June 22, 2022

Accelerate Your Financial Well-being Strategy with the Right PFM Platform

Supporting financial well-being is becoming a crucial business strategy for financial institutions. By helping customers manage their money, spend smarter, and save more, financial institutions can improve customer engagement, and drive bigger Customer Lifetime Value using advanced PFM and Money Management software.

In The Forrester Tech TideTM: Financial Well-Being, Q2 2022, Forrester Principal Analyst Aurélie L’Hostis highlighted several high-value technologies in this space. Aurélie shared insights from this research on our recent webinar, “Invest in the Right Technologies to Develop Your Financial Well-being Strategy.”

Let’s take a closer look at the highest-value technologies for financial well-being – and how Personetics can serve as your comprehensive platform to support all the requirements for a successful financial well-being strategy.

How to Choose the Right Financial Well-being Technologies: Insights from Forrester

“Leveraging the right tools and technologies to improve customers’ financial well-being is becoming very important for financial institutions,” said Aurélie L’Hostis, Principal Analyst at Forrester. “It’s a good way for firms to differentiate, show their values, and show that they are having a positive social impact.”

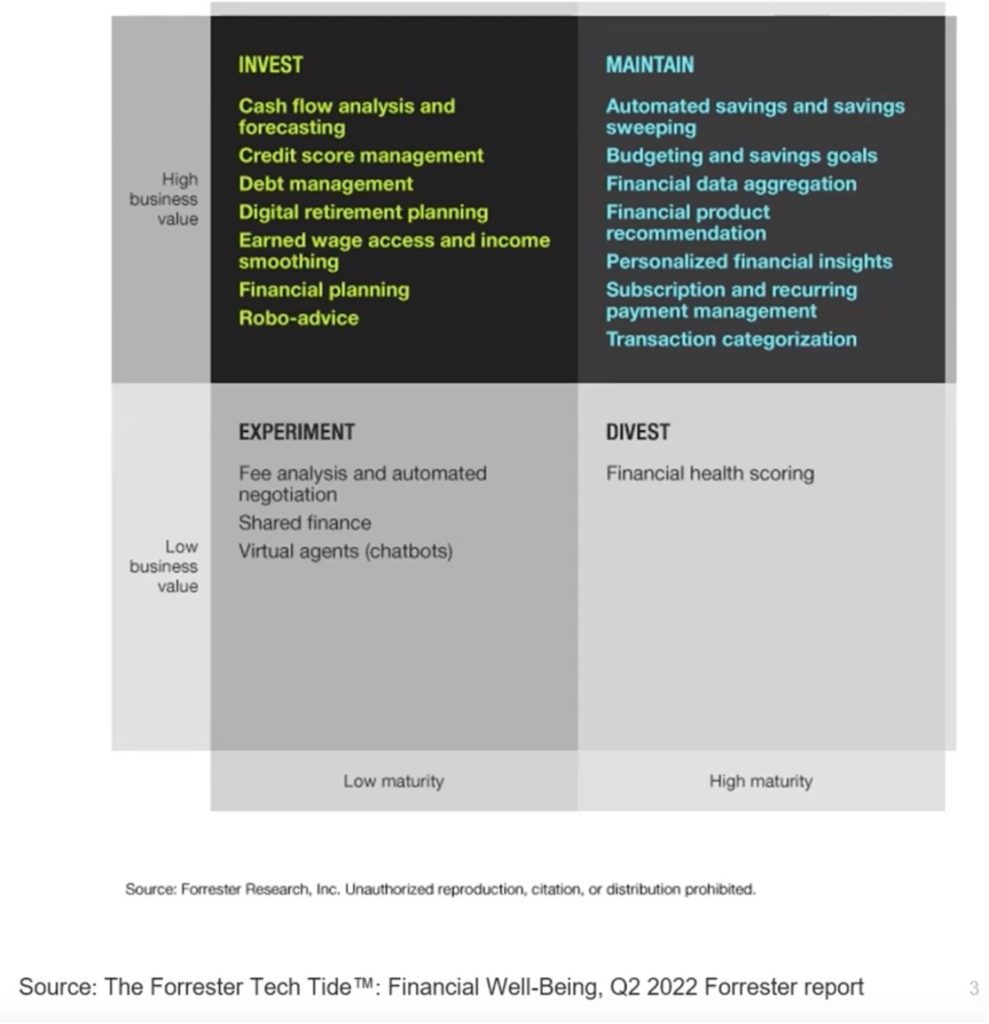

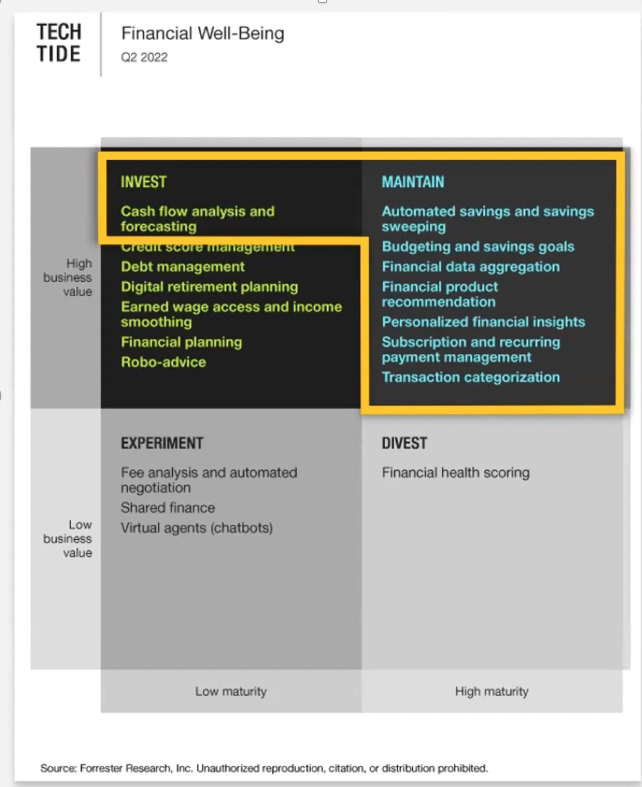

Aurélie and the Forrester research team have created a matrix of 18 different financial well-being technologies, rated by Forrester as Invest, Maintain, Experiment, or Divest.

Here are a few highlights from Forrester’s framework for how banking executives can evaluate financial wellness technologies and choose the right technology investments to drive ROI and business impact.

Invest in Low Maturity, High Business Value Technologies

The “Invest” technology categories are rated by Forrester as the highest potential for driving business ROI and improving outcomes.

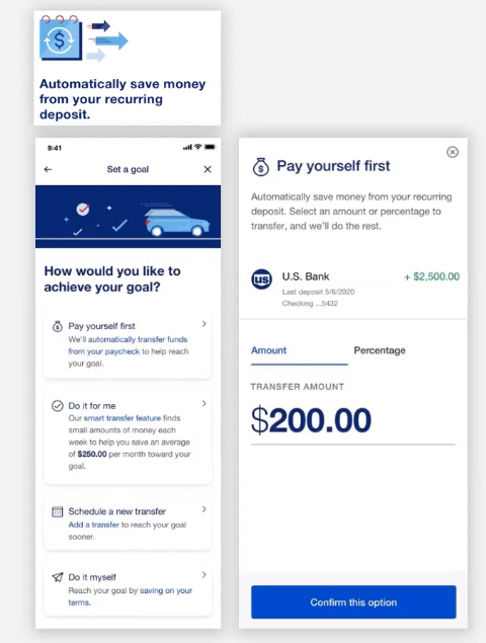

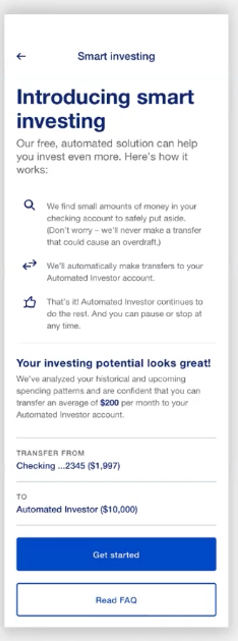

Cash flow analysis and forecasting

These capabilities provide more accurate cash flow prediction for customers, showing customers how much they can safely spend and save. By analyzing the customer’s income and spending patterns, institutions can also strengthen their underwriting and offer the right financial product at the right time.

