November 4, 2021

How to Outperform in SMB Digital Banking: Insights from Celent

I was recently a guest speaker on a webinar hosted by Personetics on the topic of “How to Outperform in SMB Digital Banking.” The SMB banking landscape is changing dramatically. Bank revenues are at risk. New competitors are entering the market. If banks want to continue to be at the center of their SMB customers’ financial lives, they need to embrace the new opportunities of SMB digital banking.

According to recent survey data, within the U.S. market, $45 billion of SMB banking revenues are at risk due to SMB bank customers who are “not completely satisfied” with their bank’s services, and $17 billion of that amount are at even higher risk, with those SMB customers saying that they are “likely to switch” financial institutions.

Another challenge to banks is the rise of a new breed of competitors. Non-bank platforms like Square, Stripe, Amazon, Shopify and QuickBooks, are expanding along small businesses’ financial management value chain. Many of them are now offering proprietary or white-label products, APIs to third-party financial services providers and app marketplaces. As a result, their SMB financial services offering spans cash management (deposit accounts), credit, the financial supply chain (invoicing/receivables and payables), as well as higher value-add services like accounting and data analytics.

If bank revenues are at risk, and non-bank competitors are starting to provide services that used to be available only at banks, what are banks supposed to do? Here are key recommendations for how banks can adapt to the new opportunities of SMB digital banking.

Embrace Design Thinking: Think Like a SMB

Banks need to think from the perspective of SMB owners. Small business owners have a lot on their mind, and they tend to think about their business operations in terms of workflows: order-to-cash, procure-to-pay, record and report. Financial management is important to small business owners, but it’s only one part of a larger picture and tends to be the most challenging and frustrating part.

Banks tend to think in terms of products: checking accounts, merchant services, credit cards. And banks typically support only a few aspects of financial management: credit, payment, and deposits. This sometimes causes a disconnect between banks and their SMB customers, which fintechs and non-bank platforms have been eager to exploit.

Platform players like Square and Stripe have an advantage here: they think in terms of actions, and they’re closer to the small business mindset: “get paid, pay bills, borrow, move money…”

Banks need to shift their mindset and their approach for engaging with SMB customers. SMB banking customers have different needs than consumers; they don’t think about banking in the same product-focused terms that banks typically use to market themselves. Think like a SMB owner, and you’ll be more likely to win their loyalty.

How Banks Can Improve SMB Customer Engagement

There are numerous ways that banks can adopt AI and digital analytics applications to think more like SMB owners, improve business impact for SMBs, and drive SMB customer engagement. Amongst the use cases cited by Personetics are:

- Insights and notifications: By using AI applications to analyze customer transaction data, banks can identify insights and deliver actionable notifications to SMB customers, such as forecasting needs, monitoring activity, and resolving issues.

- Enhanced insights with accounting data: Along with the banks’ own customer transaction data, today’s leading-edge AI and data analytics tools can utilize open finance to integrate with external data sources, such as online accounting software. By pulling in accounting data such as bills, invoices, and payroll, the bank can enhance its transaction data insights. This gives banks the ability to forecast their SMB customer’s cash flow and alert the customer to potential shortfalls.

- Recommend specific products and solutions: Along with monitoring the SMB customer’s cash flow and other financial performance, AI and data analytics tools give banks the capability to recommend relevant solutions to that SMB customer, such as invoice financing or small business line of credit.

SMB owners do not always want a new bank account or a new financial product, but they always want better insights and understanding of their business’s performance, with immediate help to resolve problems. This is how banks can deliver more relevant offerings to SMB owners and strengthen their customer relationships.

SMBs’ Hierarchy of Needs

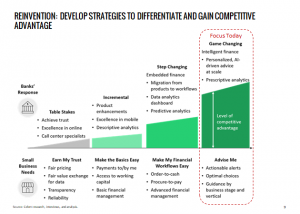

What do SMB owners want from their business banking relationships? It can be visualized as a hierarchy of needs, in ascending order of importance:

- Earn My Trust: Small businesses need financial services that are fairly priced, with a fair value data exchange, transparency and reliability.

- Make the Basics Easy: SMBs want to be able to make payments and receive payments from customers, they need access to working capital, and they need fundamental financial management tools to understand their business cash flow and other details.

- Make My Financial Workflows Easy: Banks can add even more value for SMBs if they can provide tools and support for higher-level workflows, like order-to-cash, procure-to-pay, and advanced financial management.

- Advise Me: This is the highest level of SMB needs; banks can offer relevant advice, show SMB customers their optimal choices, and guide them through opportunities and threats.

When a bank understands these needs, they can add even more value to the SMB customer relationship. The bank evolves from being a provider of basic banking products to being a trusted advisor to the customer.

How Banks Can Be Leaders in SMB Financial Wellness

AI and data analytics tools also offer advanced capabilities for banks to help improve their SMB customers’ financial wellness, including:

- Automated programs: With the right AI and data analytics applications, banks can create self-adjusting, automated financial wellness programs for SMB customers, enabling them to manage tax savings, reduce debt, or save for a specific goal.

