November 21, 2022

Personetics & UOB: Working to Solve the Savings Problem

It’s no secret that saving and debt reduction are becoming more and more complicated tasks for customers, particularly with the recent sharp cost of living increases and rising interest rates. It’s also difficult for customers to keep close track of their cash flow. Many simply do not have the right information needed to confidently set up recurring transfers into savings accounts.

This is a growing problem Personetics has been working with banks to solve, via Act, our automated self-adjustable, wellness solution.

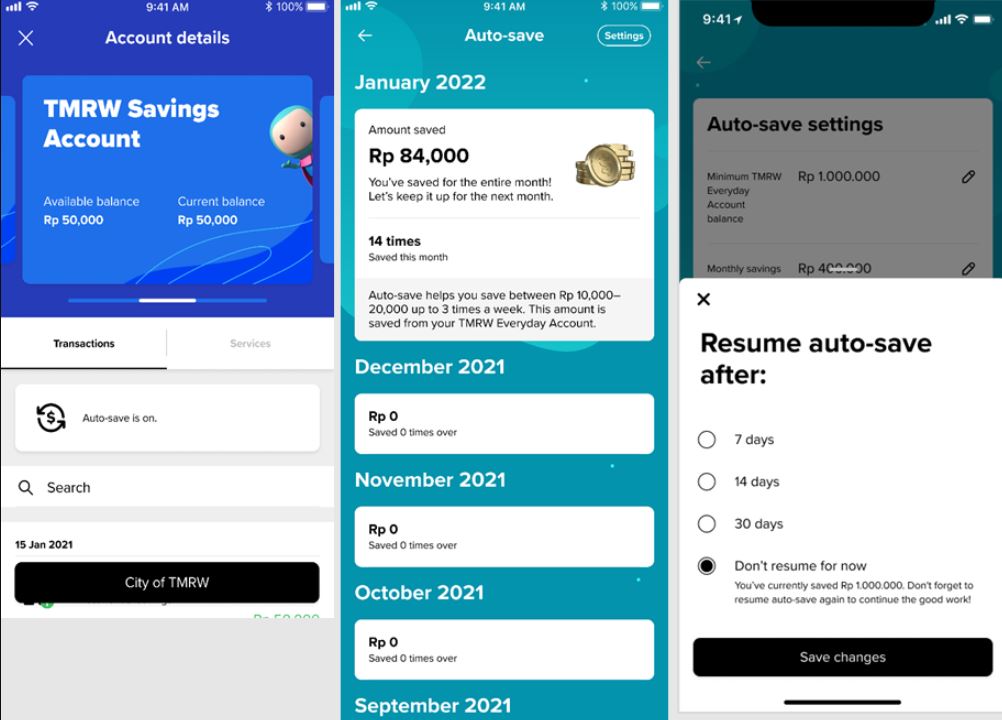

UOB, one of southeast Asia’s most innovative banks, has recently begun leveraging Personetics’ Act capabilities in a program they call “Auto-Save,” on their mobile digital banking app, TMRW.

It’s the latest chapter in the long and fruitful partnership between UOB and Personetics. Since 2018, Personetics has helped UOB to deliver more than 150 million personalised insights to customers throughout southeast Asia and achieve an average year-over-year growth of nearly 30% in mobile login users.

At the Singapore Fintech Festival earlier this month, I had the opportunity, along with Kevin Lam, Head of UOB TMRW and Group Digital Banking, to share the story of how UOB and Personetics are helping bank customers in southeast Asia save.

In our presentation, Kevin and I explained:

- What the Auto-Save program does for UOB TMRW customers

- What Personetics does on the back end to make automated savings a reality for customers

- Why automated savings should matter to customers and banks

“Surprise Money”: UOB TMRW & Auto-Save

Kevin walked the audience through how UOB uses Personetics’ AI models and capabilities to analyze their customers’ accounts, “find” money for them that they don’t need at that moment, and then automatically move it over to their savings accounts.

“What’s special about it is that the amount that’s being moved varies, from day to day,” Kevin explained. “It moves and changes, according to the patterns and the movement of money in the transaction account, always leaving a sufficient balance to meet the need of that particular customer.”

While the program is automated at its core, it still leaves final control in the hands of the customers, allowing them to pause Auto-Save for differing period of time and then restart it whenever they’re ready.

In their promotional campaigns, UOB frames this concept as “surprise money.” As Kevin described it, it’s like “money you found in your jeans during the wash.”