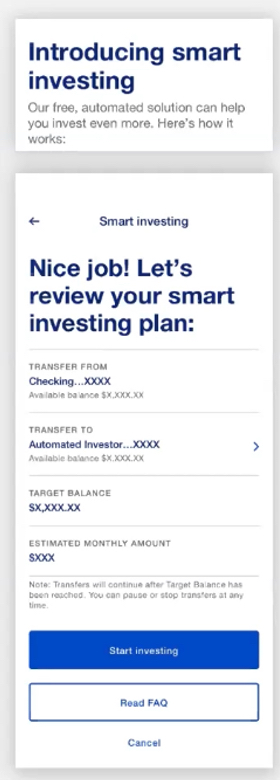

Real-life Personetics client example: US Bank’s Pay Yourself First and Smart Investing programs analyze customer cash flow to see how much money the customer can safely save or invest on a recurring basis. The customer can set a goal for how much to transfer, but Personetics’ technology will only transfer an amount that is safe to move, without causing a low balance issue.

Debt management

With the cost-of-living crisis, debt management is top-of-mind for more banking customers. Innovation is happening in this space with Open Banking, which enables financial institutions to see their customer’s entire financial position across multiple external accounts. Debt management technologies can help financial institutions to provide tailored advice, and debt repayment plans for each customer’s specific situation.

Digital retirement planning

With the right technologies and Open Banking capabilities, wealth management teams can get an overview of each customer’s holistic financial life and provide personalized advice at scale: planning and monitoring financial goals, and offering personalized insights and recommendations tailored to life stages and financial circumstances.

Maintain: Keep Investing in High Maturity, High Business Value Capabilities

The “Maintain” technology categories include these 6 technology buckets that are already on the market, but still have strong potential for business impact.

1. Transaction categorization

By using algorithm-driven merchant identification and transaction categorization, FIs can understand their customers better and provide more engaging experiences. Transaction categorization can be the foundation for other data-driven personalized engagement solutions.

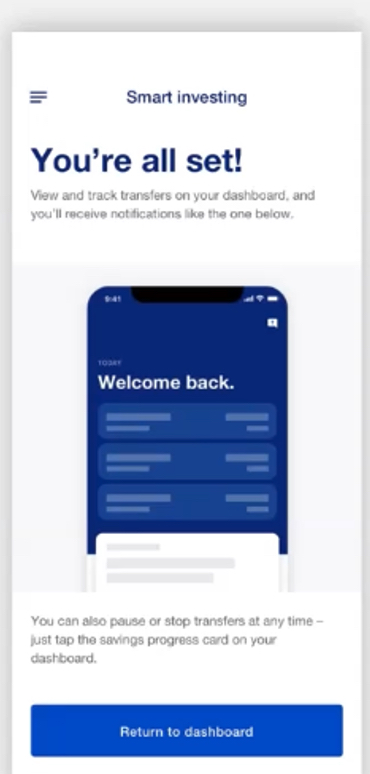

Real-life Personetics example: The Personetics Enrich offering is the industry-leading model for automated categorization of customer financial transaction data. We use the power of AI and machine learning to achieve precise categorization of your customer transactions, giving your institution more efficient cross-selling, automated mapping, and consistent cross-channel customer experiences.