- Better insights for front-office employees: When call center agents, bankers, and financial advisors get access to actionable insights and personalized contextual advice, they are empowered to build better customer relationships. For example, data analytics applications can identify situations when a SMB customer has a certain amount of spare cash and excess cash flow that can be safely put aside into savings or investments.

By using the latest data analytics technologies, banks give their SMB customers valuable insights that can help them improve their finances automatically, and the bank gets more of a holistic view of each SMB customer’s finances. Banks’ front-office staff can use these insights to start sales conversations with customers, encourage them to contribute more to their investment accounts, or take other steps to strengthen their financial wellness and resilience.

Game-Changing Competitive Advantage: Intelligent Finance

The next big game-changer in SMB banking will be intelligent finance, powered by AI and data analytics. Bringing AI to SMB digital banking can give banks the best of both worlds by balancing high-tech tools and high-touch services. AI helps banks deliver personalization and customization – with automated, self-service-oriented transactions where possible, and provide higher-value advice and human-centered interactions.

Here is a framework for how banks can adopt AI and transform their role to trusted financial advisors for their SMB customers:

- Tell Me – Basic Queries: We’re finding this increasingly common at banks. Customers can use self-service tools for basic account inquiries, spending alerts, and FAQs.

- Do it For Me – At this stage of AI adoption, banks use intelligent finance tools to help with account onboarding, initiating transactions, digitizing accounts receivable or accounts payable.

- Tell Me – Data Analytics: This stage uses data analytics for data visualization and report generation, descriptive models (such as sales trends and underlying drivers), and predictive models for cash flow and sales forecasting.

- Advise Me: This is the highest level of harnessing AI for SMB digital banking. Data analytics are used for personalized product recommendations and rationales, alerting the SMB owner to action items and options for next steps (such as “this client of yours is usually slow to pay, here is how you can avoid a cash shortfall”) as well as business growth opportunities, for example.

How Banks Can Be Leaders in Intelligent Finance

Banks worldwide are deploying advanced AI applications to improve their SMB business impact and customer engagement. An example is Royal Bank of Canada (RBC), winner of a 2018 Celent Model Bank Award for its NOMI services for consumers which delivers tailored insights based on customer banking habits. In early 2020, RBC expanded NOMI to small businesses with the objectives to improve customer engagement and help SMB customers to monitor and manage their finances, cashflow, and purchase analyses.

SMB customers are expecting more from their banks and if banks do not deliver, SMBs will seek non-bank providers to fill the gap. They need better financial advice and better visibility into their business finances, which combined results in improved financial wellness. Banks have too much revenue at risk to be complacent in the face of these new challenges. Fortunately, banks also have some inherent strengths and competitive advantages that can put them at the center of their SMB customers’ financial lives. If banks leverage AI in SMB digital banking, they can catapult from a product, transaction-oriented engagement model to being a trusted advisor with a greater share of wallet.

Note from Personetics:

We are grateful to Alenka Grealish and Celent for participating in our recent webinar and for their great insights! Personetics is proud to be a recognized leader in AI and data analytics applications, and we are already working with global banks to build stronger relationships with SMB customers. We believe that banks have an ideal opportunity to use AI and data analytics to become business partners to their SMB customers and be trusted advisor at the center of their customers’ financial lives.

Want to learn more about SMB digital banking? Sign up to watch the on-demand webinar, “How to Outperform in SMB Digital Banking.”

We also invite you to download your complimentary copy of Celent’s Banking Report: Reinventing Small Business

Want to explore how your bank can harness the power of AI to engage and serve customers? Request a demo now

Latest Posts

Why Asia Pacific Pacific Banks Must Lean into Cognitive Banking: A Conversation with Dr. Dennis Khoo

Explore our Spring Release Highlights – From Integrated Marketing Offers, to Custom Trackers, and AI Innovation

Showing the Human Side of Digital Banking: Insights from Desjardins' Nathalie Larue

ALENKA GREALISH

Senior Analysit, Celent

Alenka has over 20 years of consulting and research experience in the banking industry with deep expertise in payments, transaction banking, and commercial banking.

Her research focus is on innovation in treasury management services, trade finance, working capital finance, and the implications for customer journeys across segments, including small business. As part of her research, she tracks the digitization of the financial supply chain and the rise of fintechs and new business and revenue models.

Ms. Grealish has advised top banks on their business and technology strategies. Her consulting work has included the development of a growth strategy for the treasury management business of a leading North American bank, examination of cross-border growth opportunities in treasury management for a top European bank, and the identification and evaluation of opportunities to enable small to medium-sized businesses to automate their payment processes.

Ms. Grealish has been widely quoted in the media including Bloomberg News, Financial Times, and the Associated Press. She has given presentations at numerous conferences including Bank Administration Institute events, the NACHA Payments Conference, and the Association of Financial Professionals events.

Prior to rejoining Celent, Ms. Grealish worked for The Boston Consulting Group, where she was the global segment manager for transaction banking and payments. She started her career as an associate economist at the Federal Reserve Bank of Chicago.

Ms. Grealish earned her MBA from the University of Chicago Booth School of Business, graduating Beta Gamma Sigma. She received her BA from Northwestern University and graduated Phi Beta Kappa with superior honors in economics.