Executive Summary

Executive Summary

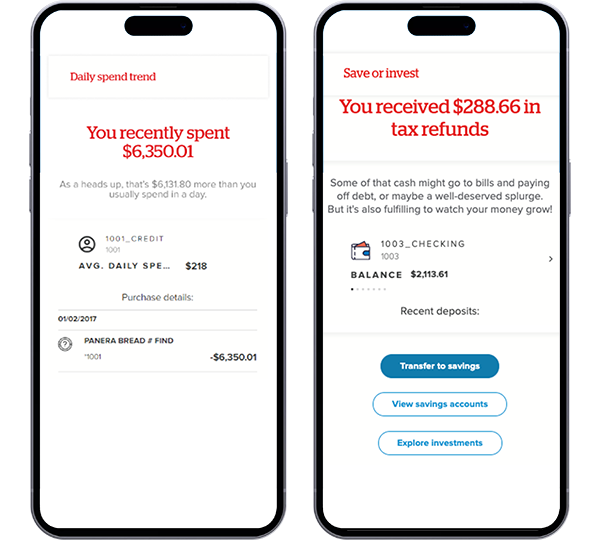

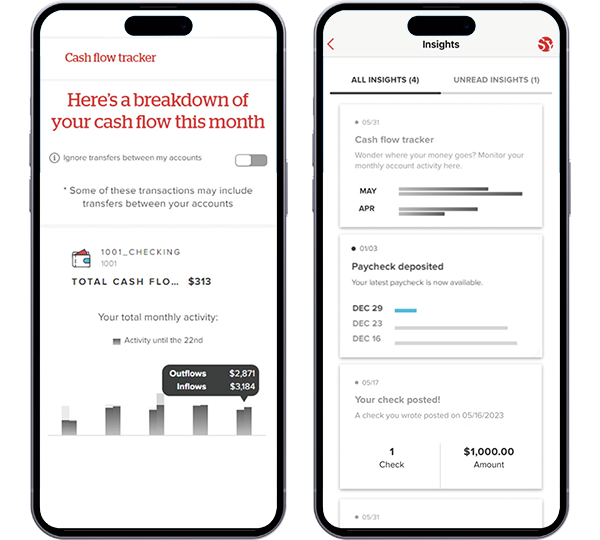

Synovus, the 8th largest bank headquartered in the Southeast U.S., partnered with Personetics to personalize its digital experience and deliver data-driven financial insights to its 300,000 consumer digital banking clients. In less than a year, the results showed a strong tie between insights engagement and stronger performance metrics. Clients engaging with the insights since launch grew their average relationship balances at a higher rate, demonstrated stronger cross-sell performance, and rated Synovus higher than pre-launch in areas such as delivering quick tips and tools to improving their financial well-being.

The key to success has been a focus on financial data-driven insights, a collaborative partnership, and a human-centered approach. Building on this success, Synovus plans to leverage these actionable personalized insights to create an interactive “virtual financial advisor” for every client, further enhancing their digital banking experience.