October 12, 2022

Credit Unions to the Rescue: How to Help Your Members Survive the Cost-of-Living Crisis (Part 2)

With soaring inflation at the forefront of the cost-of-living crisis for many, credit unions are positioned to rise to the challenge of time by providing tailored solutions for their members. In part two of the blog, we’ll look at what members are now demanding from their financial institutions and how credit unions can effectively answer their call.

By Jody Bhagat, President of Americas at Personetics

What Your Members Demand Now: Advanced Money Management and Personalized Advice

People are seeing their buying power diminish and are feeling greater urgency to get the most out of their monthly budgets. Your members are raising their expectations for the level of support, advice, and money management help that a credit union or bank should provide.

Our survey found that the theme of personalized advice resonated well with banking customers. When asked what digital banking features and support they wanted, 42% said “personalized advice and money management support within their mobile banking app.”

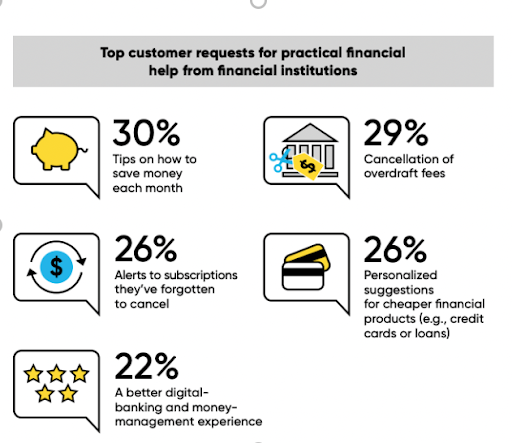

Other survey respondents wanted specific suggestions and helpful alerts, such as how much money they could save each month (30% of respondents), proactive suggestions for how to manage their finances (26%), customized suggestions for lower-cost loans or lower-interest cards (26%) or alerts for subscriptions that they forgot to cancel (26%).

Bottom line: your members are expecting your credit union to provide more advice and proactive involvement to help them spend smarter and save more money.

How credit unions can respond to this trend: Deepen your member relationships by being more proactive with personalized tips and advice. Make sure you’re showing your members a view of their finances that is accurate, targeted, and relevant to their household’s needs.

Digital Plus Human: Why “Money Management” Matters Now

Sometimes in discussions about digital transformation for credit unions, the conversation focuses too much on digital features and technology. It might often feel like credit unions are engaged in a digital arms race. But along with the question of which features to include on your mobile app, there is an even bigger opportunity for credit unions: to use digital banking capabilities to do more of what you do best – looking out for your members, advising your members, and serving a higher-value role in your members’ lives. This is the promise of money management – with the right approach, your credit union can support your members with the best of digital banking solutions and human personalized advice.

Based on our survey results, your members are ready for your institution to take a more proactive role in providing money management and improving their financial lives. Our survey found:

- 61% of respondents want their financial institutions to automate their financial decisions and money management (such as transferring spare cash to savings)

- 66% want their financial institutions to identify advance warnings of financial stress and offer solutions and advice

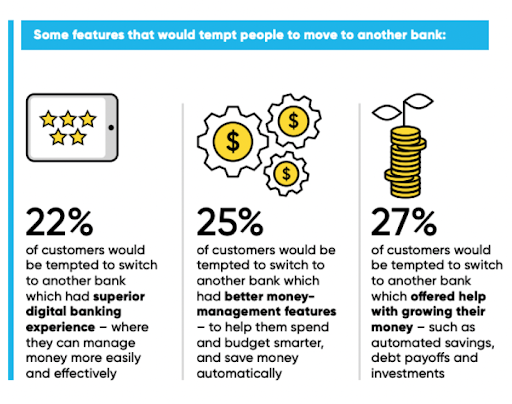

- 58% would consider switching to a competitor institution that offers better money management features

Money management is not just a list of digital features; it is a new way of thinking about how credit unions serve their members. Instead of just being a place to make deposits or apply for loans, financial institutions can build upon the foundation of PFM to take a more proactive “money manager” role at the center of people’s lives – as a trusted advisor that helps people spend smarter, save money, and make better decisions for everyday banking and long-term financial wellness.

How credit unions can respond to this trend: By partnering with Personetics to harness your members’ financial transaction data with advanced analytics and AI, your credit union can be that trusted advisor for your members – through the current cost-of-living crisis and beyond. We can give you the capabilities to watch out for your members by monitoring their spending patterns, inflows and outflows, spotting possible issues before they happen, and guiding people to a better place in their financial life.

The same personalized advice and automated money management that people are demanding from financial institutions can become a reality for your credit union with Personetics. We can help you be a guiding light for your members in turbulent times.

Originally published on NAFCU, October 12, 2022: https://www.nafcu.org/nafcuservicesnafcu-services-blog/credit-unions-rescue-how-help-your-members-survive-cost-living-crisis-2

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

Jody Bhagat

President of Americas

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.