2. Budgeting and savings goals

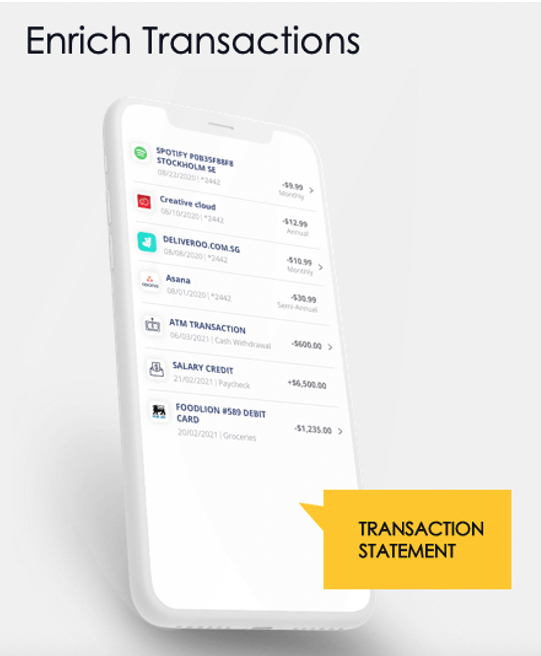

These solutions are part of the evolution of PFM to Money Management, with more accurate data enrichment and automated data categorization based on machine learning. Banks can leverage this to deliver actionable financial advice and product recommendations to their customers.

Real-life Personetics client example: Real-life Personetics client example: one of Europe’s largest banks KBC partnered with Personetics and, is seeing a 20% month-to-month growth in Smart Budgets usage. 33% of customers their customers are now highly engaged.

3. Automated savings and savings sweeping

By understanding and analyzing customer financial transaction data, institutions can identify safe-to-save excess cash based on cash flow. This creates engagement, help customers build savings, and attract more savings deposits to the institution.

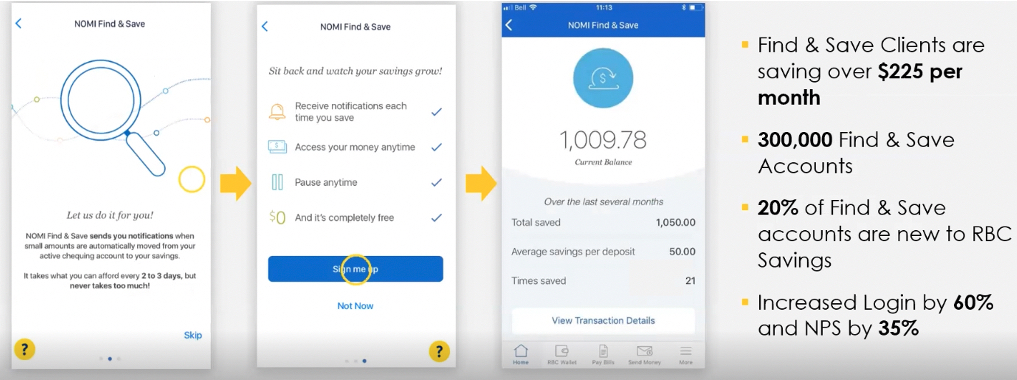

Real-life Personetics client example: RBC Nomi Find & Save automated savings program helps the bank’s customers save an average of $225 per month. The bank has opened 300,000 new Find & Save accounts, and 20% of these were new to RBC savings. RBC has also seen increases in logins of 60% and NPS increase of 35%.

4. Personalized financial insights

Building on a strong foundation of enriched, accurately categorized customer financial transaction data, institutions can recommend specific actions, and nudge their customers to better financial wellness.

