November 3, 2024

Redefining Financial Engagement in Australia with Open Banking

Open Banking is reshaping finance by fostering innovation and competition, creating a user-friendly and inclusive ecosystem across banks, fintechs, and other financial service providers. Originally designed to enhance competition and customer choice, Open Banking empowers consumers to share their financial data securely (with consent) across multiple providers, enabling services like account aggregation, financial product comparison, and streamlined access to tailored savings or lending options. By promoting transparency and giving customers greater control, Open Banking allows Australians to access financial services that meet their specific needs, creating a more holistic and flexible approach to managing their finances.

While some institutions may perceive Open Banking as a challenge to traditional customer relationships, banks that embrace this shift stand to build stronger, loyalty-driven relationships through transparency, data-driven insights, and enhanced engagement. Open Banking offers a pathway for banks to differentiate themselves by becoming trusted advisers in a landscape where customer empowerment and choice are central.

In Australia, the journey toward Open Banking has been primarily regulator-led rather than market-driven. Mandatory investments required by regulations have led to substantial infrastructural changes; however, consumer adoption has lagged. As of the end of 2023, approximately 0.3% of bank customers were taking advantage of the Consumer Data Right (CDR), with over 50% of data-sharing agreements lapsed or cancelled due to short-term value or limited use cases, according to the Australian Banking Association.

Despite Australians being receptive to digital transformation, the lack of compelling use cases has hindered broader Open Banking adoption. This challenge requires banks to find innovative ways to engage customers and clearly communicate the tangible value Open Banking can deliver, especially around security, convenience, and control.

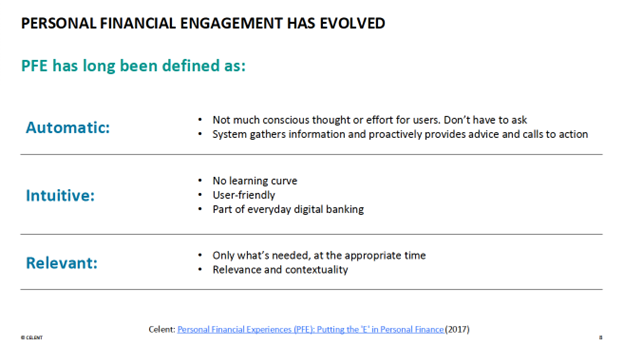

Personal Financial Engagement (PFE) serves as a critical enabler. PFE promotes financial wellness, enabling personalized, actionable, and real-time guidance that enhances decision-making and deepens customer engagement. By providing insights into customer behaviour, banks can transform into trusted partners and advisers. This deeper engagement motivates customers to adopt Open Banking by connecting external accounts for a full view of their finances, creating opportunities for banks to monetise their investments in Open Banking infrastructure. Fostering these connections with customers is crucial for unlocking the full potential of Open Banking and driving mutual success.

How Open Banking Benefits PFE

Open Banking enables secure access to data from multiple accounts and financial sources, providing banks with the comprehensive data PFE uses to create a complete view of each customer’s financial landscape. PFE aggregates and presents this data, offering customers a unified view of their finances and eliminating the hassle of managing multiple logins and platforms. It also provides real-time, personalized insights, simplifying financial decision-making.

For example, once a customer’s accounts are connected, PFE can analyse spending patterns, suggest savings opportunities, or recommend debt repayment adjustments. PFE also allows banks to identify when customers are repaying loans and offer alternative loan plans with better terms. This enhanced understanding of each customer empowers banks to deliver personalized services that align with their goals, fostering stronger relationships and promoting financial wellness.

How PFE Benefits Open Banking

By providing tangible value to customers, PFE drives Open Banking adoption. Through personalized insights and proactive guidance based on Open Banking data, PFE demonstrates the benefits of data sharing, enhancing customer experience. For example, PFE enables banks to offer tailored advice on budgeting, savings, and investments, making customers more likely to continue sharing their data.

PFE also simplifies financial management by turning raw data into actionable insights, offering a comprehensive, ‘at-a-glance’ view of the customer’s financial ecosystem. This ease of use empowers customers to take control of their finances, delivering concrete value. By showcasing benefits like immediate savings, budgeting support, and monthly financial health snapshots, customers are more likely to embrace Open Banking and fully benefit from PFE capabilities.

