Central Bank Boosts Financial Wellness for Customers Through Personetics’ AI-powered Platform

Midwest U.S. regional bank bringing money management platform with hyper-personalized insights, advice and smart savings to retail customers

NEW YORK – March 27, 2024 – Central Bank, a progressive $20 billion regional bank headquartered in Jefferson City, Missouri, is elevating financial wellness for its consumer franchise by implementing Personetics’ financial data-driven engagement platform. The AI-driven solutions infuse Central Bank’s digital channels with hyper-personalized insights, advice and smart savings tailored to each customer’s financial situation and goals.

Central Bank distinguishes itself with advanced in-house innovation and IT teams that enable the bank to control and evolve the customer experience. Adding Personetics’ AI platform allows Central Bank to enhance and expedite their time to market and to provide hyper-personalized money management guidance and experiences on par with super regional and national banks. Importantly, the platform will enable Central Bank to proactively answer questions their customers may not have even thought to ask — a key advantage in driving financial wellness.

“Delivering exceptional digital experiences is essential for promoting healthy, financial growth in our communities,” said Daniel Westhues, Executive Vice President and CMO at Central Bank. “With this AI-driven platform provided by Personetics, we can better understand each of our customers’ unique needs and proactively guide them with personalized financial insights and proactive advice tailored to them.”

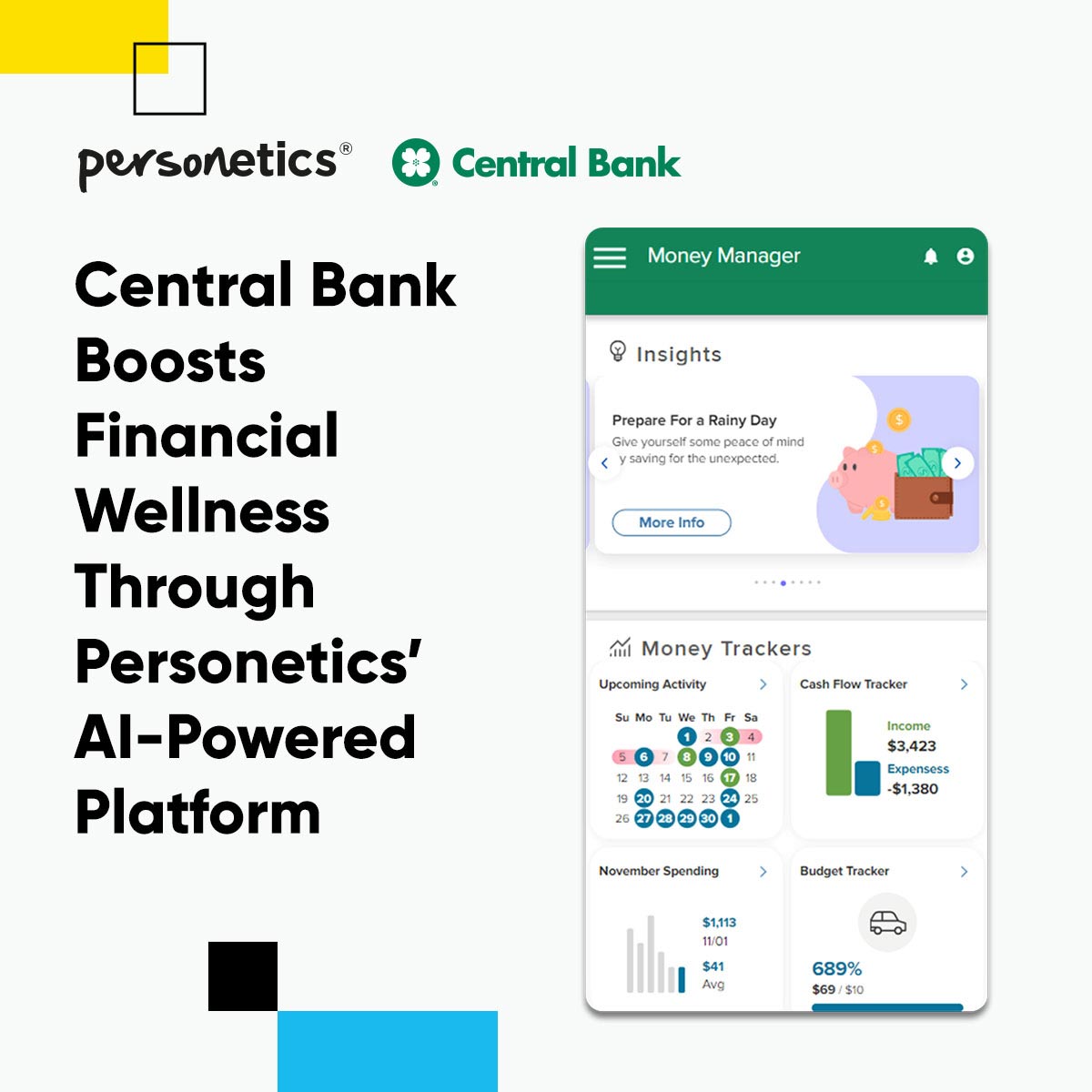

Central Bank is digitally transforming its legacy offerings by moving to an on-cloud implementation, offering its digital users an intelligent dashboard, a goal-based savings experience, and personalized money advice, powered by Personetics. The solution includes unified customer account aggregation enabling Central Bank to compete in the open banking era.

Key capabilities include:

- A reimagined money management hub replacing outdated budgeting tools

- Smart savings and wellness programs targeted to individual goals

- Contextualized, real-time guidance and advice based on cash flow analysis

- A consolidated view of all internal and external customer accounts for holistic real-time advice.

“Community banks intimately know their customers’ financial lives, but lacked the technology to truly individualize their experience – until now,” said Jody Bhagat, President of Americas at Personetics. “Our AI-powered platform empowers regional and community banks to deliver tailored digital money experiences rivaling national banks.”

Personetics’ powerful financial data-driven personalization engine enables Central Bank to provide customers with comprehensive money analysis, recommendations, and wellness programs typically available only from the largest institutions.

Central Bank hosted a co-branded webinar with Personetics on March 28 to discuss how advanced AI enables hyper-personalized customer service and financial wellness guidance. To view the on-demand webinar, click here.

About Central Bank

Founded in 1902, Central Bank is a community bank serving clients across 140 locations across the Midwest. Central Bank is committed to creating a work environment built on trust, respect, and valuing differences. The bank provides a comprehensive suite of personal and business banking solutions delivered through its digital channels and network of branches in Missouri, Kansas, Illinois, Oklahoma, Colorado and Florida. For more information, visit www.centralbank.com.

About Personetics

Personetics is the global leader in financial data-driven personalization, enabling financial institutions to forge deeper relationships by enhancing clients’ financial wellness and helping them make smarter decisions. Personetics reaches 135 million customers across 35 global markets while serving more than 140 financial institutions. Personetics’ AI analyzes financial data in real-time to understand customer financial behavior, anticipate needs, and deliver a hyper-personalized experience with day-to-day actionable insights, personalized recommendations, product-based financial advice, and automated financial wellness programs. The company has offices in New York, London, Singapore, São Paulo, and Tel Aviv.