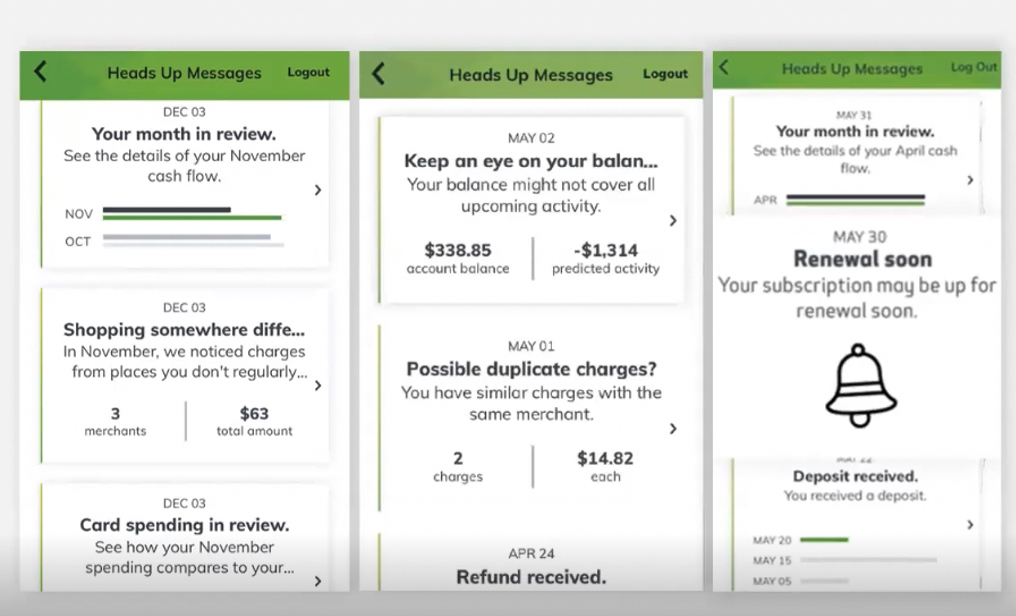

Real-life Personetics client example: Huntington Bank offers Huntington Heads Up® real-time personalized insights on spending and saving. Over 30% of the bank’s customers are engaged with personalized insights over 10 times per month.

5. Financial product recommendation

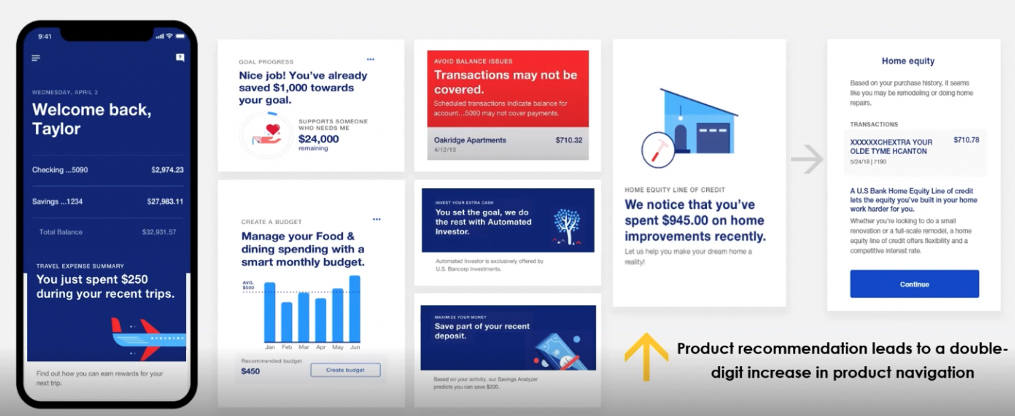

With a more complete view of the customer’s financial life provided by the customer transaction data, banks can see changes in the customer’s financial behavior and recommend tailored products (loans, savings, credit cards, etc.)

Real-life Personetics client example: US Bank is using Personetic’s patented automated cash-flow saving to gain insights to customer transaction data. With this insight the bank notices when a customer is spending more than usual on home improvement; enabaling the bank to offer a relevant product recommendation for a home equity line of credit.

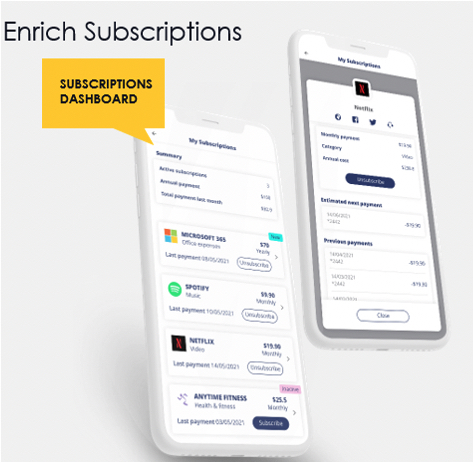

6. Subscription and recurring payment management

The rise of subscription-based services has driven a rise in the need for subscription management. This can help the customer’s financial well-being and reduce the bank’s operational costs (by reducing customer disputes about subscription payments).

