December 4, 2023

3 Critical Steps for Financial Institutions Fighting for Deposits

For the first time in 15 years, the economic environment is forcing banks and credit unions in North America to aggressively compete to attract bank deposits and savings accounts. Add to this economic backdrop the recent bank failures triggering a “flight to quality”, and you have an all–out battle for deposits underway. This Financial Times article is just one of many written in recent weeks.

Let’s consider what financial institutions (FI) can do to both retain and attract deposits in this hyper-competitive environment.

The Old Banking Tactics for Attracting Deposits Don’t Drive Impact

While not a completely unfamiliar situation for the banking industry, current times do call for very different tactics to be successful. Traditional tactics of promotional rates and bonuses don’t deliver sustainable gains. They can deliver a bump in new customer acquisition, but don’t attract the kinds of relationships that banks and credit unions desire. Also, customers expect more from their financial institution than simply incentives to open new accounts.

These tactics are not going to strengthen customer loyalty and are not going to look very innovative when compared to some of the aggressive tactics used by fintechs.

The 3-Step Approach for Defending and Acquiring Deposits

Consider instead, complementing your incentive programs with a comprehensive program that will help your institution retain and grow your current deposits, as well as attract new funds.

Step 1: Use Your Customers’ Financial Data to Identify Deposit Vulnerabilities and Opportunities

Rather than a universal approach across customers, consider a more tailored approach based on customer needs and behaviors. This recognition starts with an understanding of the customers’ financial situation, depth of relationship, and how dynamic (or static) their funds are.

This can be done by leveraging advanced data and analytics capabilities and creating a “customer money map.” The customer money map is derived primarily from the transaction account and shows what moneys are being retained or leaving your institution and the capacity the customer has to save. The Customer Money Map can also incorporate Open Banking data to offer a more holistic view of the customer.

Step 2: Use Customer Financial Data to Foster Engagement and Build Loyalty

Most customers don’t just shop rates. They want to put money with institutions they feel are “looking out for them” and will help improve their financial well-being.

To move this from slogans to actions, you need to leverage customers’ financial data to deliver timely, contextual and hyper-personalized insights and advice via the digital channels (and subsequently through their bankers). This isn’t the stale, steering with the rearview mirror approach of traditional PFM (Personal Financial Management), which only shows you what you did in the past and offers up one-size fits all suggestions across the entire customer base. These interactions are personal, forward-looking and proactive, alerting customers ahead of time when they’re likely to have an overdraft issue or when they have a subscription service that’s about to renewed at a fee. More specifically to cash flow, personalized and proactive insights should inform customers when they have excess cash they can move into your bank’s savings account, capturing funds before they are likely to leave the institution, as identified in the Customer Money Map.

These are the interactions that build customer engagement, which then quickly builds loyalty and customer satisfaction. A loyal customer is far more likely to keep their deposits with you, and to act on your suggestions and advice when they see those actions are in their best interest.

Step 3: Do the Hard Savings Work for Your Customers

Many customers want to increase their money savings. They just don’t want to figure out all the details. They have lives to lead, kids to raise, businesses to run. Managing their money and figuring out how much to set aside very month is stressful and burdensome.

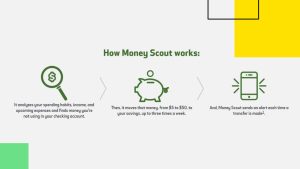

Again, it’s not enough to show them a chart of their previous income and expenses. You need tools to analyze each customer’s cash flows and then let them know when it’s safe to set aside money into savings, how much they can safely move out of checking and into savings, and even – if the customer feels comfortable – automatically move the money into a deposit account for them. Deliver a practical savings journey that helps customers set up money saving goals – a new home, a vacation, a child’s education, etc. – and helps them track their progress toward them.

Huntington Bank, which is perennially recognized as an industry leader in customer satisfaction, offers a tool called Money Scout that helps customers with their savings journey. It’s a part of an overall proposition that enabled Huntingon’s mobile app to be ranked No. 1 in customer satisfaction in 2022.

To put it succinctly, giving your customer’s a helping hand in the savings journey is more valuable to most customers than the extra quarter point the bank down the street is offering on their deposits account.

You Can’t Sit Out the Battle for Deposits

Identifying the right situations to defend or win back deposits, fostering engagement to build loyalty and trust, and delivering savings journeys should be part of a comprehensive deposit strategy.

It’s more challenging than simply raising rates or offering incentives but will deliver rewards in the form of a strong customer deposit franchise. You’ll need the right tools and the right strategic alignment with your leadership to make it happen. But perhaps the greatest incentive will be the knowledge that no one can sit on the sidelines during this battle. If you don’t do anything to protect your customers’ deposits and to attract new funding, rest assured, your competitors most certainly will.

Learn more about how Personetics Act can help ease the burden of savings for your customers. Interested in booking a demo? Click here.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President of Americas, Personetics

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.