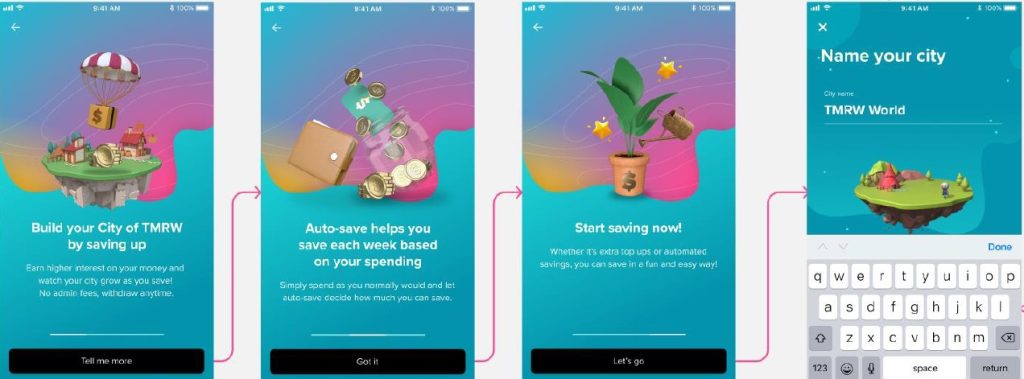

To spark participation in the program, UOB is using gamification: Customers are urged to “Build your City of TMRW” by building up their savings accounts. The more they save – the bigger their virtual city

“You build a level of engagement that causes the customers to come back intrinsically wanting to save more money,” Kevin explained. “It’s not driven by interest rates, but by the urge to see your city build up.”

What’s Driving Auto-Save?

Auto-Save is made possible by multiple Personetics’ AI ACT algorithms, working behind the scenes to accomplish each step in the process:

Assess each customer’s profile

How much do they earn? What are their spending patterns? How predictable are they? All this information is used to group customers into certain eligibility segments, so Auto-Save knows what to do with each one when the time is right.

Get a view of what’s happening now

What are the customer’s must-have expenses? What predicted income can we discern?

Decide whether to move the money

The algorithms also determine how much money should be moved and check the customer’s real-time balance again to be certain it’s safe to shift the money into savings.

A Win-Win for the Customer & the Bank

The benefits to the customer are obvious. Banks like UOB that have implemented Personetics’ Act solution have seen their customers grow savings by an average of ~ $3,700 per year.

As for the bank, automated savings helps on multiple fronts:

Improving Retention

When RBC (Royal Bank of Canada), another Personetics partner, took a closer look at their customers who were participating in their “Nomi Find and Save” program, they found this group had stickiness levels that were 4-5 times higher than other RBC customers. They were far more likely to use RBC products and far less likely to leave for a competitor.

Growing Investments

UOB TMRW has started by focusing on savings accounts, but other banks have tailored their Act instances to help customers move money into mutual fund offerings and managed portfolios, and even to nudge them toward meeting with one of the bank’s investment advisors.

Aggregation/Open Banking

With Personetics’ automated savings and open banking capabilities, customers now have a compelling reason to link external accounts to your institution. Doing this gives the customer more locations where unused money can be “found” and moved over to their savings at your institution. While those links help the customer save more, they also help your institution save – by removing the expensive task of trying to acquire those external accounts instead.

A Powerful, Growing Partnership

UOB for years has been one of the most forward-thinking and innovative leaders in banking in Asia, and we are proud to expand our partnership with them. I believe UOB’s Auto-Save program will be an ideal fit for the needs of the southeast Asian banking market, as customers in this region demand a higher level of support and involvement from their financial institutions in not just selling products but improving their financial lives.

Want to learn more about the UOB/Personetics Partnership? <<Click here>>

Want to learn more about Act and how it can help your financial institution? <<Click here>>

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Engagement Marketing Masterclass: Taking Data-Driven Personalization to the Next Level

Going Big in Japan

Understanding AI’s Impact on Banking

David Sosna

Co-Founder & CEO

David Sosna has more than 20 years’ experience in the financial services arena. Prior to founding Personetics, David was co-founder and chief executive officer of Actimize, the leading provider of financial crime, risk and compliance solutions. Under his leadership, Actimize was recognized as a global leader in the financial services market and was acquired in 2007 by NICE Systems. Prior to Actimize, David founded Gilon Information Systems, which grew under his leadership to become Israel’s largest business intelligence company. David graduated from the Department of Industrial Engineering and Management at Ben-Gurion University.