Real-life Personetics example: The Personetics Enrich offering includes subscription management capabilities, showing customers a complete view of their recurring expenses for streaming video, music, software, and other services. Banks can offer customers the ability to see which subscriptions are up for renewal, quickly cancel unwanted or unused subscriptions, or see when a free trial is about to end. Our subscription insights have a 96% approval rating from banking customers.

As your institution evaluates financial technologies, you can combine multiple propositions, and offer comprehensive support for your customers’ financial well-being.

“Magic happens when you combine things,” Aurélie L’Hostis said. “Combining data with machine learning with personalized insights with real-time interaction management will enable you to provide digital financial coaching to customers.”

Personetics Supports Financial Well-being with an All-in-One Platform for Customer Engagement PFM and Money Management

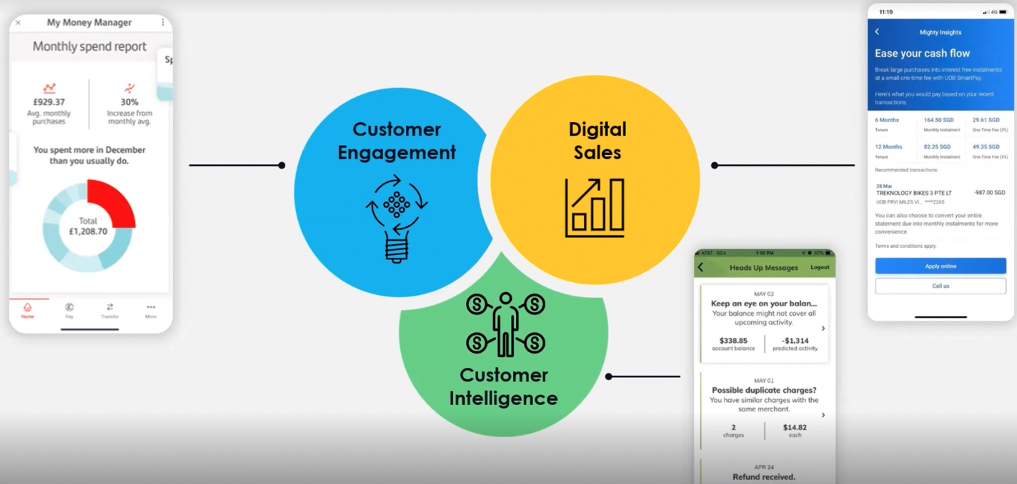

Banks are sitting on a gold mine of customer transaction data. If your institution can truly understand your customers’ data, you will know your customers better, and you’ll be able to deliver an agile, personalized, proactive digital banking experience that provides better opportunities for sales and service. Ultimately, your institution can become a trusted advisor to your customers by providing advanced PFM and money management capabilities – helping your customers manage their entire financial life, while unlocking value for the institution.

Personetics combines all of Forrester’s top-rated technologies in one comprehensive PFM and Money Management platform.

The Personetics platform drives business impact across three objectives at once:

- Customer Intelligence: Know your customers’ complete financial lives.

- Customer Engagement: Offer advanced money management capabilities to support financial well-being and increase touchpoints across channels.

- Digital Sales: Improve conversions through relevant offers and enhanced trust with customers.

Building a successful strategy for financial well-being does not have to be time-consuming or require multiple vendors and point solutions. Instead, you can get all the essential technologies for your financial well-being strategy in one place. Personetics can be your strategic partner for financial well-being, delivering the right propositions to your customers in one comprehensive platform.

Ready to learn more? Watch the replay of our webinar with our special guest from Forrester: “Invest in the Right Technologies to Develop Your Financial Well-being Strategy.”

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.