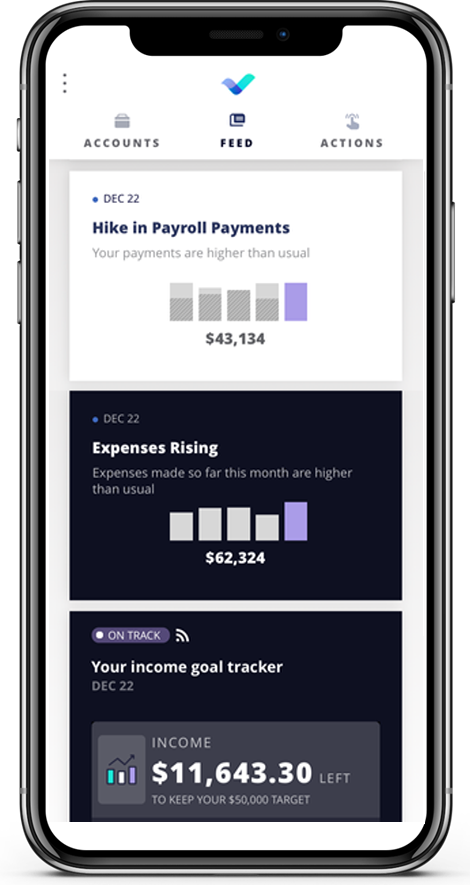

Personetics’ leading bank-specific AI models help banks turn financial data into proactive, personalized real-time insights and advice for banking customers and their bankers. By using Personetics’ Data-Driven Engagement and Personalization offering on a cloud environment powered by AWS, banks can get a deeper understanding of each client’s financial behavior by uncovering trends, patterns and latent needs in their transaction data.

Enabling Banks to Deliver on Key Strategies

Particularly relevant in light of the current financial and humanitarian catastrophe of COVID-19, Personetics’ Personalized Engagement Platform helps banks quickly identify those customers showing signs of financial stress and reaches out and helps those customers become financially resilient with specific and personalized insights and actionable recommendations.

Drive Impact on Key Business Outcomes

Personetics data-driven personalization and customer engagement platform for financial services, utilizes AI and Machine Learning to analyze information in real-time to understand customer behavior to better anticipate financial needs and act on their behalf. Personetics enables banks to offer daily insights, financial advice, and wellness programs to their banking customers.

Want to explore how your bank can harness the power of AI to engage and serve customers?

We work with banks of all sizes across all geographies and will be happy to see how we can help.

New York

London

Tel Aviv

Singapore

Tokyo