Customer Benefits

- Holistic View of Finances: Customers can see their entire financial landscape by consolidating data from various accounts, offering a clearer understanding of their financial health.

- Improved Financial Control: Personalized insights enable informed decisions, enhancing financial wellness and helping customers achieve their goals.

- Continuous Engagement: Real-time alerts and recommendations keep customers engaged, helping them seize financial opportunities and avoid pitfalls.

- Enhanced Security and Control: Customers have full control over which data is shared, with clear permissions and the ability to revoke access at any time.

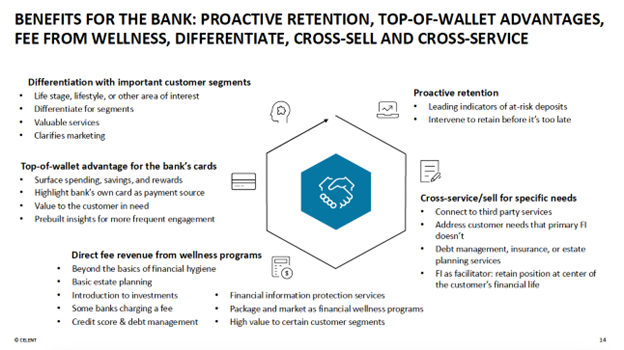

Bank Benefits

- Enhanced Customer Engagement: Leveraging financial data allows banks to provide personalized insights, strengthening loyalty and enhancing customer experience.

- Ongoing Value: The synergy between Open Banking and PFE delivers continuous value with ongoing, hyper-personalized insights, helping customers reach financial goals while increasing long-term customer value.

- Monetisation and Cross-Selling: With a complete customer financial picture, banks can better identify cross-sell opportunities, expand wallet share, and generate new revenue streams.

First-Mover Advantage and Customer Loyalty: Banks adopting combined Open Banking and PFE gain a first-mover advantage, strengthening customer loyalty. When customers benefit from viewing their financial landscape through their primary bank, switching becomes less appealing. This ease, combined with personalized engagement, reinforces retention and positions forward-thinking banks as essential financial partners.

Australia’s Banking Industry and Open Banking

Australia’s banking industry is highly competitive and digitally advanced, with both major banks and fintechs offering diverse, innovative services. However, the sector faces challenges, including tightening regulations and rising customer expectations for transparency and personalization. Although resilient, banks are managing margin squeezes, regulatory pressures, and competition from fintechs while contending with a slow-growing economy and the cost-of-living crisis.

As banks balance profitability, efficiency, and innovation, Open Banking presents a promising path for customer engagement and new revenue generation. Although Australian banks have invested an estimated $1.5 billion in Open Banking since 2018, results have been limited. However, with the global Open Banking market projected to reach $43 billion in 2024 and the Asia-Pacific region expected to grow at a compound annual growth rate (CAGR) of 26.8% from 2021 to 2028, significant change is on the horizon. Leveraging Open Banking can help banks enhance offerings, becoming trusted partners who deliver timely, accurate financial guidance and added value.

Personetics – Setting the Gold Standard in PFE Banking

Partnering with Personetics allows banks to harness the best of both worlds: AI-powered capabilities that personalize customer experiences and a proven framework to deepen relationships. Recognised as the category leader in PFE by Celent, Personetics supports 130 financial institutions and over 150 million end customers worldwide. This partnership offers Australian banks a powerful suite of insights and tools, enabling them to deliver real-time, personalized guidance that builds trust and deepens their role as essential financial partners.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

How Open Banking Will Drive Business Impact Across APAC

How Open Banking Will Drive Business Impact Across APAC

How Personalized Engagement Drives Business Impact for Banks Across Southeast Asia

Beyond PFM: The Rise of Impactful Personal Financial Engagement (PFE)

MyState Bank Helps Customers Reach Their Banking Goals

Simon Melton

Regional Sales Director APAC

Simon Melton brings over 15 years of enterprise sales experience in financial services, specializing in helping organizations leverage technology to build deeper customer connections and achieve meaningful business outcomes. Having partnered with leading banks across APAC, Simon is passionate about the transformative potential of data-driven solutions in shaping the future of financial experiences. At Personetics, he leads revenue growth across the region, supporting banks in achieving their digital transformation goals and meeting evolving customer needs.